Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

The Current Housing Shortage Helps Keep Home Prices from Crashing (Video)

The current housing shortage helps keep home prices from crashing. To learn about home prices in our local market, let’s connect.

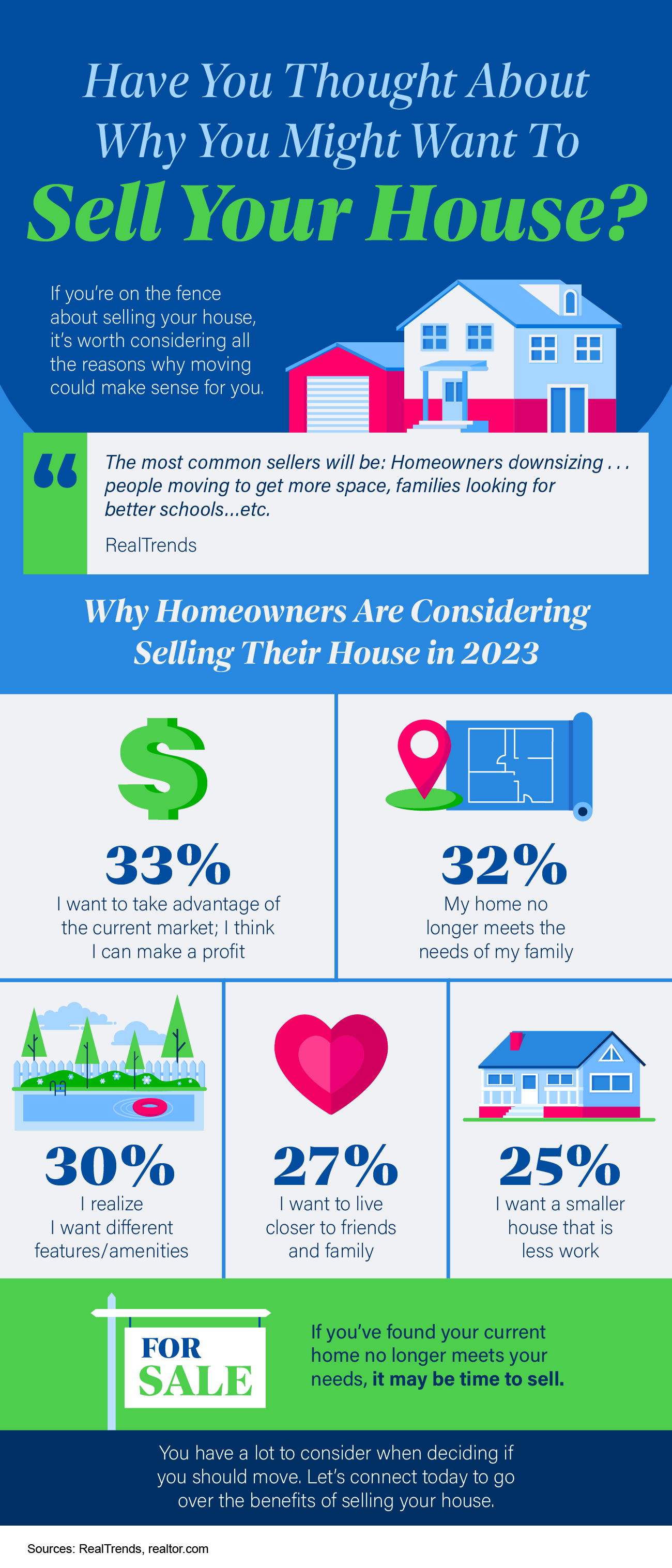

Have You Thought About Why You Might Want To Sell Your House?

If you’re considering selling your house, it’s important to take the time to think about why you’re doing it. While the obvious reason is to move to a new home, there can be many other motivations behind the decision to sell. As a real estate agent, I often encounter clients who are unsure about why they want to sell and the implications of that decision. In this blog post, I’ll explore some of the reasons why people sell their homes and the things to consider before taking that step.

The most common reason for selling a home is to move to a new property. This might be because you need more space, you’re downsizing, or you want to live in a different area. If this is your reason for selling, it’s important to think about your priorities for your new home. What are the must-haves that you need in your new home? Do you have a specific location in mind? What is your budget for the new property? Answering these questions will help you determine whether selling your current home is the right move.

Another reason why people sell their homes is to free up cash. This might be because you’re retiring and need to access the equity in your property, or you’re looking to invest in a new venture. If this is your motivation, it’s important to consider the financial implications of selling your home. How much equity do you have in your property? Will you be able to achieve your financial goals by selling your home? Will you need to downsize to free up more cash? Answering these questions will help you make an informed decision.

Some people sell their homes because they’re facing financial difficulties. This might be because they’re struggling to keep up with mortgage repayments or they’ve experienced a change in their financial circumstances. If this is your reason for selling, it’s important to seek professional advice. A financial advisor or real estate agent can help you explore your options and make the best decision for your situation.

Finally, some people sell their homes because they’re looking for a fresh start. This might be because of a divorce or a change in family circumstances. If this is your motivation, it’s important to think about what you want from your new home. Do you need a fresh start in a new area? Are you looking for a property that is more suited to your new lifestyle? Answering these questions will help you determine whether selling your current home is the right move.

In conclusion, selling your home is a big decision and it’s important to think carefully about your motivations before taking that step. Whether you’re looking to move to a new property, free up cash, or start afresh, there are a range of factors to consider. By taking the time to explore your options and seek professional advice, you can make an informed decision that meets your needs and helps you achieve your goals. As a real estate agent, I’m here to help you every step of the way. If you’re considering selling your home, get in touch to discuss your options and find the right solution for your needs.

Have You Thought About Why You Might Want To Sell Your House?

- If you’re on the fence about selling your house, it’s worth considering all the reasons why moving could make sense for you.

- If you find your home no longer meets your needs, it may be time to sell.

- You have a lot to consider when deciding if you should move. Let’s connect today to go over the benefits of selling your house.

Why Buying a Home Is a Sound Decision

If you’re thinking about buying a home, you want to know the decision will be a good one. And for many, that means thinking about what home prices are projected to do in the coming years and how that could impact your investment.This year, we aren’t seeing home prices fall dramatically. As the year goes on, however, some markets may go up in value while others may lose value. That’s why it’s helpful to keep the long-term view in mind. Experts project a return to a steadier rate of price appreciation in the years that follow.

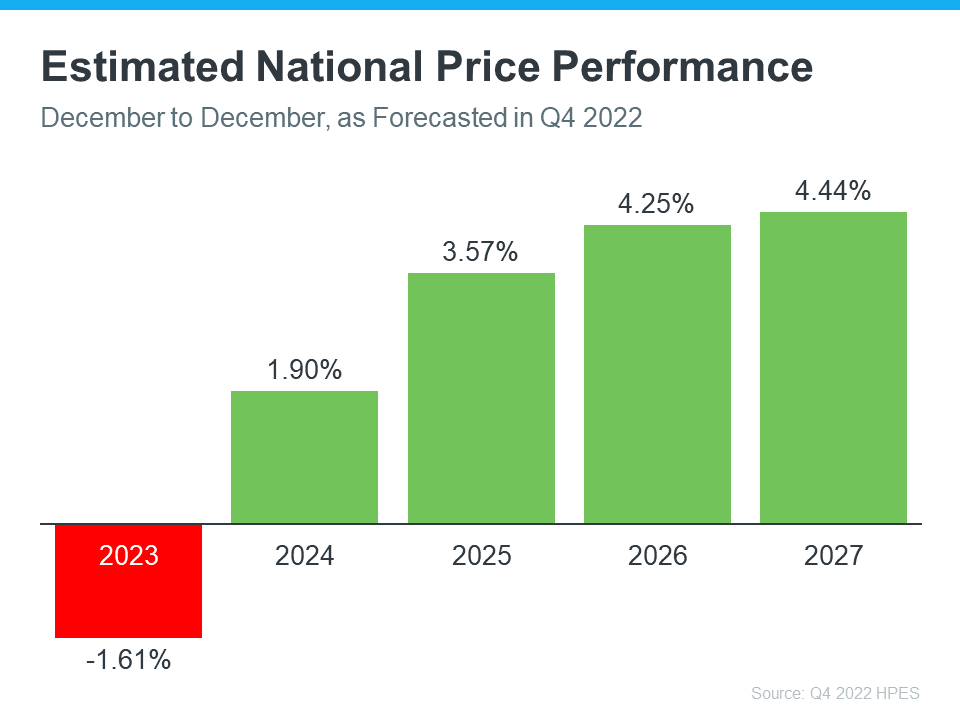

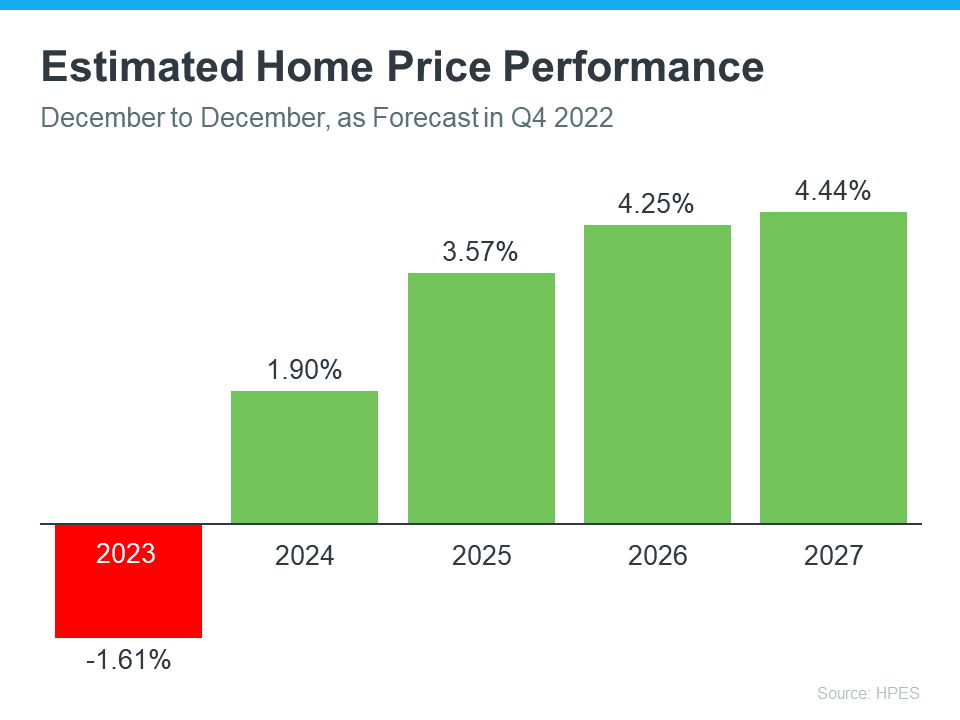

Home Price Appreciation in the Years Ahead

Over 100 economists, investment strategists, and housing market analysts were polled by Pulsenomics in their latest quarterly Home Price Expectation Survey (HPES). The report indicates what they believe will happen with home prices over the next five years. As the graph below shows, after mild depreciation this year, these experts forecast home prices will return to more normal levels of appreciation through 2027.

The big takeaway is experts aren’t forecasting a drastic fall in home prices nationally, even though some markets will see home price appreciation while others may depreciate. And when they look further out, they see steady price appreciation in the long run. That’s a great example of why homeownership wins over time.

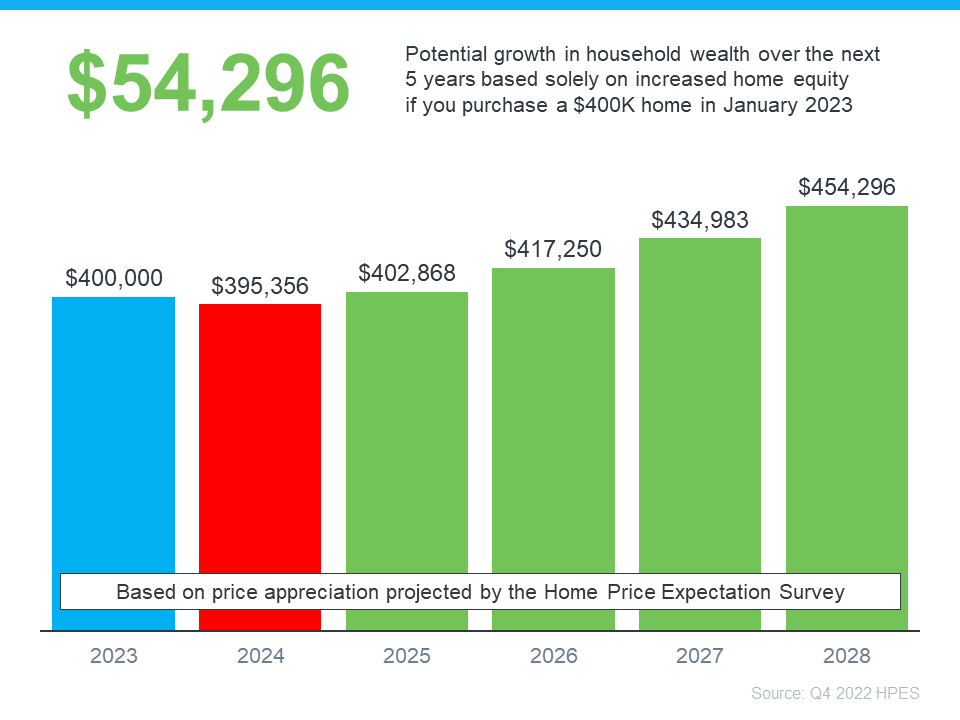

What Does This Mean for You?

Once you buy a home, price appreciation raises your home’s value, and that grows your household wealth. Here’s how a typical home’s value could change over the next few years using the expert price appreciation projections from the survey mentioned above (see graph below):

In this example, if you bought a $400,000 home at the beginning of this year and factor in the forecast from the HPES, you could accumulate over $54,000 in household wealth over the next five years. So, if you’re wondering if buying a home is a sound decision, keep in mind what a strong wealth-building tool it is long term.

Bottom Line

According to the experts, while we may see slight depreciation this year, home prices are expected to grow over the next five years. If you’re ready to become a homeowner, know that buying today can set you up for long-term success as home values (and your own net worth) are projected to grow. Let’s connect to begin the homebuying process today.

Reasons To Consider Condos in Your Home Search

Are you having trouble finding a home that fits your needs and your budget? If so, you should know there’s an option worth considering – condominiums, also known as condos. According to Bankrate:

“A condo can be a more affordable entry point to homeownership than a single-family home. And as a homeowner, you’ll build equity over time and have access to tax benefits that a renter wouldn’t.”

That’s why expanding your search to include additional housing types, like condominiums, could help you accomplish your homeownership goals this spring, especially if you can be flexible about the space you need. Condos are typically smaller than a single-family home, but that’s part of what can make them more budget-friendly (see graph below):

In addition to providing more options in your home search and possibly your price point, there are several other benefits to condo living. They tend to require less upkeep and lower maintenance – and that can give you more time to spend doing the things you enjoy. Plus, since many condos are in or near city centers, they offer the added benefit of being in close proximity to work and leisure.

Remember, your first home doesn’t have to be your forever home. The important thing is to get your foot in the door as a homeowner so you can start building wealth in the form of home equity. In time, the equity you develop can fuel a future purchase if your needs change.

Ultimately, owning and living in a condo can be a lifestyle choice. And if that appeals to you, they could provide the added options you need in today’s market.

The Role of Access in Selling Your House

Once you’ve made the decision to sell your house and have hired a real estate agent to help, they’ll ask how much access to your home you want to give potential buyers. Your answer matters more now than it did in recent years. Here’s why.At the height of the buying frenzy seen during the pandemic, there was a rise in the number of homebuyers who put offers on houses sight unseen. That happened for three reasons:

- Extremely low housing inventory

- A lot of competition from other buyers wanting to take advantage of historically low mortgage rates

- And general wariness of in-person home tours during a pandemic

Today, the market’s changing, and buyers can usually be more selective and take more time to explore their options.

So, in order to show your house and sell it efficiently, you’ll want to provide buyers with as much access as you can. Before letting your agent know what works for you, consider these five levels of access you can provide. They’re ordered from most convenient for a buyer to least convenient. Remember, your agent will be better able to sell your house if you provide as much access to buyers as possible.

- Lockbox on the Door – This allows buyers the ability to see the home as soon as they are aware of the listing or at their convenience.

- Providing a Key to the Home – This would require an agent to stop by an office to pick up the key, which is still pretty convenient for a buyer.

- Open Access with a Phone Call – This means you allow a showing with just a phone call’s notice.

- By Appointment Only – For example, you might want your agent to set up a showing at a particular time and give you advance notice. That way you can prepare the house and be sure you have somewhere else you can go in the meantime.

- Limited Access – This might mean you’re only willing to have your house available on certain days or at certain times of day. In general, this is the most difficult and least flexible way to show your house to potential buyers.

As today’s housing market changes, be sure to work with your local agent to give buyers as much access as you can to your house when you sell.

What’s Ahead for Home Prices in 2023

Over the past year, home prices have been a widely debated topic. Some have said we’ll see a massive drop in prices and that this could be a repeat of 2008 – which hasn’t happened. Others have forecasted a real estate market that could see slight appreciation or depreciation depending on the area of the country. And as we get closer to the spring real estate market, experts are continuing to forecast what they believe will happen with home prices this year and beyond.Selma Hepp, Chief Economist at CoreLogic, says:

“While 2023 kicked off on a more optimistic note for the U.S. housing market, recent mortgage rate volatility highlights how much uncertainty remains. Nevertheless, the continued shortage of for-sale homes is likely to keep price declines modest, which are projected to top out at 3% peak to trough.”

Additionally, every quarter, Pulsenomics surveys a panel of over 100 economists, investment strategists, and housing market analysts regarding their five-year expectations for future home prices in the United States. Here’s what they said most recently:

So, given this information and what experts are saying about home prices, the question you might be asking is: should I buy a home this spring? Here are three reasons you should consider making a move:

- Buying a home helps you escape the cycle of rising rents. Over the past several decades, the median price of rent has risen consistently. The bottom line is, rent is going up.

- Homeownership is a hedge against inflation. A key advantage of homeownership is that it’s one of the best hedges against inflation. When you buy a home with a fixed-rate mortgage, you secure your housing payment, so it won’t go up like it would if you rent.

- Homeownership is a powerful wealth-building tool. The average net worth of a homeowner is $255,000 compared to $6,300 for a renter.

Experts are projecting slight price depreciation in the housing market this year, followed by steady appreciation. Given that, you may be wondering if you should move ahead with buying a home this spring. The decision to purchase a home is best made when you do it knowing all the facts and have an expert on your side.

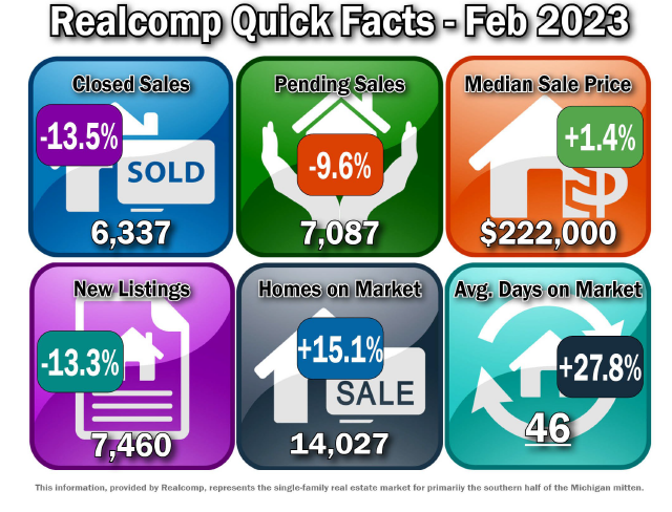

Inventory of Homes of Increases Significantly in February

Inventory of Homes of Increases Significantly in February Overall Median Sales Price Rises Slightly

February – National and Local Real Estate Commentary

In its continued effort to curb inflation, the Federal Reserve raised its benchmark interest rate in February by a quarterpercentage point to 4.50% – 4.75%, its 8th rate hike since March of last year, when the interest rate was nearly zero. Mortgage interest rates have dipped slightly from their peak last fall, leading pending sales to increase 8.1% month-tomonth as of last measure, but affordability constraints continue to limit homebuyer activity overall, with existing-home sales declining for the twelfth consecutive month, according to the National Association of Realtors® (NAR).

Closed Sales decreased 11.9 percent for Residential homes and 23.4 percent for Condo homes. Pending Sales decreased 9.4 percent for Residential homes and 11.3 percent for Condo homes. Inventory increased 14.8 percent for Residential homes and 17.2 percent for Condo homes.

The Median Sales Price increased 1.8 percent to $222,000 for Residential homes and 1.8 percent to $224,000 for Condo homes. Days on Market increased 24.3 percent for Residential homes and 31.3 percent for Condo homes. Month’s Supply of Inventory increased 36.4 percent for Residential homes and 41.7 percent for Condo homes.

“Once again market factors are continuing to largely dictate activity,” said Karen Kage, CEO, Realcomp II Ltd. “At the same time, potential home buyers have more options to choose from without the competitive pressures they were experiencing last year at this time.”

With buyer demand down from peak levels, home price growth has continued to slow nationwide, although prices remain up from a year ago. Sellers have been increasingly cutting prices and offering sales incentives in an attempt to attract buyers, who have continued to struggle with affordability challenges this winter. The slight decline in mortgage rates earlier this year convinced some buyers to come off the sidelines, but with rates ticking up again in recent weeks, buyers are once again pulling back, causing sales activity to remain down heading into spring.

February Y-O-Y Comparison — Residential & Condos Combined — All MLS

- New Listings decreased by 13.3% from 8,603 to 7,460.

- Pending Sales decreased by 9.6% from 7,841 to 7,087.

- Closed Sales decreased by 13.5% from 7,325 to 6,337.

- Average days on market (DOM) increased by 10 days from 36 to 46.

- Median Sale Price increased by 1.4% from $219,000 to $222,000.

- Percent of last list price received decreased by 2.2% from 100.1% to 97.9%.

- Inventory of Homes for Sale increased by 15.1% from 12,188 to 14,027.

- Months-Supply of Inventory increased by 36.4% from 1.1 to 1.5.

- Average Showings per Home decreased by 4.2 from 14.4 to 10.2.

- Listings that were both listed and pended in the same month were at 2,874. This represents 38.5% of the new listings for the month and 40.5% of the pended listings.

February 5-Year Perspectives — Residential & Condos Combined — All MLS

February 5-Year Perspectives — Residential & Condos Combined – City of Detroit Numbers

February 5-Year Perspectives — Residential & Condos Combined — Livingston County

February 5-Year Perspectives — Residential & Condos Combined — Macomb County Numbers

February 5-Year Perspectives — Residential & Condos Combined — Oakland County Numbers

February 5-Year Perspectives — Residential & Condos Combined — Wayne County Numbers

*high points noted with an asterisk.

It’s important to note that these numbers present a high-level view of what is happening in the real estate market in the lower part of Michigan and in specific regions. Be sure to contact a REALTOR® for their expertise about local markets.

Realcomp Shareholder Boards & Associations of REALTORS®:

- DABOR, Erin Richard, CEO, 313-278-2220

- DAR, Sharon Armour, EVP, 313-962-1313

- ETAR, Laura VanHouteghen, 810-982-6889

- GMAR, Vickey Livernois, EVP, 248-478-1700

- GPBR, Bob Taylor, CEO, 313-882-8000

- LUTAR, 810-664-0271

- LCAR, Pam Leach, EVP, 810-225-1100

- NOCBOR, Patricia Jacobs, EVP, 248-674-4080

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link