Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

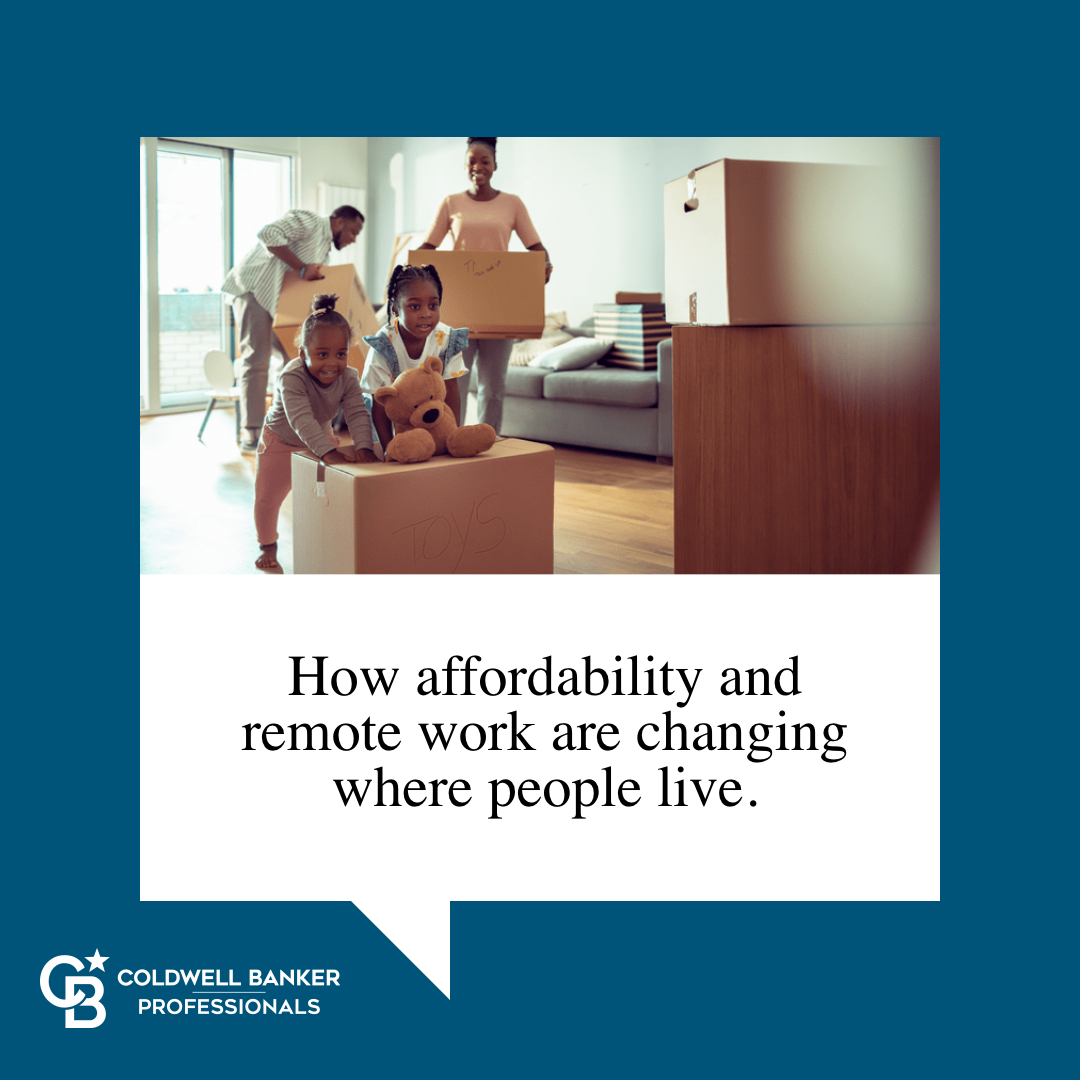

How Affordability and Remote Work Are Changing Where People Live

There’s an interesting trend happening in the housing market. People are increasingly moving to more affordable areas, and remote or hybrid work is helping them do it.

Consider Moving to a More Affordable Area

Today’s high mortgage rates combined with continually rising home prices mean it’s tough for a lot of people to afford a home right now. That’s why many interested buyers are moving to places where homes are less expensive, and the cost of living is lower. As Orphe Divounguy, Senior Economist at Zillow, explains:

“Housing affordability has always mattered . . . and you’re seeing it across the country. Housing affordability is reshaping migration trends.”

If you’re hoping to buy a home soon, it might make sense to broaden your search area to include places where homes that fit your needs are more affordable. That’s what a lot of other people are doing right now to find a home within their budget. Extra Space Storage explains:

“55% of American adults are looking to relocate to a different state or city for more affordable homes and lower costs of living. . . Specifically, states with a strong economy, lower costs of living, and remote work options continue to be the ideal places to live in the U.S.”

Remote Work Opens Up More Home Options

If you work remotely or drive into the office only a few times each week, you have many more possibilities when looking for your next home. That’s because you can cast a broader net and include more suburban or rural areas nearby. As Market Place Homes says:

“People start to reconsider where they want to live when commute times are slashed in half or eliminated altogether. If they have a longer commute but don’t have to do it daily, they may feel like they can tolerate living farther away from their job. Or, if someone works entirely remotely, they can move to a cheaper area and get a lot of house for their dollar.”

How a Real Estate Agent Can Help

A real estate agent can help you find the perfect home for your budget. They’re especially valuable if you’re moving to a new, unfamiliar area. Bankrate says:

“If you’re moving far away, you may not have a good idea about which neighborhoods or towns will be the best fit. An experienced local agent can help you find the lifestyle you’re looking for in a home you can afford.”

So, if you’re thinking about relocating to somewhere with more affordable homes, what are you waiting for? With the added flexibility of remote work, you might have more options than before.

Bottom Line

Dreaming of a place where your money goes further? Let’s connect so you have someone to help you find your next home. Together, we’ll make your dream of homeownership a reality.

The Biggest Mistakes Homebuyers Are Making Right Now

Want to know the biggest mistakes homebuyers are making today? They include everything from putting off pre-approval for too long, holding out for the perfect home, buying more than they can afford, and skipping out on hiring a pro. Let’s connect to make sure you have a pro on your side who can help you avoid these mistakes.

The Biggest Mistakes Homebuyers Are Making Right Now (Video)

Some of the biggest mistakes homebuyers are making right now are putting off pre-approval, holding out for perfection, and buying more than they can afford. The best way to avoid making these mistakes? Hire an agent who knows today’s market and how to help you navigate it.

Unlocking Homebuyer Opportunities in 2024

There’s no arguing this past year has been difficult for homebuyers. And if you’re someone who has started the process of searching for a home, maybe you put your search on hold because the challenges in today’s market felt like too much to tackle. You’re not alone in that. A Bright MLS study found some of the top reasons buyers paused their search in late 2023 and early 2024 were:

- They couldn’t find anything in their price range

- They didn’t have any successful offers or had difficulty competing

- They couldn’t find the right home

If any of these sound like why you stopped looking, here’s what you need to know. The housing market is in a transition in the second half of 2024. Here are four reasons why this may be your chance to jump back in.

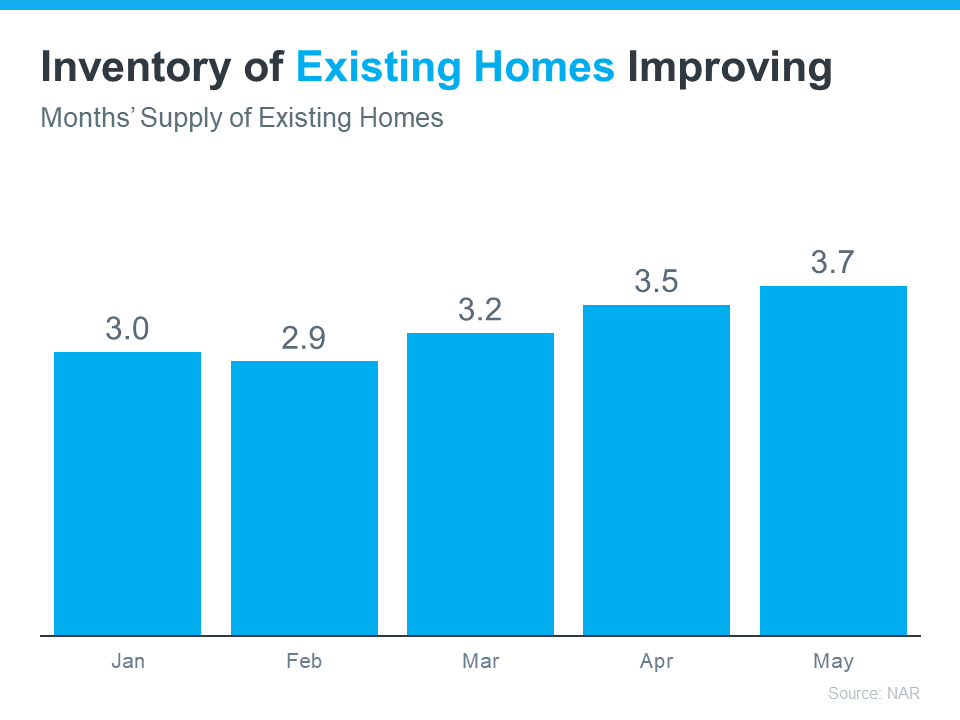

1. The Supply of Homes for Sale Is Growing

One of the most significant shifts in the market this year is how the months’ supply of homes for sale has increased. If you look at data from the National Association of Realtors (NAR), you’ll see how inventory has grown throughout 2024 (see graph below):

This graph shows the months’ supply of existing homes – homes that were previously lived in by another homeowner. The upward trend this year is clear.

This increase means you have a better chance of finding a home that suits your needs and preferences. And if the biggest reason you put off your home search was difficulty finding the right home, this is a big relief.

2. There’s More New Home Construction

And if you still don’t see an existing home you like, another big opportunity lies in the rise of new home construction. Builders have worked to increase the supply of newly built homes this year. And they’ve turned their attention to crafting smaller, more affordable homes based on what’s most needed in today’s market. This helps address the long-standing issue of housing undersupply throughout the country, and those smaller homes also offset some of the affordability challenges you’re feeling today.

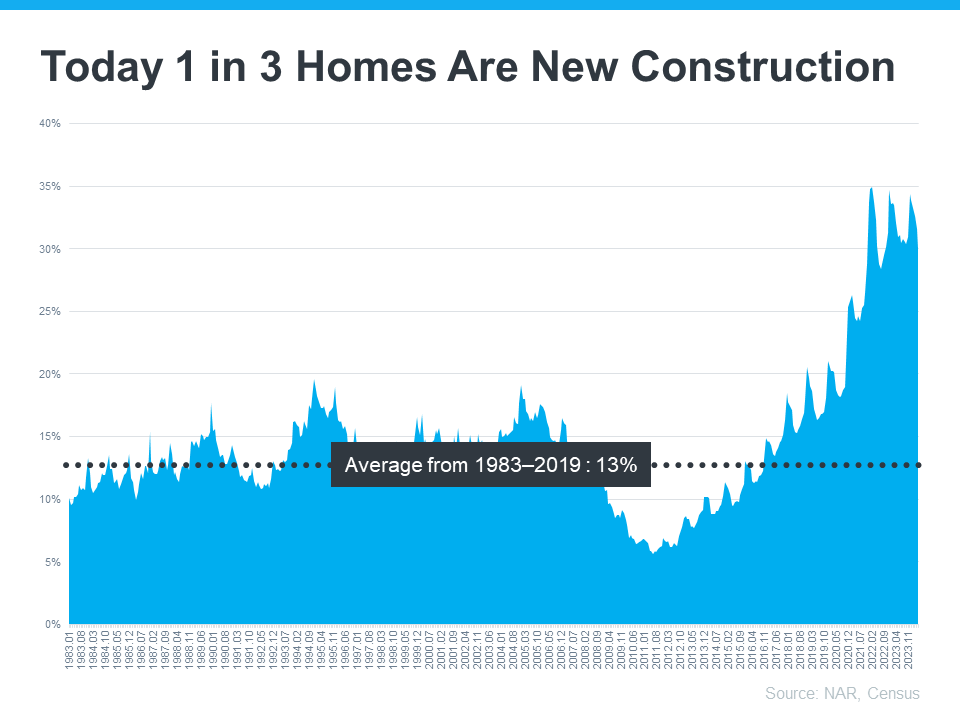

According to data from the Census and NAR, one in three homes on the market is a newly built home (see graph below):

This means, that if you didn’t previously look at newly built homes as part of your search, you may have been cutting your pool of options by a third. Not to mention, some builders are also offering incentives like buying down mortgage rates to make it easier for buyers to get a home that fits their budget.

So, consider talking to your agent about what builders have to offer in your area. Your agent’s expertise on builder reputations, contracts, and more will help you weigh your options.

3. Less Buyer Competition

Mortgage rates are still hovering around 7%, so buyer demand isn’t as fierce as it once was. And when you combine that with more housing supply, you have a better chance of avoiding an intense bidding war. Danielle Hale, Chief Economist at Realtor.com, highlights the positive trend for the latter half of 2024, saying:

“Home shoppers who persist could see better conditions in the second half of the year, which tends to be somewhat less competitive seasonally, and might be even more so since inventory is likely to reach five-year highs.”

This creates a unique opportunity for you to find a home you want to buy with less stress and at a potentially better price.

4. Home Prices Are Moderating

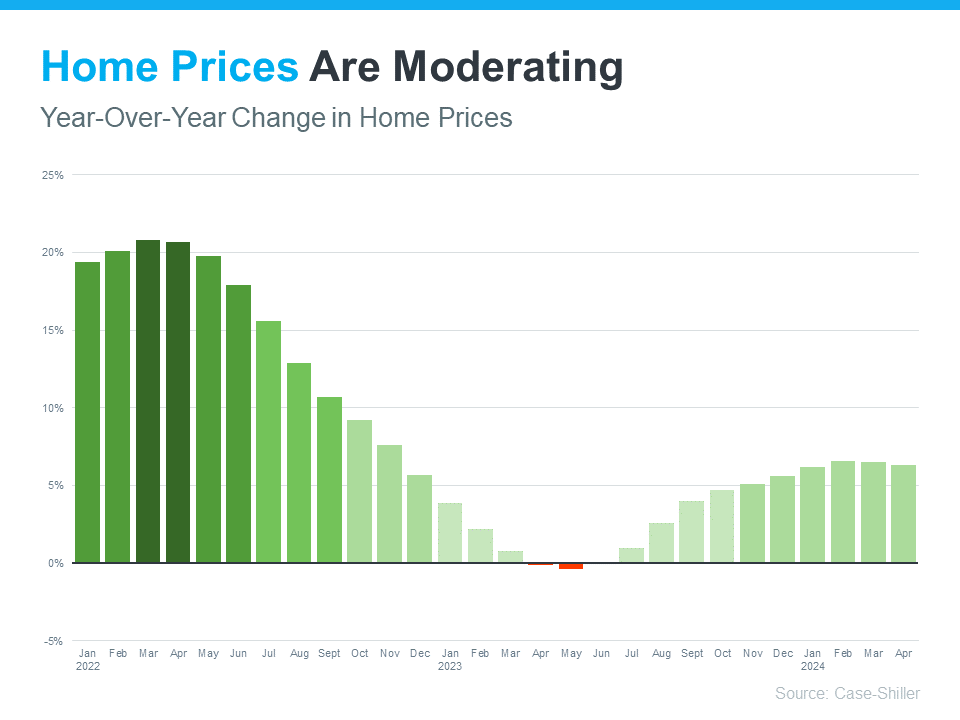

Speaking of prices, home prices are also showing signs of moderation – and that’s a welcome shift after the rapid appreciation seen in recent years (see graph below):

This moderation is mostly due to supply and demand. Supply is growing and demand is easing, so prices aren’t rising as fast. But make no mistake, that doesn’t mean prices are falling – they’re just rising at a more normal pace. You can see this in the graph. The bars are still showing prices increasing, just not as dramatic as it was before.

The average forecast for home price appreciation in 2024 is for positive growth around 3% to 5%, which is more in line with historical norms. That moderation means that you are less likely to face the steep price increases we saw a few years ago.

The Opportunity in Front of You

If you’re ready and able to buy, you may find that the second half of 2024 is a bit easier to navigate. There are still challenges, but some of the biggest hurdles you’ve faced are getting better as time wears on.

On the other hand, you could choose to wait. But if you do, here’s the risk you run. As more buyers recognize the shift in the market, competition will grow again. On a similar note, if mortgage rates do come down (as forecasts say), more buyers will flood back into the market. So, making a move now helps you take advantage of the current market conditions and get ahead of those other buyers.

Bottom Line

If you’ve put your dream of homeownership on hold, the second half of 2024 may be your chance to jump back in. Let’s connect to talk more about the opportunities you have in today’s market.

Why Fixing Up Your House Can Help It Sell Faster

If you’re thinking about selling your house, you should know there are buyers who are ready and able to pay today’s high prices. But they want a home that’s move-in ready. A recent press release from Redfin explains:

If you’re thinking about selling your house, you should know there are buyers who are ready and able to pay today’s high prices. But they want a home that’s move-in ready. A recent press release from Redfin explains:

“Buyers are still out there and they’re willing to pay today’s high prices, but only if the house is in really good shape. They don’t want to spend extra money on paint or new appliances.”

It makes sense when you think about it. They’re having to pay a lot of money for a house in today’s market. That means they may not be able to easily afford upgrades after they move in. So, if your home is outdated or needs some work, buyers might pass it by or offer a lower price than you were hoping for.

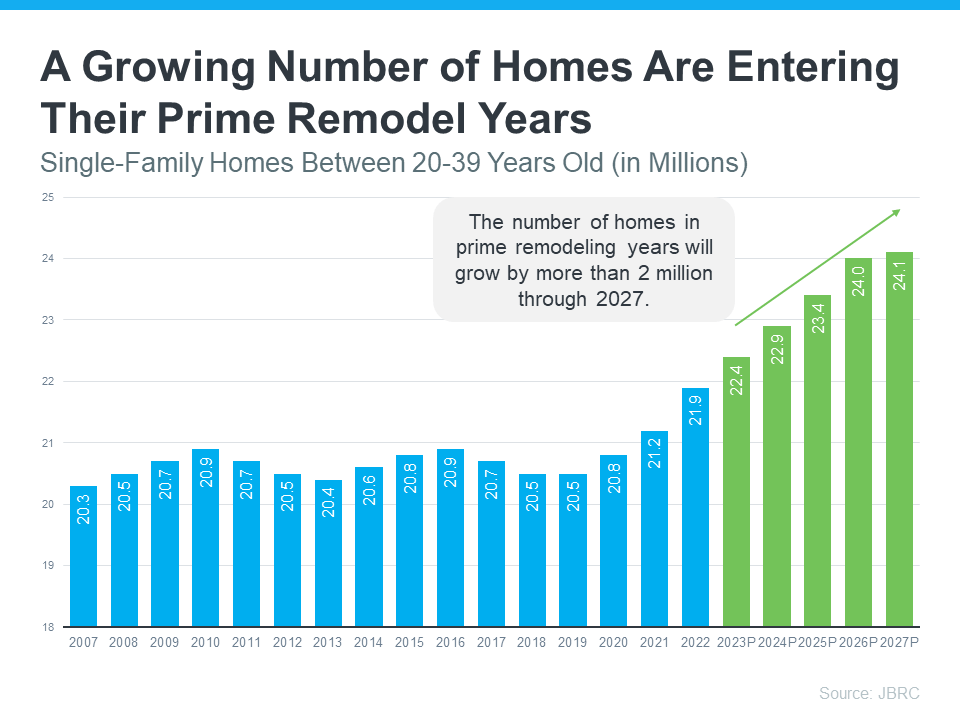

And there are a lot of homes that need upgrades right now. Millions are entering their prime remodel years, meaning they’re between 20 and 39 years old. Maybe yours is one of them. According to John Burns Research and Consulting (JBRC), the number of homes in their prime remodel years is high and growing (see graph below):

If your house falls into this category, it’s important to consider making selective updates to help it appeal to buyers, so it sells faster. But how do you know where to spend your time and money?

Why You Need a Real Estate Agent

By working with a local real estate agent to be strategic about the improvements you make, you can be sure you’re making a smart investment. Put simply, not all upgrades are worth the cost. As Bankrate says:

“Before you spend money on costly upgrades, be sure the changes you make will have a high return on investment. It doesn’t make sense to install new granite countertops, for example, if you only stand to break even on them, or even lose money.”

And, as that same Bankrate article goes on to say, that’s where a local real estate agent comes in:

“. . . a good real estate agent will know what local buyers expect and can help you decide what needs doing and what doesn’t.”

Your agent will know what buyers in your area are looking for and what they’re willing to pay for it. By working together, you can avoid spending money on upgrades that won’t pay off. Instead, they’ll fill you in on which changes will make your house more appealing and valuable.

Bottom Line

Selling a house right now requires more than just putting up a For Sale sign. You need to make sure it’s in good condition to attract buyers who are willing to pay today’s high prices.

The way to do that is by making smart improvements that will give you the best return on your investment. Let’s work together so you know what buyers are looking for and what your house needs before selling.

How To Determine if You’re Ready To Buy a Home

If you’re trying to decide if you’re ready to buy a home, there’s probably a lot on your mind. You’re thinking about your finances, today’s mortgage rates and home prices, the limited supply of homes for sale, and more. And, you’re juggling how all of those things will impact the choice you’ll make.

While housing market conditions are definitely a factor in your decision, your own personal situation and your finances matter too. As an article from NerdWallet says:

“Housing market trends give important context. But whether this is a good time to buy a house also depends on your financial situation, life goals and readiness to become a homeowner.”

Instead of trying to time the market, focus on what you can control. Here are a few questions that can give you clarity on whether you’re ready to make your move.

1. Do You Have a Stable Job?

One thing to consider is how stable you feel your employment is. Buying a home is a big purchase, and you’re going to sign a home loan stating you’ll pay that loan back. That’s a big commitment. Knowing you have a reliable job and a steady stream of income coming in can help put your mind at ease when making such a large purchase.

2. Have You Figured Out What You Can Afford?

If you have reliable paychecks coming in, the next thing to figure out is what you can afford. That’ll depend on your spending habits, debt, and more. To be sure you have a good idea of what to expect from a number’s perspective, start by talking to a trusted lender.

They’ll be able to tell you about the pre-approval process and what you’re qualified to borrow, current mortgage rates and your approximate monthly payment, closing costs to anticipate, and other expenses you’ll want to budget for. That way you can make an informed decision about whether you’re ready to buy.

3. Do You Have an Emergency Fund?

Another key factor is whether you’ll have enough cash left over in case of an emergency. While that’s not fun to think about, it’s an important thing to consider. You don’t want to overextend on the house, and then not be able to weather a storm if one comes along. As CNET says:

“You’ll want to have a financial cushion that can cover several months of living expenses, including mortgage payments, in case of unforeseen circumstances, such as job loss or medical emergencies.”

4. How Long Do You Plan To Live There?

It was mentioned above, but buying a home involves some upfront expenses. And while you’ll get that money back (and more) as you gain equity, that process takes time. If you plan to move too soon, you may not recoup your investment. For example, if you’re looking to sell and move again in a year, it might not make sense to buy right now. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains:

“Five years is a good, comfortable mark. If the price of your home appreciates considerably, then even three years would be fine.”

So, think about your future. If you plan to transfer to a new city with the upcoming promotion you’re working toward or you anticipate your loved ones will need you to move closer to take care of them, that’s something to factor in.

5. Above all else, the most important question to answer is: do you have a team of real estate professionals in place?

If not, finding a trusted local agent and a lender is a good first step. The pros can talk you through your options and help you decide if you’re ready to take the plunge or if you have a few more things to get in order first.

Bottom Line

If you want to have a conversation about all the things you need to consider to determine if you’re ready to buy, let’s connect.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link