Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

Unlock the True Value of Your Estate: The Power of a Probate Broker Price Opinion

There might be an inconsistency in the appraisal that was conducted, or is about to be. Here’s the crux: The house typically stands as the most prized asset of any estate. Yet, an appraisal might not be the finest way to ascertain its value. Instead, consider a PBPO.

Wondering what PBPO is? PBPO stands for Probate Broker Price Opinion, a method that furnishes an extremely precise estimate of your property’s value.

But, you might wonder, why does a PBPO offer a more precise evaluation than an appraisal?

Appraisers conducting estate evaluations usually don’t physically inspect the interior of homes as real estate agents do. Rather, they browse through property listings online and rely on real estate agents for more comprehensive details.

As a Certified Probate Real Estate Specialist (CPRES) like myself, I’m involved in property transactions daily and have hands-on knowledge of the properties that appraisers only browse on their screens.

So, what truly determines the value of a property? It boils down to the amount a buyer is willing to part with. Real estate agents are proficient at gauging this figure, as they interact with buyers daily to facilitate property sales.

By this point, you’ve likely received your Probate Orders, leading you to question how to acquire a PBPO and the associated cost.

Here’s the crucial part:

You can trust me to ensure your interests are safeguarded and that you receive the BEST POSSIBLE OFFER in the current market! To assist in your decision-making process, I am offering a Probate Broker Price Opinion (PBPO) completely free of charge!

Normally, a professional PBPO involves a cost due to the extensive work it requires, but I want you to be well-informed when it comes to your property’s evaluation.

Simplify your life today. Reach out to me either via call at (810) 965-4566 or email at bob.devore@coldwellbanker.com, and I’ll arrange a meeting either by phone, a house visit, or at my office to provide you with your PBPO.

The True Value of Homeownership

Buying and owning your home can make a big difference in your life by bringing you joy and a sense of belonging. And with June being National Homeownership Month, it’s the perfect time to think about all the benefits homeownership provides.

Of course, there are financial reasons to buy a house, but it’s important to consider the non-financial benefits that make a home more than just where you live.

Here are three ways owning your home can give you a sense of accomplishment, happiness, and pride.

You May Feel Happier and More Fulfilled

Owning a home is associated with better mental health and well-being. Gary Acosta, CEO and Co-Founder at the National Association of Hispanic Real Estate Professionals (NAHREP), explains:

“Studies have shown the emotional and psychological benefits that homeownership has on a person’s health and self-esteem . . .”

Similarly, Habitat for Humanity says:

“Residential stability among homeowners is related to improved life satisfaction, . . . along with better physical and mental health.”

So, according to the experts, owning a home can improve your psychological wellness by making you feel happier and more accomplished.

You Can Engage in Your Neighborhood and Grow Your Sense of Community

Your home connects you to your community. Homeowners tend to stay in their homes longer than renters, and that can help you feel more connected to your community because you have more time to build meaningful relationships. And, as Acosta says, when people stay in the same area for a longer period of time, it can lead to them being more involved:

“Homeowners also tend to be more active in their local communities . . .”

After all, it makes sense that someone would want to help improve the area they’re going to be living in for a while.

You Can Customize and Improve Your Living Space

Your home is a place that’s all yours. When you own it, unless there are specific homeowner’s association requirements, you’re free to customize it however you see fit. Whether that’s small home improvements or full-on renovations, your house can be exactly what you want and need it to be. As your tastes and lifestyle change, so can your home. As Investopedia tells us:

“One often-cited benefit of homeownership is the knowledge that you own your little corner of the world. You can customize your house, remodel, paint, and decorate without the need to get permission from a landlord.”

Renting can limit your ability to personalize your living space, and even if you do make changes, you may have to undo them before your lease ends. The ability homeownership gives you to customize and improve where you live creates a greater sense of ownership, pride, and connection with your home.

Bottom Line

Owning your home can change your life in a way that gives you greater satisfaction and happiness. Let’s connect today if you’re ready to explore homeownership and all it has to offer.

Keys to Success for First-Time Homebuyers

Buying your first home is an exciting decision and a major milestone that has the power to change your life for the better. As a first-time homebuyer, it’s a vision you can bring to life, but, as the National Association of Realtors (NAR) shares, you’ll have to overcome some factors that have made it more challenging in recent years:

“Since 2011, the share of first-time home buyers has been under the historical norm of 40% as buyers face tight inventory, rising home prices, rising rents and high student debt loads.”

That said, if you’re looking to purchase your first home, here are two things you can consider to help make your dreams a reality.

Save Money with First-Time Homebuyer Programs

Being able to pay for the initial costs and fees associated with homeownership can feel like a major hurdle. Whether that’s getting a loan, being able to put together a down payment, or having money for closing costs – there are a variety of expenses that can make buying your first home feel challenging.

Fortunately, there are a lot of public and private first-time homebuyer programs that can help you get a loan with little-to-no money upfront. CNET explains:

“A first-time homebuyer program can help make homeownership more affordable and accessible by offering lower mortgage rates, down payment assistance and tax incentives.”

In fact, as Bankrate says, many of these programs are offered by state and local governments:

“Many states and local governments have programs that offer down payment or closing cost assistance – either low-interest-rate loans, deferred loans or even forgivable loans (aka grants) – to people looking to buy their first house . . .”

To take advantage of these programs, contact the housing authority in your state and browse sites like Down Payment Resource.

The Supply of Homes for Sale Is Low, So Explore Every Possibility

It’s a sellers’ market, meaning there aren’t enough homes on the market to meet buyer demand. So, how can you be sure you’re doing everything you can to find a home that works for you? You can increase your options by considering condominiums (condos) and townhomes. U.S. News tells us these housing types are often less expensive than single-family homes:

“Condos are usually less expensive than standalone houses . . . They are also less expensive to insure.”

One reason why they may be more affordable is because they’re often smaller. But they still give you the chance to get your foot in the door and achieve your dream of owning and building equity. Beyond that, another major perk is they typically require less maintenance. As U.S. News says in the same article:

“The strongest reason for purchasing a condo is that all external maintenance is usually covered by the condo association, such as landscaping, pool maintenance, external painting, paving, plowing and more. This fee also covers some internal maintenance, such as gas, electric, plumbing, HVAC and other mechanical systems.”

Townhomes and condos are great ways to get into homeownership. Owning your home allows you to build equity, increase your net worth, and can fuel a future move.

The best way to make sure you’re set up for success, especially if you’re just starting out, is to work with a trusted real estate agent. They can educate you on the homebuying process, help you understand your local area to find options that are right for you, and coach you through making an offer in a competitive market.

Bottom Line

Today’s housing market provides some challenges for first-time homebuyers. But, there are still ways to achieve your goals, like utilizing first-time homebuyer programs and considering all of your housing options. Let’s connect so you have an expert on your side who can help you navigate the process.

A Guide to Maximizing Probate Real Estate Value: Introducing the PBPO

man with a magnifying glass looks at the house. home search concept

As a probate executor, you possess the qualities of a true champion. From navigating complex paperwork and legalities to resolving disputes among heirs, and making crucial decisions regarding personal property and real estate, your role is invaluable. I want to express my sincere appreciation for your efforts. Rest assured, when you require assistance with your probate matters, you can rely on me. I am committed to working tirelessly on your behalf, ensuring nobody works harder than I do!

Now, you might be wondering, what can I provide that has proven most helpful to other executors?

The answer lies in a PBPO.

When it comes to estates, the most valuable asset typically is the HOUSE!

While appraisals are commonly relied upon to determine a property’s value, there is a more accurate alternative—the PBPO.

But what exactly is a PBPO?

PBPO stands for Probate Broker Price Opinion, which offers an exceptionally precise estimate of a property’s value.

“But Bob,” you might ask, “why is a PBPO more accurate than an appraisal?”

The answer lies in the fact that estate appraisers seldom set foot inside the houses they evaluate. Instead, they rely on computer-based research and often consult real estate agents for additional insights.

This is where Certified Probate Real Estate Specialists (CPRES) like myself come in. We sell properties day in and day out, gaining firsthand knowledge of every property that appraisers merely observe on their screens.

And here’s a familiar truth: What determines the value of a property?

Ultimately, it is what a buyer is willing to pay. Real estate agents, who work with buyers daily to sell properties, possess the deepest understanding of buyer behavior. That’s why working with a Certified Probate Real Estate Specialist (CPRES) is the optimal way to secure the highest possible price for this valuable asset.

Unfortunately, many executors and administrators unknowingly lose thousands of dollars by listing estate properties with non-probate certified real estate agents. Don’t fall into that trap!

A Certified Probate Real Estate Specialist (CPRES) ensures that you fulfill your fiduciary responsibility to all parties involved, safeguarding you against potential future problems.

Rest assured, I am here to protect your interests and ensure you receive the BEST POSSIBLE OFFER in today’s market! To aid you in the decision-making process…

I am currently providing a complimentary Probate Broker Price Opinion (PBPO) exclusively for you!

Typically, such a service incurs a cost due to the meticulous nature of conducting a truly professional PBPO. However, I believe in empowering you with the knowledge required to evaluate your real property effectively.

Take the first step in simplifying your life today. All you need to do is call me at (810) 965-4566 or email me at bob.devore@coldwellbanker.com. I will arrange a convenient time for us to connect via phone, conduct a home visit, or meet at my office to present the PBPO to you.

Today’s Real Estate Market: The ‘Unicorns’ Have Galloped Off

Comparing real estate metrics from one year to another can be challenging in a normal housing market. That’s due to possible variability in the market making the comparison less meaningful or accurate. Unpredictable events can have a significant impact on the circumstances and outcomes being compared.

Comparing this year’s numbers to the two ‘unicorn’ years we just experienced is almost worthless. By ‘unicorn,’ this is the less common definition of the word:

“Something that is greatly desired but difficult or impossible to find.”

The pandemic profoundly changed real estate over the last few years. The demand for a home of our own skyrocketed, and people needed a home office and big backyard.

- Waves of first-time and second-home buyers entered the market.

- Already low mortgage rates were driven to historic lows.

- The forbearance plan all but eliminated foreclosures.

- Home values reached appreciation levels never seen before.

It was a market that forever had been “greatly desired but difficult or impossible to find.” A ‘unicorn’ year.

Now, things are getting back to normal. The ‘unicorns’ have galloped off.

Comparing today’s market to those years makes no sense. Here are three examples:

Buyer Demand

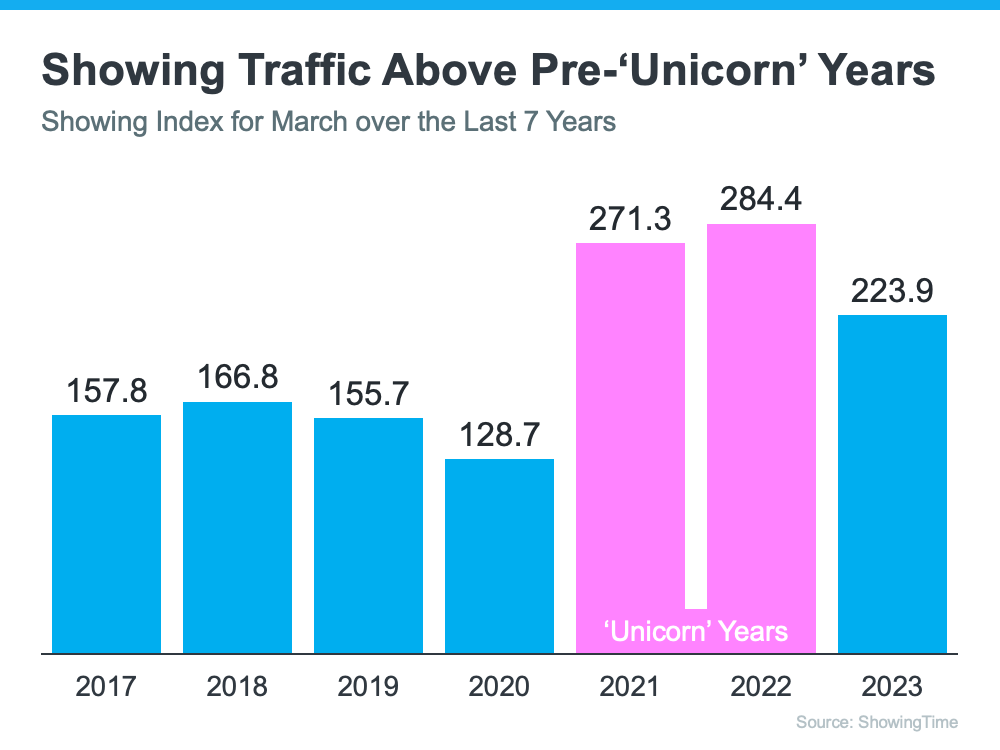

If you look at the headlines, you’d think there aren’t any buyers out there. We still sell over 10,000 houses a day in the United States. Of course, buyer demand is down from the two ‘unicorn’ years. But, according to ShowingTime, if we compare it to normal years (2017-2019), we can see that buyer activity is still strong (see graph below):

Home Prices

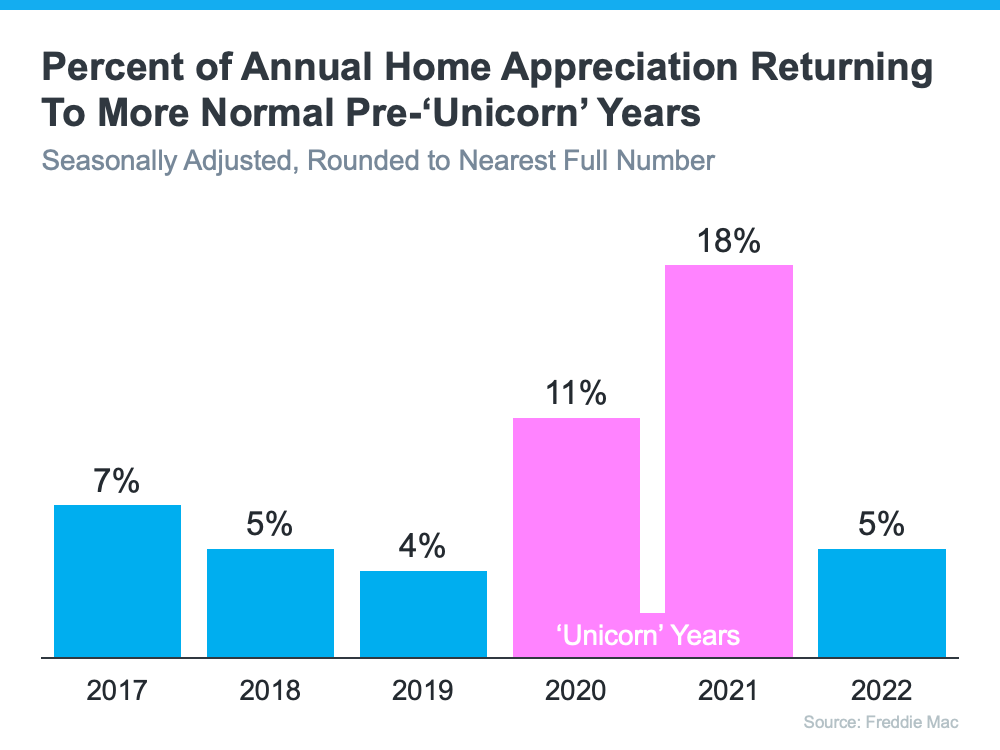

We can’t compare today’s home price increases to the last couple of years. According to Freddie Mac, 2020 and 2021 each had historic appreciation numbers. Here’s a graph also showing the more normal years (2017-2019):

We can see that we’re returning to more normal home value increases. There were several months of minimal depreciation in the second half of 2022. However, according to Fannie Mae, the market has returned to more normal appreciation in the first quarter of this year.

Foreclosures

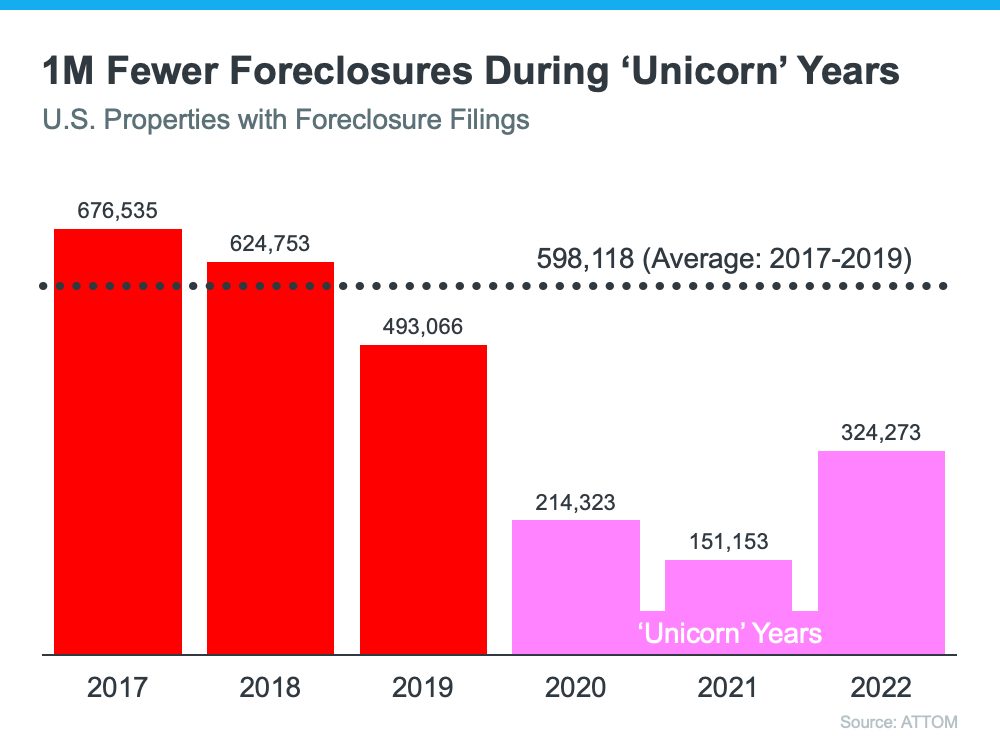

There have already been some startling headlines about the percentage increases in foreclosure filings. Of course, the percentages will be up. They are increases over historically low foreclosure rates. Here’s a graph with information from ATTOM, a property data provider:

There will be an increase over the numbers of the last three years now that the moratorium on foreclosures has ended. There are homeowners who lose their home to foreclosure every year, and it’s heartbreaking for those families. But, if we put the current numbers into perspective, we’ll realize that we’re actually going back to the normal filings from 2017-2019.

Bottom Line

There will be very unsettling headlines around the housing market this year. Most will come from inappropriate comparisons to the ‘unicorn’ years. Let’s connect so you have an expert on your side to help you keep everything in proper perspective.

Who Gets Grandma’s Yellow Pie Plate?™

Vintage pie plate vector illustration, remixed from the artwork by Cora Parker

While the process may seem taxing and at times even exasperating, remember, you were singled out because of your demonstrated leadership, fairness, meticulous attention to detail, and compassion. These are the qualities that earned you the role of an executor for a probate estate.

Even in moments of frustration and exhaustion, always remember that nobody could fulfill this role as effectively as you.

Now, I have an important question for you…

Did you find the responsibility of determining “who gets what” and deciding what to do with the personal property of the estate more complex than you initially thought?

Well, let me share a resource with you…

Several years ago, I stumbled upon a highly insightful article from the University of Montana. This article has proven to be a valuable guide for many executors like you, especially when it comes to distributing personal property.

The article is aptly named “Who Gets Grandma’s Yellow Pie Plate?” and you can find it attached at the end of this blog post.

Who Gets Grandma’s Yellow Pie Plate?™

Personal belongings often have special meaning for individuals and family members. Planning to pass on such items — treasured wedding photo, Grandpa’s fishing tackle box, or a well-used yellow pie plate — can be challenging and may lead to family conflict.

“This yellow pie plate belonged to my great grandmother who spent time in the kitchen with her daughters’ baking pies. She gave it to our grandmother. The tradition of baking pies has continued through the generations and the yellow pie plate is always on the table at family gatherings. I hope someday it will be mine. It’s a piece of my living history.” -Andrea

Who Gets Grandma’s Yellow Pie Plate?™ provides people with practical information about the inheritance and transfer of non-titled personal property. The curriculum, workshop, and related web resources help families communicate, make decisions, and lessen conflict.

No matter who you are in the process — parent, spouse, child, educator, legal professional, or social service staff — the Who Gets Grandma’s Yellow Pie Plate?™ resources, and the related Intergenerational Land Transfer resources, can help you:

- Bring up inheritance issues for discussion.

- Prepare a legally appropriate list of non-titled property.

- Decide what “fair” means.

- Ask others what objects they would like and why.

- Identify transfer goals.

- Select distribution and transfer methods that fit goals.

- Consider how to deal with conflicts before they arise.

If you would like to learn more about personal property distribution from the eyes of an executor or administrator, this is a great workbook to obtain. It is available for purchase on Amazon.com.

Who Gets Grandma’s Yellow Pie Plate? Workbook: A Guide to Passing on Personal Possessions

Nov 2011

by Marlene S. Stum

Fill This Gaping Hole in Your Probate Duties

How would you like to have absolute clarity about your probate duties?

You were chosen to be an executor because of your ability to lead and make good decisions. If you are like me, then you like to have a clear picture of all your options so that you feel that you have made the best decision.

Look, most real estate agents and attorneys needlessly make executors feel overwhelmed by a mountain of complicated probate information.

That is exactly why I attached this plain and easy to follow flowchart: Estate Executor’s and Administrator’s Duties During the Probate Process <

As your real estate agent who specializes in probate (a CPRES Agent/Certified Probate Real Estate Specialist) you can count on me to make the sale of the property in the probate estate as simple as possible.

So, take a look at the attached flow chart. Let me know what you think. Good or bad, helpful, or not?

Let me know either way.

Bob DeVore

Probate Specialist

Coldwell Banker Professionals

www.michiganrealestateprobate.com

bob.devore@coldwellbanker.com

(810) 965-4566

Moving Now Can Give Your House Its Day in the Sun

Some Highlights

- If you want to sell your house, consider doing it this summer. The days are longer, the weather is warmer, and it’s a great time for sellers.

- If your needs have changed, now’s the time to capitalize on the low inventory and multiple offers in today’s sellers’ market.

- Let’s connect today if you’re ready to sell your house and move to a home that meets your changing needs.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link