Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

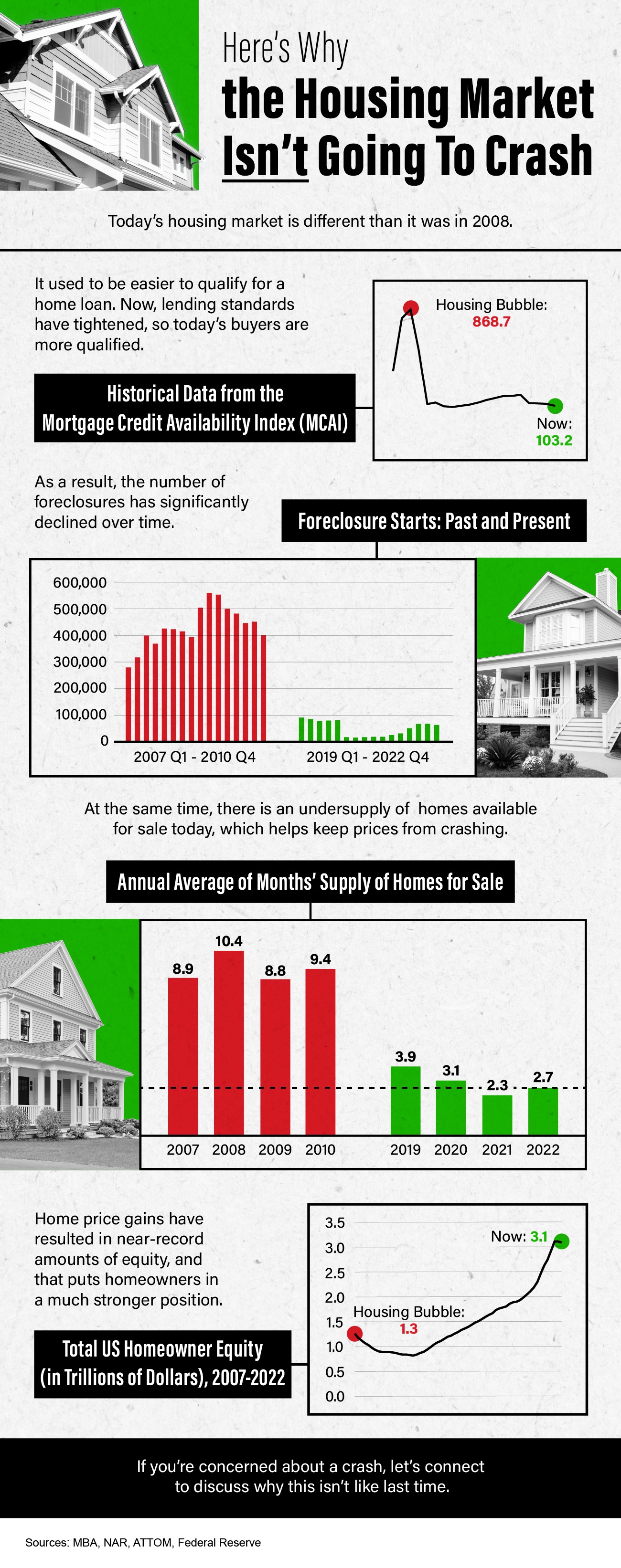

Here’s Why the Housing Market Isn’t Going To Crash

Some Highlights

- Today’s housing market is different than it was in 2008.

- Lending standards have tightened, foreclosures have declined, home inventory is much lower, and homeowners have far more equity.

- If you’re concerned about a crash, meet with a local real estate professional to discuss why this isn’t like last time.

Condos Are a Great Entryway to Homeownership (Video)

If you’re looking to buy your first home, you may want to consider condos. Let’s connect to explore your options.

Understanding the Timeline of Probate in Real Estate

When a loved one passes away, their estate goes through a legal process known as probate. If the deceased owned any real estate property, the probate process can be complex and time-consuming. It’s important to understand the timeline of probate in real estate to prepare yourself for what lies ahead.

What is Probate?

Probate is a legal process that takes place after a person dies to ensure that their assets are distributed according to their wishes. Probate involves the court system and can take several months or even years to complete. The probate process involves identifying and appraising assets, paying off any debts and taxes, and distributing assets to the heirs or beneficiaries.

Probate in Real Estate

If the deceased owned real estate, it will be included in the probate process. The timeline for probate in real estate can vary depending on the complexity of the estate, the number of heirs involved, and the state laws where the property is located.

The probate process begins when the executor of the estate files a petition with the court to start probate. The court will then issue a notice to all interested parties, including heirs, beneficiaries, and creditors, informing them of the probate proceedings. The notice will also be published in a local newspaper to give any unknown creditors an opportunity to make a claim against the estate.

Once the notice is published, the executor will need to identify and appraise all of the assets in the estate, including any real estate property. The executor will also need to pay off any debts and taxes owed by the estate. If the estate does not have enough funds to pay off its debts, the property may need to be sold to cover the costs.

After all debts and taxes have been paid, the executor can distribute the assets to the heirs or beneficiaries. If the deceased left a will, the assets will be distributed according to the terms of the will. If there is no will, the assets will be distributed according to state laws.

Timeline of Probate in Real Estate

The timeline of probate in real estate can vary depending on several factors. In general, the probate process can take anywhere from six months to two years or more. The following is a rough timeline of the probate process:

- Filing the Petition – The probate process begins when the executor files a petition with the court. This can take a few weeks to a few months depending on the court’s backlog.

- Notice to Interested Parties – After the petition is filed, the court will issue a notice to all interested parties. This can take a few weeks.

- Appraisal of Assets – The executor will need to identify and appraise all of the assets in the estate. This can take several months, depending on the complexity of the estate.

- Payment of Debts and Taxes – The executor will need to pay off any debts and taxes owed by the estate. This can take several months.

- Distribution of Assets – Once all debts and taxes have been paid, the executor can distribute the assets to the heirs or beneficiaries. This can take several months, depending on the number of heirs and the complexity of the distribution.

Conclusion

The timeline of probate in real estate can be complex and time-consuming. It’s important to work with an experienced probate attorney to guide you through the process and ensure that everything is done correctly. With the right guidance, you can successfully navigate the probate process and ensure that your loved one’s assets are distributed according to their wishes.

For More Probate Answers, please Click Here.

Navigating Probate and Real Estate: A Step-by-Step Guide

When a loved one passes away, dealing with their estate can be a complex and emotional process. If they owned real estate, you may need to go through probate to transfer ownership of the property to the beneficiaries. Probate is the legal process that occurs after someone dies to transfer their assets to their heirs or beneficiaries. This can be a time-consuming and sometimes complicated process, but it can be made easier if you know what steps to take. In this post, we will guide you through the steps to take when dealing with probate and real estate.

Step 1: Understand the Probate Process

Probate laws can vary by state, but the overall process is similar. The first step is to understand the probate process and how it works in your state. In general, the probate process involves:

- Filing a petition with the court to open probate

- Appointing an executor or personal representative to manage the estate

- Identifying and gathering the deceased person’s assets

- Paying any outstanding debts and taxes

- Distributing the remaining assets to the beneficiaries

It’s important to note that probate can be a lengthy and expensive process, and some assets may not need to go through probate. For example, if the deceased person owned property in joint tenancy or had a living trust, those assets may pass directly to the joint owner or trust without going through probate.

Step 2: Identify the Real Estate Assets

Once you have a basic understanding of the probate process, the next step is to identify the real estate assets. This includes any property that the deceased person owned, including their primary residence, vacation home, rental property, or land. It’s important to locate all the property and have it appraised to determine its value.

Step 3: Determine the Ownership Status of the Real Estate

The next step is to determine the ownership status of the real estate. Was the property owned solely by the deceased person, or did they co-own it with someone else? If they co-owned the property, was it held in joint tenancy or tenancy in common? If it was held in joint tenancy, the property will pass automatically to the surviving owner. If it was held in tenancy in common, the deceased person’s share will need to go through probate.

Step 4: Hire an Attorney and/or Real Estate Agent

Dealing with probate and real estate can be complex, so it’s important to work with professionals who have experience in this area. You may want to hire an attorney to help you navigate the probate process and a real estate agent to help you sell the property. The attorney can assist with the legal aspects of probate and ensure that all the proper paperwork is filed. The real estate agent can help you determine the best way to market the property and get the best possible price.

Step 5: Market the Property and Sell it

Once you have identified the real estate assets, determined their ownership status, and hired professionals to help you, the final step is to market the property and sell it. This may involve making repairs or improvements to the property, cleaning and staging it for showings, and marketing it to potential buyers. Once you have an offer, the attorney can assist with the closing process to ensure that the sale goes smoothly.

In conclusion, dealing with probate and real estate can be a challenging process, but it can be made easier by understanding the steps involved and working with professionals who can help guide you through the process. By following these steps, you can ensure that the real estate assets are properly identified, valued, and distributed to the beneficiaries in accordance with the deceased person’s wishes.

For More Probate Answers, please Click Here.

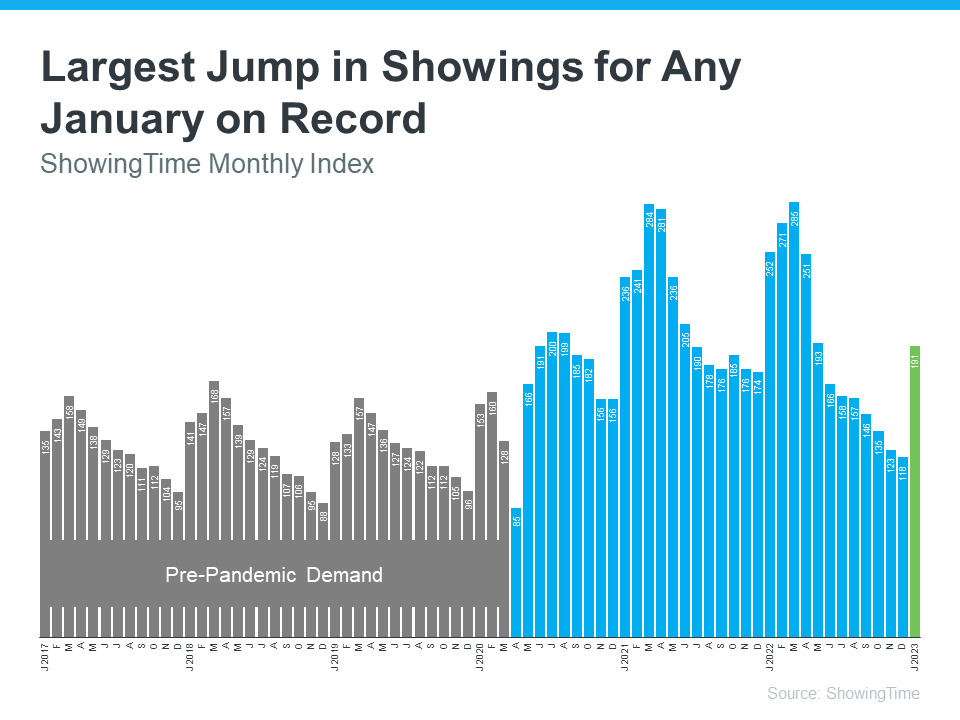

What Buyer Activity Tells Us About the Housing Market

Though the housing market is no longer experiencing the frenzy of a year ago, buyers are showing their interest in purchasing a home. According to U.S. News:

“Housing markets have cooled slightly, but demand hasn’t disappeared, and in many places remains strong largely due to the shortage of homes on the market.”

That activity can be seen in the latest ShowingTime Showing Index, which is a measure of buyers actively touring available homes (see graph below):

The 62% jump in showings from December to January is one of the largest on record. There were also more showings in January than in any other month since last May. As you can see in the graph, it’s normal for showings to increase early in the year, but the jump this January was larger than usual, and a lot of that has to do with mortgage rates. Michael Lane, VP of Sales and Industry at ShowingTime+, explains:

“It’s typical to see a seasonal increase in home showings in January as buyers get ready for the spring market, but a larger increase than any January before after last year’s rapid cooldown is significant. Mortgage rate activity this spring will play a big role in sales activity, but January’s home showings are a positive sign that buyers are getting back out there . . .”

It’s important to note that mortgage rates hovered in the low 6% range in January, which played a role in the high number of showings. What does this mean? When mortgage rates eased, buyer interest climbed. The jump in home showings early this year makes one thing clear – while rates may be volatile right now, there are interested buyers out there, and when mortgage rates are favorable, they’re ready to make their move.

Balancing Your Wants and Needs as a Homebuyer This Spring

Though there are more homes for sale now than there were at this time last year, there’s still an undersupply with fewer houses available than in more normal, pre-pandemic years. The Monthly Housing Market Trends Report from realtor.com puts it this way:

“While the number of homes for sale is increasing, it is still 43.2% lower than it was before the pandemic in 2017 to 2019. This means that there are still fewer homes available to buy on a typical day than there were a few years ago.”

The current housing shortage has an impact on how you search for a home this spring. With limited options on the market, buyers who consider what’s a necessity versus what’s a nice-to-have will be more successful in their home search.

The first step? Get pre-approved for a mortgage. Pre-approval helps you better understand what you can borrow for your home loan, and that plays an important role in how you’ll put your list together. After all, you don’t want to fall in love with a home that’s out of reach. Once you have a good grasp on your budget, the best way to prioritize all the features you want and need in a home is to put together a list.

Here’s a great way to think about them before you begin:

- Must-Haves – If a house doesn’t have these features, it won’t work for you and your lifestyle.

- Nice-To-Haves – These are features you’d love to have but can live without. Nice-to-haves aren’t dealbreakers, but if you find a home that hits all the must-haves and some of the these, it’s a contender.

- Dream State – This is where you can really think big. Again, these aren’t features you’ll need, but if you find a home in your budget that has all the must-haves, most of the nice-to-haves, and any of these, it’s a clear winner.

Finally, once you’ve created your list and categorized it in a way that works for you, discuss it with your real estate agent. They’ll be able to help you refine the list further, coach you through the best ways to stick to it and find a home in your area that meets your needs.

An Expert Gives You Clarity in Today’s Housing Market

The housing market has been going through shifts lately. That’s why it’s so important to work with an industry professional who can be your guide throughout the process.

A real estate expert uses their knowledge of what’s really happening with home prices, housing supply, expert projections, and more to give you the best advice. Someone who can provide clarity like that is critical right now. Jay Thompson, Real Estate Industry Consultant, explains:

“Housing market headlines are everywhere. Many are quite sensational, ending with exclamation points or predicting impending doom for the industry. Clickbait, the sensationalizing of headlines and content, has been an issue since the dawn of the internet, and housing news is not immune to it.”

Unfortunately, when information in the media isn’t clear, it can generate a lot of fear and uncertainty in the market. As Jason Lewris, Co-Founder and Chief Data Officer at Parcl, says:

“In the absence of trustworthy, up-to-date information, real estate decisions are increasingly being driven by fear, uncertainty, and doubt.”

But it doesn’t have to be that way. Buying a home is a big decision, and it should be one you feel confident making. You can lean on an expert to help you separate fact from fiction and get the answers you need.

The right agent can help you understand what’s happening at the national and local levels, and they can debunk headlines using data you can trust. Experts have in-depth knowledge of the industry and can provide context, so you know how current trends compare to the normal ebbs and flows in the industry, historical data, and more.

Then, to make sure you have the full picture, an agent can tell you if your local area is following the national trend or if they’re seeing something different in your market. Together, you can use all that information to make the best possible decision.

After all, making a move is a potentially life-changing milestone. It should be something you feel ready for and excited about. And that’s where a trusted expert comes in.

Bottom Line

For expert advice and the latest housing market insights, let’s connect.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link