Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

This Real Estate Market Is the Strongest of Our Lifetime

When you look at the numbers today, the one thing that stands out is the strength of this housing market. We can see this is one of the most foundationally strong housing markets of our lifetime – if not the strongest housing market of our lifetime. Here are two fundamentals that prove this point.

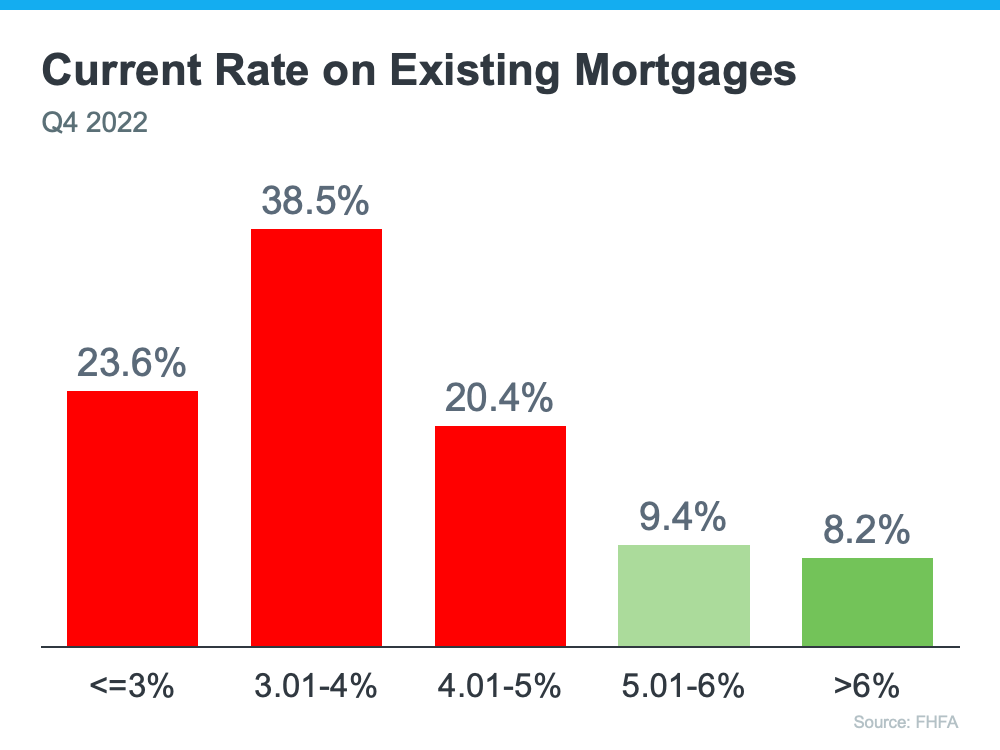

1. The Current Mortgage Rate on Existing Mortgages

First, let’s look at the current rate on existing mortgages. According to the Federal Housing Finance Agency (FHFA), as of the fourth quarter of last year, over 80% of existing mortgages have a rate below 5%. That’s significant. And, to take that one step further, over 50% of mortgages have a rate below 4% (see graph below):

Now, there’s a lot of talk in the media about a potential foreclosure crisis or a rise of homeowners defaulting on their loans, but consider this. Homeowners with such good mortgage rates are going to work as hard as they can to keep that mortgage and stay in their homes. That’s because they can’t go out and buy another house, or even rent an apartment, and pay what they do today. Their current mortgage payment is more affordable. Even if they downsize, with today’s higher mortgage rates, it could cost more.

Here’s why this gives the housing market such a solid foundation today. Having so many homeowners with such low mortgage rates helps us avoid a crisis with a flood of foreclosures coming to market like there was back in 2008.

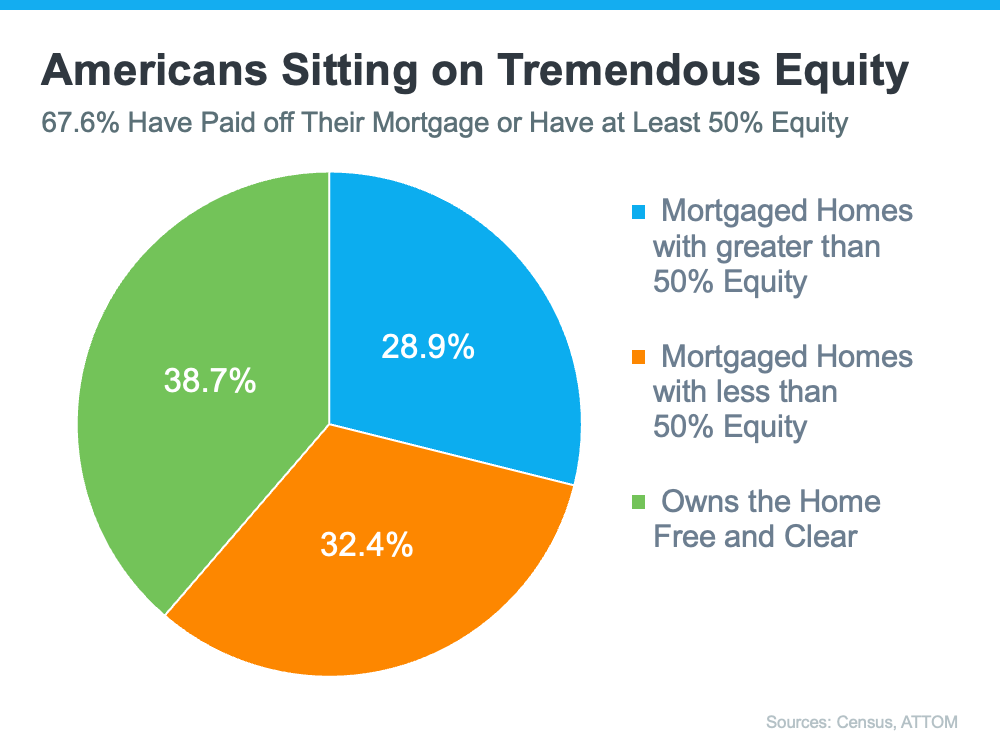

2. The Amount of Homeowner Equity

Second, Americans are sitting on tremendous equity right now. According to the Census and ATTOM, roughly two-thirds (around 68%) of homeowners have either paid off their mortgage or have at least 50% equity (see chart below):

In the industry, the term for this is equity rich. This is significant because if you think back to 2008, some people had to make the difficult decision to walk away from their homes because they owed more on the home than it was worth.

But this time, things are different because homeowners have built up so much equity over the past few years alone. And, when homeowners have that much equity, it helps us avoid another wave of distressed properties coming onto the market like we saw during the crash. It also creates an extremely strong foundation for today’s housing market.

Bottom Line

We are in one of the most foundationally strong housing markets of our lifetime because homeowners are going to fight to keep their current mortgage rate and they have a tremendous amount of equity. This is yet another reason things are fundamentally different than in 2008.

Saving for a Down Payment? Here’s What You Need To Know.

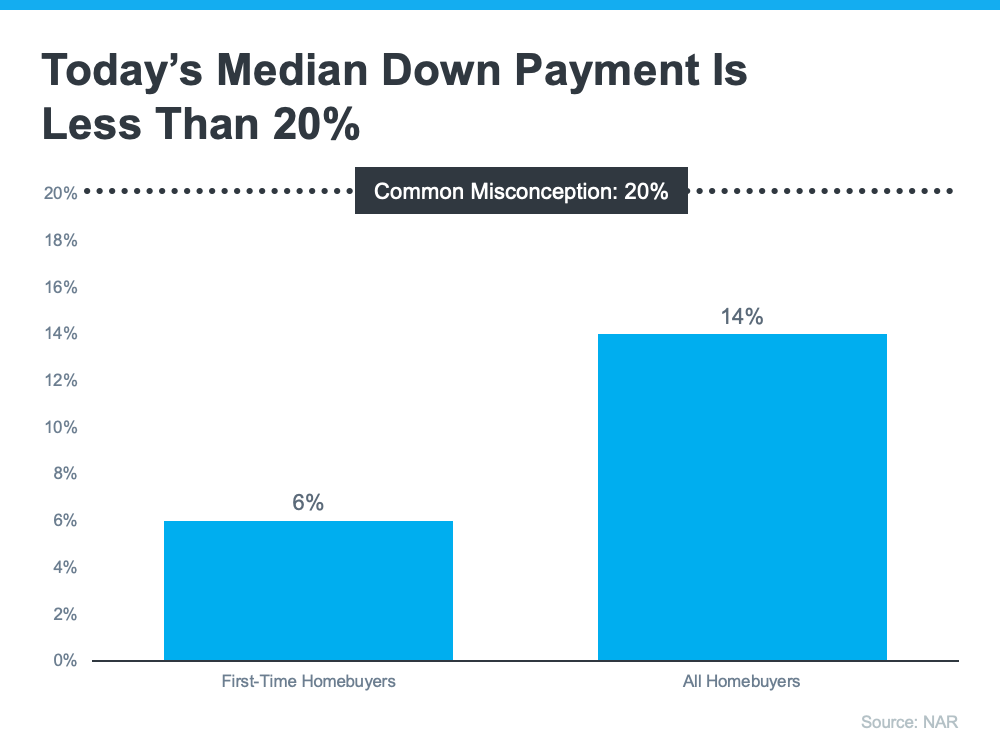

If you’re planning to buy your first home, then you’re probably focused on saving for all the costs involved in such a big purchase. One of the expenses that may be at the top of your mind is your down payment. If you’re intimidated by how much you need to save for that, it may be because you believe you must put 20% down. That doesn’t necessarily have to be the case. As the National Association of Realtors (NAR) notes:

“One of the biggest misconceptions among housing consumers is what the typical down payment is and what amount is needed to enter homeownership.”

And a recent Freddie Mac survey finds:

“. . . nearly a third of prospective homebuyers think they need a down payment of 20% or more to buy a home. This myth remains one of the largest perceived barriers to achieving homeownership.”

Here’s the good news. Unless specified by your loan type or lender, it’s typically not required to put 20% down. This means you could be closer to your homebuying dream than you realize.

According to NAR, the median down payment hasn’t been over 20% since 2005. In fact, the median down payment for all homebuyers today is only 14%. And it’s even lower for first-time homebuyers at just 6% (see graph below):

What does this mean for you? It means you may not need to save as much as you originally thought.

Learn About Options That Can Help You Toward Your Goal

And it’s not just how much you need for your down payment that isn’t clear. There are also misconceptions about down payment assistance programs. For starters, many people believe there’s only assistance available for first-time homebuyers. While first-time buyers have many options to explore, repeat buyers have some, too.

According to Down Payment Resource, there are over 2,000 homebuyer assistance programs in the U.S., and the majority are intended to help with down payments. That same resource goes on to say:

“You don’t have to be a first-time buyer. Over 38% of all programs are for repeat homebuyers who have owned a home in the last 3 years.”

Plus, there are even loan types, like FHA loans with down payments as low as 3.5% as well as options like VA loans and USDA loans with no down payment requirements for qualified applicants.

If you’re interested in learning more about down payment assistance programs, information is available through sites like Down Payment Resource. Then, partner with a trusted lender to learn what you qualify for on your homebuying journey.

Bottom Line

Remember, a 20% down payment isn’t always required. If you want to purchase a home this year, let’s connect to start the conversation about your homebuying goals.

The Main Reason Mortgage Rates Are So High

Today’s mortgage rates are top-of-mind for many homebuyers right now. As a result, if you’re thinking about buying for the first time or selling your current house to move into a home that better fits your needs, you may be asking yourself these two questions:

- Why Are Mortgage Rates So High?

- When Will Rates Go Back Down?

Here’s context you need to help answer those questions.

1. Why Are Mortgage Rates So High?

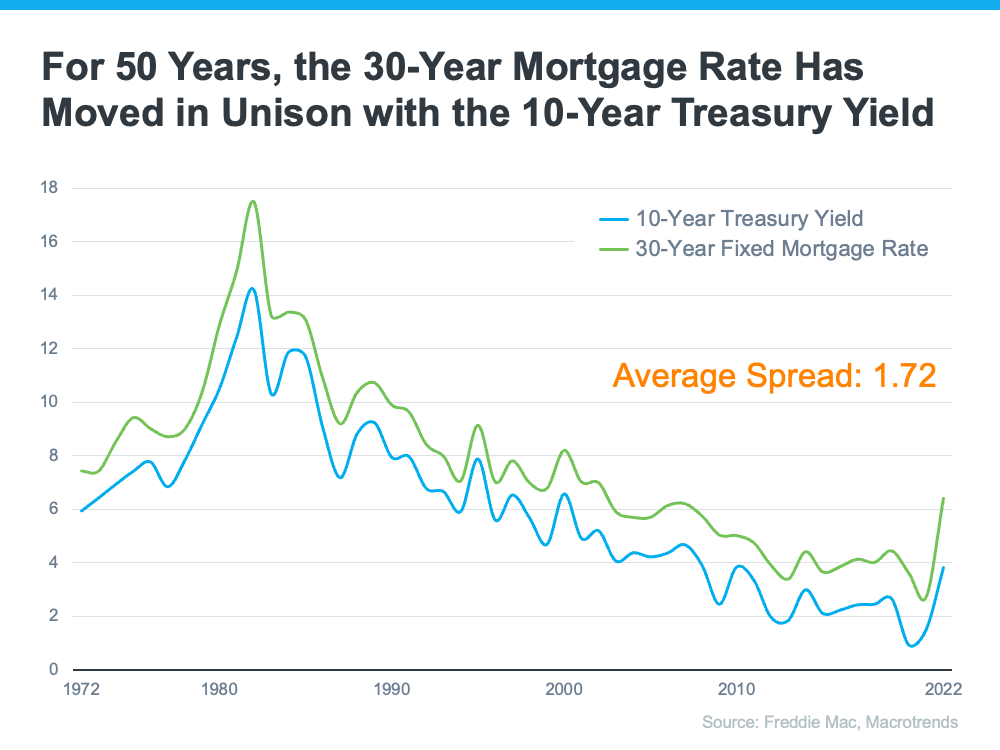

The 30-year fixed-rate mortgage is largely influenced by the supply and demand for mortgage-backed securities (MBS). According to Investopedia:

“Mortgage-backed securities (MBS) are investment products similar to bonds. Each MBS consists of a bundle of home loans and other real estate debt bought from the banks that issued them . . . The investor who buys a mortgage-backed security is essentially lending money to home buyers.”

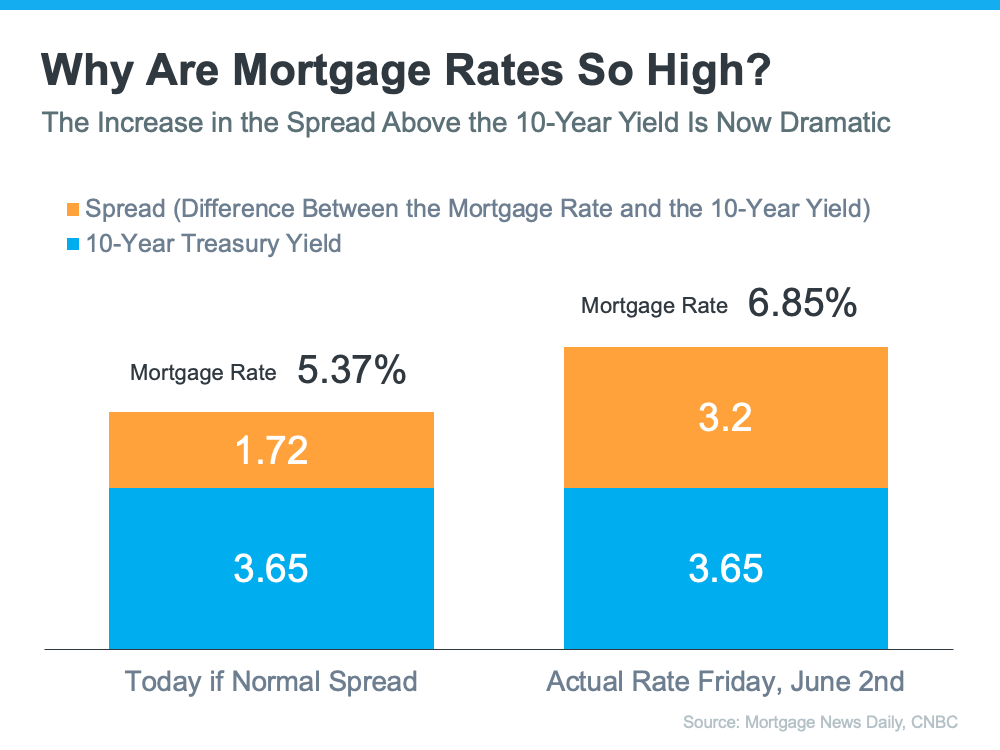

Demand for MBS helps determine the spread between the 10-Year Treasury Yield and the 30-year fixed mortgage rate. Historically, the average spread between the two is 1.72 (see chart below):

Last Friday morning, the mortgage rate was 6.85%. That means the spread was 3.2%, which is almost 1.5% over the norm. If the spread was at its historical average, mortgage rates would be 5.37% (3.65% 10-Year Treasury Yield + 1.72 spread).

This large spread is very unusual. As George Ratiu, Chief Economist at Keeping Current Matters (KCM), explains:

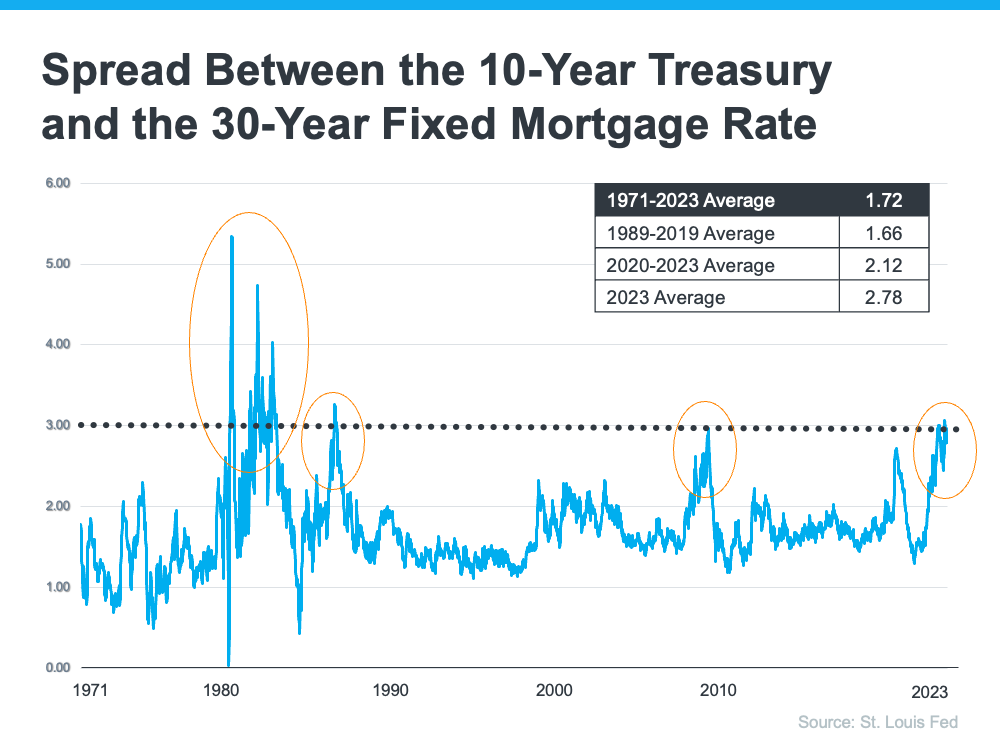

“The only times the spread approached or exceeded 300 basis points were during periods of high inflation or economic volatility, like those seen in the early 1980s or the Great Financial Crisis of 2008-09.”

The graph below uses historical data to help illustrate this point by showing the few times the spread has increased to 300 basis points or more:

The graph shows how the spread has come down after each peak. The good news is, that means there’s room for mortgage rates to improve today.

So, what’s causing the larger spread and making mortgage rates so high today?

The demand for MBS is heavily influenced by the risks associated with investing in them. Today, that risk is impacted by broader market conditions like inflation and fear of a potential recession, the Fed’s interest rate hikes to try to bring down inflation, headlines that create unnecessarily negative narratives about home prices, and more.

Simply put: when there’s less risk, demand for MBS is high, so mortgage rates will be lower. On the other hand, if there’s more risk with MBS, demand for MBS will be low, and we’ll see higher mortgage rates as a result. Currently, demand for MBS is low, so mortgage rates are high.

2. When Will Rates Go Back Down?

Odeta Kushi, Deputy Chief Economist at First American, answers that question in a recent blog:

“It’s reasonable to assume that the spread and, therefore, mortgage rates will retreat in the second half of the year if the Fed takes its foot off the monetary tightening pedal and provides investors with more certainty. However, it’s unlikely that the spread will return to its historical average of 170 basis points, as some risks are here to stay.”

Bottom Line

The spread will shrink when the fear investors feel is eased. That’ll mean we should see mortgage rates moderate as the year goes on. However, when it comes to forecasting mortgage rates, no one can know for sure exactly what will happen.

What Happens to a Mortgage When Someone Dies (Video)

Navigating Probate Estate Settlement: Common Mistakes to Avoid

A beautiful shot of the famous Roman Colosseum amphitheater under the breathtaking sky at sunrise

- The Misconception of Property Appraisal as Actual Value

One of the significant pitfalls executors and administrators often face during probate estate settlement is assuming the appraised value equates to the property’s actual market value. As any seasoned real estate professional will attest, a property’s value can vary considerably under these three distinct scenarios:

- When an appraiser assigns a value for the estate

- When the property is listed on the market

- When the property is ultimately sold

However, a unique exception exists if you immediately sell to the first buyer without exposing the property to the broader market on the internet. The simple rule of thumb is: the more potential buyers, the higher the potential sale price. Therefore, having a Probate Comparable Market Analysis from a Certified Probate Real Estate Specialist (CPRES) is crucial, especially during probate proceedings.

- The Oversight of Not Engaging a Probate Real Estate Specialist

Always opt for a Certified Probate Real Estate Specialist for your real estate transactions. They come equipped with specialized knowledge and skills to mitigate complications that may arise during the sales process.

- The Delay in Filing Essential Tax Documents

Before taking any action regarding the property’s sale, consult your accountant to ascertain the estate’s tax liability, if any. This proactive step helps prevent avoidable delays and possible penalties.

- The Neglect of Necessary Paperwork before Property Sale

It’s essential to ensure you’ve obtained your Letters of Administration or Letters Testamentary issued by the probate court before initiating the sale of the property. A Certified Probate Real Estate Specialist can aid you in assembling these documents.

- The Failure to Secure Multiple Repair Quotes

Before deciding to sell the property as-is, explore the potential benefits of carrying out repairs. Always aim to get at least two quotes from contractors or handymen for an accurate comparison.

As a CPRES Agent, my mission is to help you bypass these common errors and more. I’m dedicated to achieving the highest possible price for your property while providing exemplary service.

In addition, I can connect you with a range of service providers adept at assisting with probate-related matters. These include but are not limited to junk removal services, handymen, landscapers, CPAs, home appraisers, trash removal services, estate sale specialists, personal property estate appraisers, roofers, plumbers, electricians, locksmiths, and general contractors.

Should you require assistance with any of the above services, feel free to reach out to me for a list of my top service providers. Contact me at (810) 965-4566 or via email at bob.devore@coldwellbanker.com.

Navigating the Probate Process: A Guide for Executors

Have you ever tried to juggle 30 balls? Well, as a probate real estate agent, you know that your job as an executor of a probate estate can be even more challenging! In this blog post, we’ll explore the numerous tasks and responsibilities that come with being an executor, and how clarity can be your greatest ally in efficiently managing the probate process.

The Essential Guide: Estate Executors and Administrator’s Duties During the Probate Process Click Here for Chart

As an executor, you are not just a leader but also an expert in getting things done efficiently. To successfully navigate the complexities of probate, you need clarity. That’s why we present to you the flowchart of Estate Executors and Administrator’s Duties During the Probate Process.

Discovering Clarity: A Roadmap for Executors

This comprehensive flowchart outlines over 30 essential items and tasks that you need to account for as an executor. From locating assets to filing tax returns and distributing property, every step is meticulously detailed, providing you with a clear roadmap throughout the probate process.

Why Executors Value Clarity

Probate executors understand the value of having a quick reference guide to remind them of their responsibilities. Whether you need a refresher on what needs to be done or a reminder of tasks already completed, this flowchart will become an invaluable resource in your daily duties.

Simplify Your Role: Let Clarity Guide You

By embracing the clarity offered by the flowchart, you can streamline your role as an executor, making your life easier and more efficient. Say goodbye to confusion and uncertainty as you confidently tackle each task, knowing that you have a reliable tool at your disposal.

Take the First Step: Embrace Clarity Today!

Ready to simplify your life as a probate executor? Take a quick look at the Estate Executors and Administrator’s Duties During the Probate Process flowchart. Experience the power of clarity and discover how it can help you accomplish your tasks effectively and efficiently. Don’t wait any longer—start making your probate journey smoother today!

Conclusion: Being an executor of a probate estate is no easy feat. However, with the right resources and a clear roadmap, you can confidently navigate the complexities of the probate process. Embrace the clarity provided by the flowchart and empower yourself to fulfill your duties efficiently. Simplify your role as a probate executor and experience the benefits of clarity today!

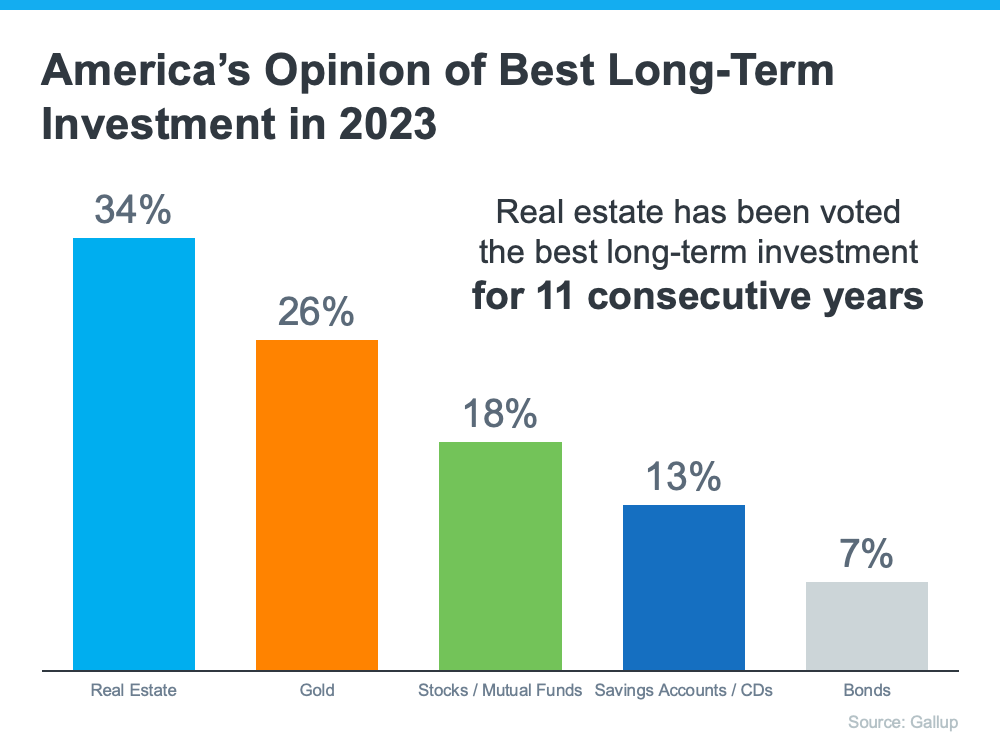

Real Estate Is Still Considered the Best Long-Term Investment

With all the headlines circulating about home prices and rising mortgage rates, you may wonder if it still makes sense to invest in homeownership right now. A recent poll from Gallup shows the answer is yes. In fact, real estate was voted the best long-term investment for the 11th consecutive year, consistently beating other investment types like gold, stocks, and bonds (see graph below):

If you’re thinking about purchasing a home, let this poll reassure you. Even with everything happening today, Americans recognize owning a home is a powerful financial decision.

Why Do Americans Still Feel So Positive About the Value of Investing in a Home?

Purchasing real estate has typically been a solid long-term strategy for building wealth in America. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), notes:

“. . . homeownership is a catalyst for building wealth for people from all walks of life. A monthly mortgage payment is often considered a forced savings account that helps homeowners build a net worth about 40 times higher than that of a renter.”

That’s because owning a home grows your net worth over time as your home appreciates in value and as you pay down your mortgage. And, since building that wealth takes time, it may make sense to start as soon as you can. If you wait to buy and keep renting, you’ll miss out on those monthly housing payments going toward your home equity.

Bottom Line

Buying a home is a powerful decision. So, it’s no wonder so many people view real estate as the best long-term investment. If you’re ready to start on your own journey toward homeownership, let’s connect today.

Oops! Home Prices Didn’t Crash After All

During the fourth quarter of last year, many housing experts predicted home prices were going to crash this year. Here are a few of those forecasts:

Jeremy Siegel, Russell E. Palmer Professor Emeritus of Finance at the Wharton School of Business:

“I expect housing prices fall 10% to 15%, and the housing prices are accelerating on the downside.”

Mark Zandi, Chief Economist at Moody’s Analytics:

“Buckle in. Assuming rates remain near their current 6.5% and the economy skirts recession, then national house prices will fall almost 10% peak-to-trough. Most of those declines will happen sooner rather than later. And house prices will fall 20% if there is a typical recession.”

“Housing is already cooling in the U.S., according to July data that was reported last week. As interest rates climb steadily higher, Goldman Sachs Research’s G-10 home price model suggests home prices will decline by around 5% to 10% from the peak in the U.S. . . . Economists at Goldman Sachs Research say there are risks that housing markets could decline more than their model suggests.”

The Bad News: It Rattled Consumer Confidence

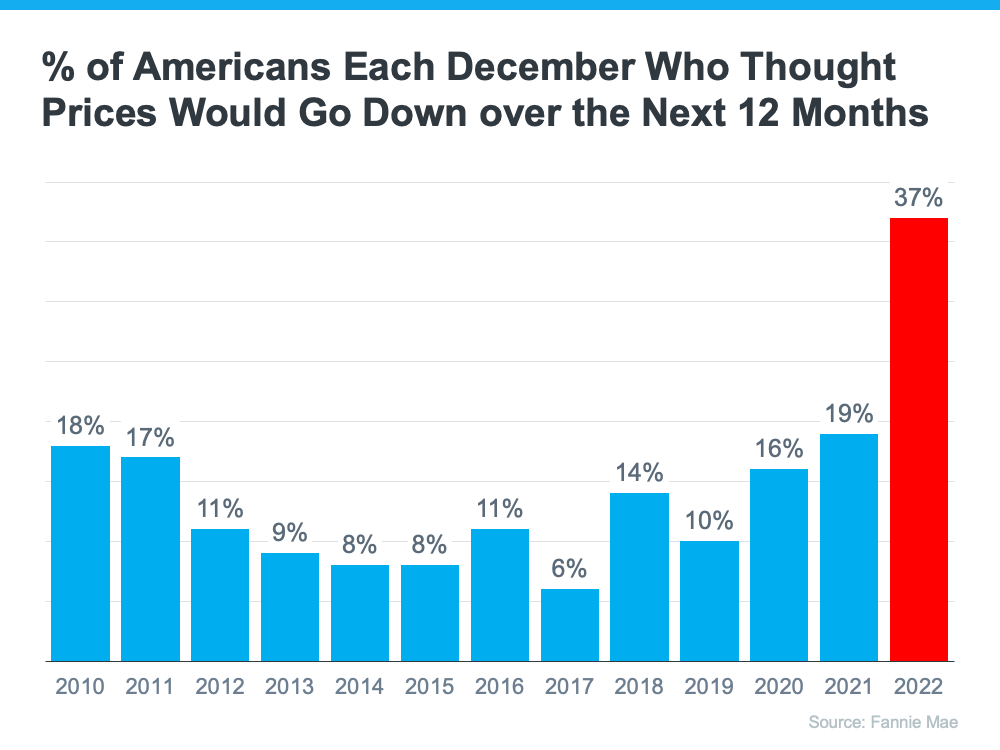

These forecasts put doubt in the minds of many consumers about the strength of the residential real estate market. Evidence of this can be seen in the December Consumer Confidence Survey from Fannie Mae. It showed a larger percentage of Americans believed home prices would fall over the next 12 months than in any other December in the history of the survey (see graph below). That caused people to hesitate about their homebuying or selling plans as we entered the new year.

The Good News: Home Prices Never Crashed

However, home prices didn’t come crashing down and seem to be already rebounding from the minimal depreciation experienced over the last several months.

In a report just released, Goldman Sachs explained:

“The global housing market seems to be stabilizing faster than expected despite months of rising mortgage rates, according to Goldman Sachs Research. House prices are defying expectations and are rising in major economies such as the U.S.,. . . ”

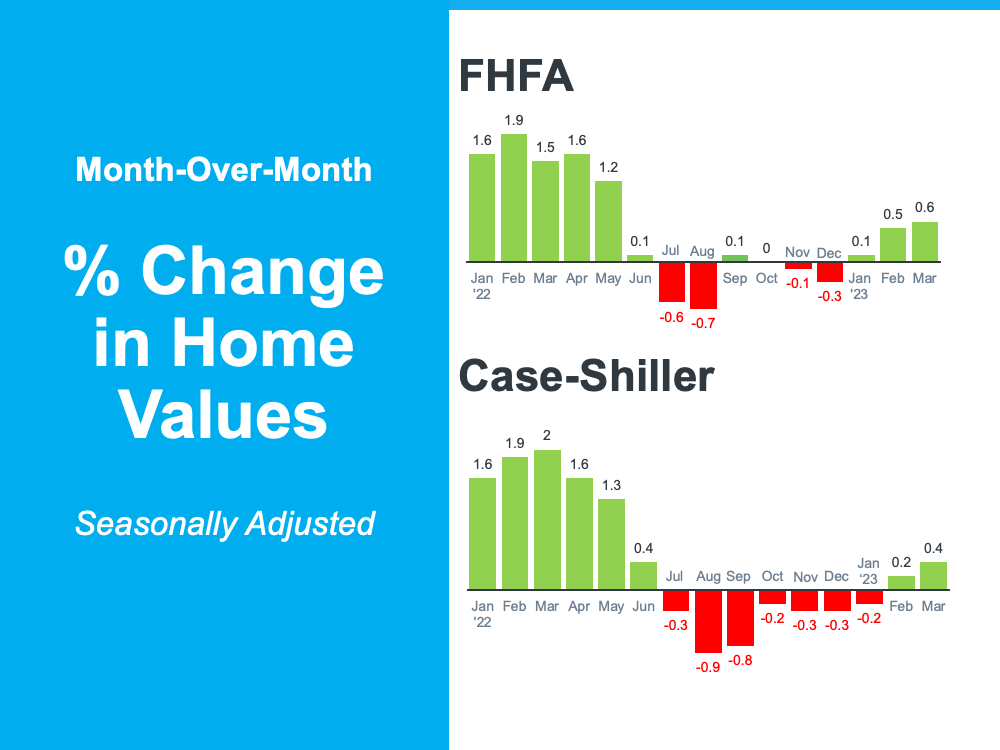

Those claims from Goldman Sachs were verified by the release last week of two indexes on home prices: Case-Shiller and the FHFA. Here are the numbers each reported:

Home values seem to have turned the corner and are headed back up.

Bottom Line

When the forecasts of significant home price appreciation were made last fall, they were made with megaphones. Mass media outlets, industry newspapers, and podcasts all broadcasted the news of an eminent crash in prices.

Now, forecasters are saying the worst is over and it wasn’t anywhere near as bad as they originally projected. However, they are whispering the news instead of using megaphones. As real estate professionals, it is our responsibility – some may say duty – to correct this narrative in the minds of the American consumer.

Reasons To Own Your Home

Some Highlights

- June is National Homeownership Month, and it’s a perfect time to think about all the benefits that come with owning your home.

- Owning a home not only makes you feel proud and accomplished, but it’s also a big step toward having a secure and stable financial future.

- Are you ready to enjoy all the amazing advantages that come with owning a home? Let’s get in touch to start the process today.

Homeowners Have a Surprising Amount of Equity Right Now (Video)

Homeowners have a surprising amount of equity right now. Let’s connect to figure out how much equity you have and how you can use it to fuel your next move.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link