- Find Your Home

- Local Housing Market Reports

- Bob's Blog

- Buyers

- Sellers

- Properties

- Real Estate & Probate

- What About Bob

- Neighborhood News

- America's Preferred Home Warranty

- Coldwell Banker Global Luxury

- More

Unlocking the Benefits of Your Home’s Equity

Equity is the difference between what your house is worth and what you still owe on your mortgage. The typical homeowner gained $28,000 over the past year and has a grand total of $305,000 in equity. And there are a lot of great ways you can use that equity. Want to know how much equity […]

Read MoreUnlocking the Benefits of Your Home’s Equity (Video)

Home equity is the difference between how much your home is worth and how much you owe on your mortgage. And for most people it’s gotten a big boost in recent years, thanks to rising home prices. If you want to find out how much equity you have, reach out for a professional equity assessment […]

Read MoreHow the Economy Impacts Mortgage Rates

As someone who’s thinking about buying or selling a home, you’re probably paying close attention to mortgage rates – and wondering what’s ahead. One thing that can affect mortgage rates is the Federal Funds Rate, which influences how much it costs banks to borrow money from each other. While the Federal Reserve (the Fed) doesn’t […]

Read MoreDisability Income Mortgage Reports Quote

If you’re wondering if buying a home with disability income is possible, the good news is, the answer is yes. If you want to learn more or explore your options for a home loan, connect with a lender. With the right team in place, we can make your dream of homeownership a reality.

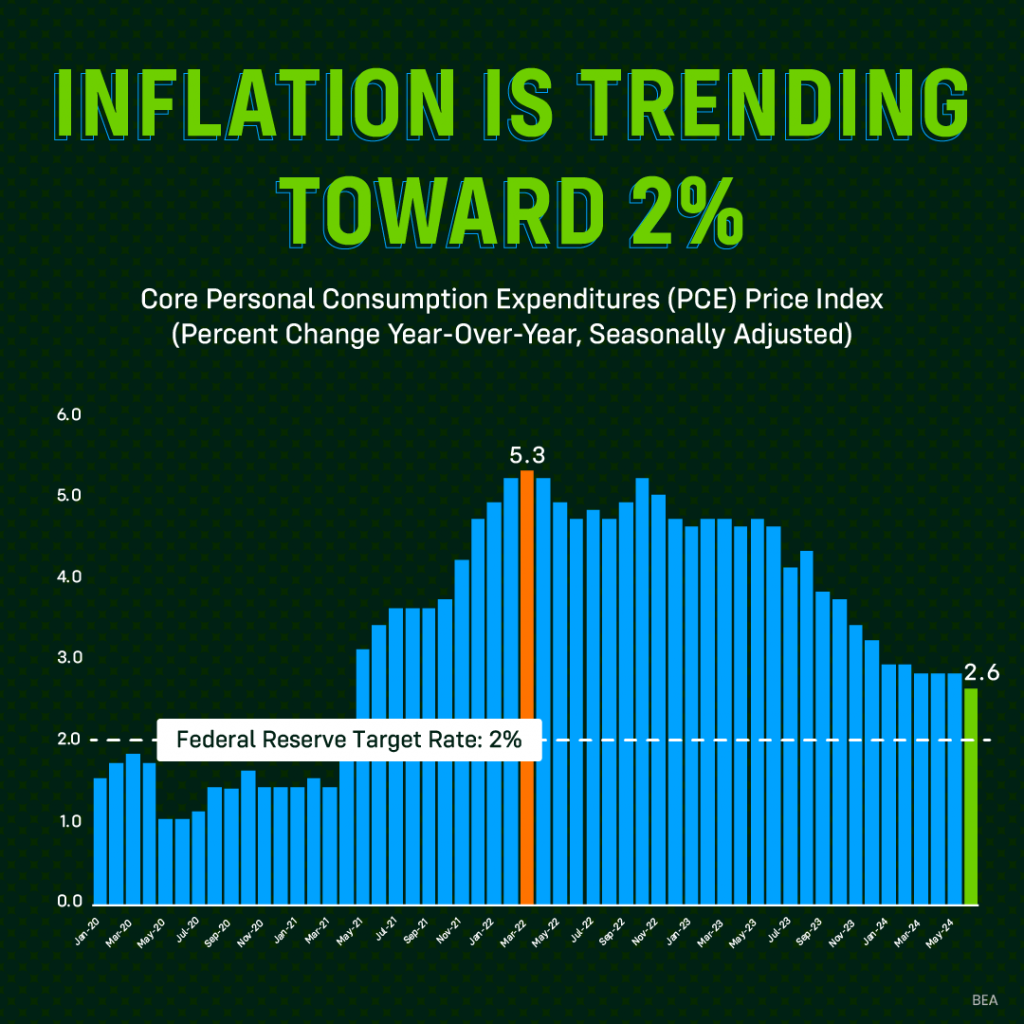

Read MoreInflation Is Trending Down

Inflation is cooling – and that’s a good sign for mortgage rates. Once the rate of inflation reaches the Fed’s target of 2%, they may lower the Federal Funds Rate. When they do, mortgage rates are likely to respond. But this isn’t the only factor at play. For the latest updates on what’s happening, follow […]

Read MoreA Newly Built Home May Be More Cost-Effective

New trend alert. The median price for new builds has dipped lower than the median for existing homes. Plus, some builders are tossing in sweet perks like competitive mortgage rates and free upgrades. So, if you aren’t already considering brand-new homes, it may be worth looking into. Drop a comment with your dream home feature, […]

Read More

© 2022 Coldwell Banker Residential LLC