Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

Early Forecasts for the 2025 Housing Market Infographic

Some Highlights

- Thinking about making a move in 2025 and wondering what you can expect? Here’s what expert forecasts say lies ahead.

- Mortgage rates will come down slightly. More homes will sell. And prices will rise more moderately.

- Let’s connect to go over what these forecasts mean for your move and what to expect from our local market in 2025.

The Fall Guides for Buying or Selling a Home Are Here (Video)

The Fall Guides for buying or selling a home are here. Let’s connect so you can get the latest digital copies of these guides.

The Latest on the Luxury Home Market

Luxury living is about more than just stunning views and cutting-edge smart home technology—it’s about elevating your lifestyle. And if you’re in the market for a million-dollar home, now is an excellent time to explore the thriving luxury market. Here’s why.

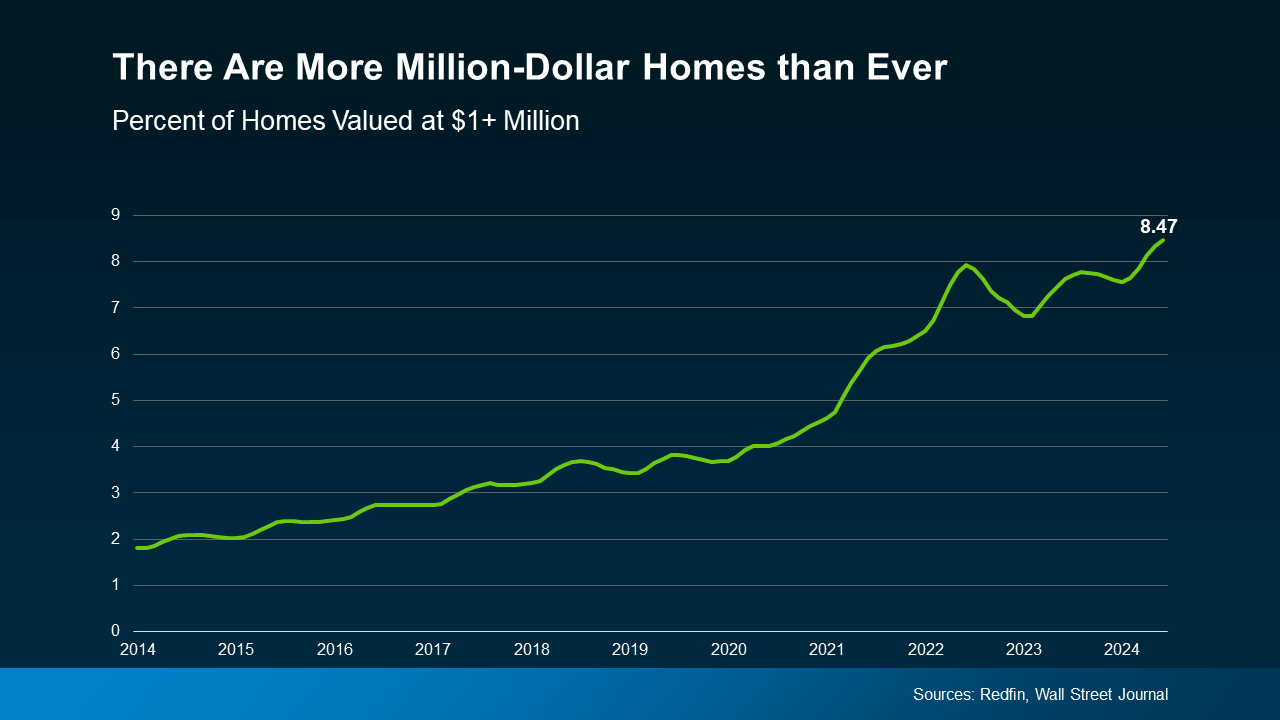

The Number of Luxury Homes Is Growing

The top of the market, or luxury homes, can mean different things depending on where you live. But in general, these are homes that are in the top 5% price range in any area. According to a recent report from Redfin, the average value of those homes has risen to over one million dollars:

“The median sale price for U.S. luxury homes, defined as the top 5% of listings, rose 9% year-over-year to a record $1.18 million during the second quarter.”

That same report goes on to show the percentage of homes valued at a million dollars or more has risen to an all-time high (see graph below):

That means, if this is your desired price range, you have options to choose from, each with different features and styles.

That means, if this is your desired price range, you have options to choose from, each with different features and styles.

Whether you’re looking for the latest designs, like modern kitchens with high-end appliances, exclusive amenities, or enhanced privacy and security, the market that fits this lifestyle is growing.

Your Luxury Home Is an Investment

In addition, a luxury home could help you build significant long-term wealth. As the Redfin quote mentioned earlier says, luxury home prices are rising. That may be the reason there are a lot of people investing in luxury real estate right now. According to the August Luxury Market Report:

“By the end of July, the overall growth in the volume of sales in 2024 stood at 14.82% for single-family homes and 11.35% for attached homes compared to the same period in 2023.”

Bottom Line

With more million-dollar homes on the market and prices going up, you have luxury options to choose from and a chance to build significant long-term wealth. Want to see the best homes in our area? Let’s get in touch today.

How the Federal Reserve’s Next Move Could Impact the Housing Market

Now that it’s September, all eyes are on the Federal Reserve (the Fed). The overwhelming expectation is that they’ll cut the Federal Funds Rate at their upcoming meeting, driven primarily by recent signs that inflation is cooling, and the job market is slowing down. Mark Zandi, Chief Economist at Moody’s Analytics, said:

“They’re ready to cut, just as long as we don’t get an inflation surprise between now and September, which we won’t.”

But what does this mean for the housing market, and more importantly, for you as a potential homebuyer or seller?

Why a Federal Funds Rate Cut Matters

The Federal Funds Rate is one of the key factors that influences mortgage rates – things like the economy, geopolitical uncertainty, and more also have an impact.

When the Fed cuts the Federal Funds Rate, it signals what’s happening in the broader economy, and mortgage rates tend to respond. While a single rate cut might not lead to a dramatic drop in mortgage rates, it could contribute to the gradual decline that’s already happening.

As Mike Fratantoni, Chief Economist at the Mortgage Bankers Association (MBA), points out:

“Once the Fed kicks off a rate-cutting cycle, we do expect that mortgage rates will move somewhat lower.”

And any upcoming Federal Funds Rate cut likely won’t be a one-time event. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“Generally, the rate-cutting cycle is not one-and-done. Six to eight rounds of rate cuts all through 2025 look likely.”

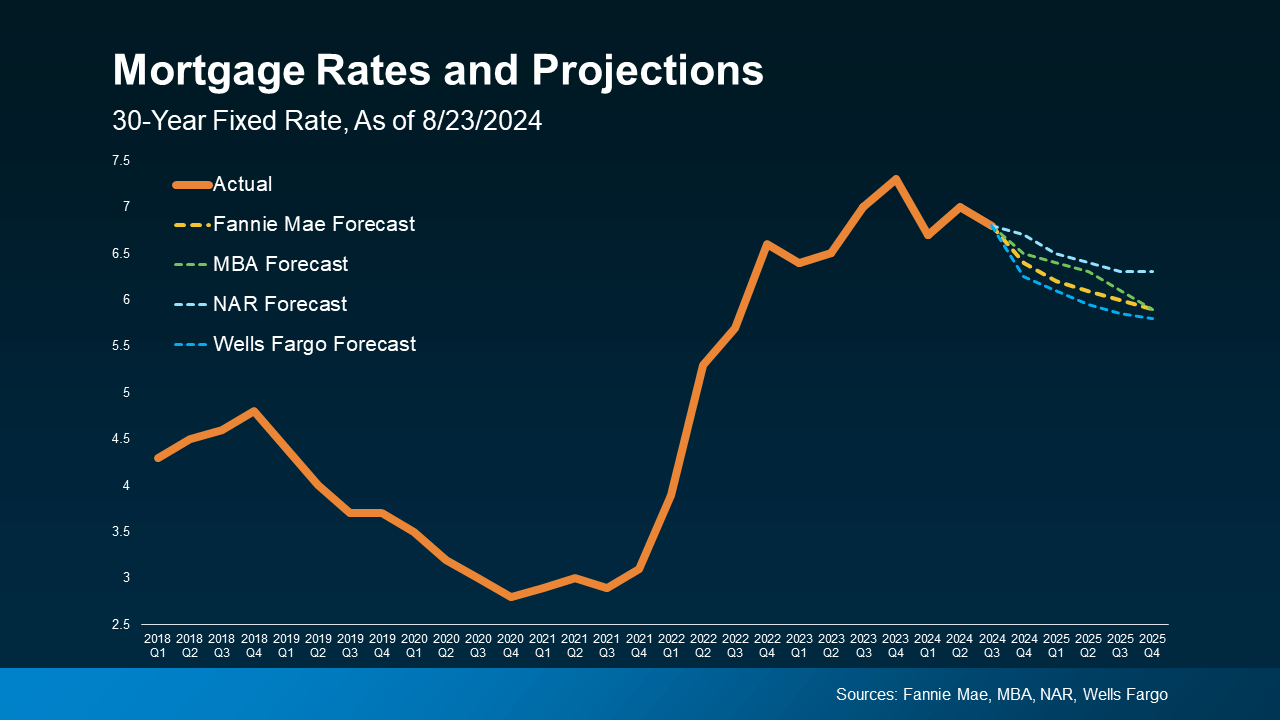

The Projected Impact on Mortgage Rates

Here’s what experts in the industry project for mortgage rates through 2025. One contributing factor to this ongoing gradual decline is the anticipated cuts from the Fed. The graph below shows the latest forecasts from Fannie Mae, MBA, NAR, and Wells Fargo (see graph below):

So, with recent improvements in inflation and signs of a cooling job market, a Federal Funds Rate cut is likely to lead to a moderate decline in mortgage rates (shown in the dotted lines). Here are two big reasons why that’s good news for both buyers and sellers:

So, with recent improvements in inflation and signs of a cooling job market, a Federal Funds Rate cut is likely to lead to a moderate decline in mortgage rates (shown in the dotted lines). Here are two big reasons why that’s good news for both buyers and sellers:

1. It Helps Alleviate the Lock-In Effect

For current homeowners, lower mortgage rates could help ease the lock-in effect. That’s where people feel stuck within their current home because today’s rates are higher than what they locked in when they bought their current house.

If the fear of losing your low-rate mortgage and facing higher costs has kept you out of the market, a slight reduction in rates could make selling a bit more attractive again. However, this isn’t expected to bring a flood of sellers to the market, as many homeowners may still be cautious about giving up their existing mortgage rate.

2. It Should Boost Buyer Activity

For potential homebuyers, any drop in mortgage rates will provide a more inviting housing market. Lower mortgage rates can reduce the overall cost of homeownership, making it more feasible for you if you’ve been waiting to make a move.

What Should You Do?

While a Federal Funds Rate cut is not expected to lead to drastically lower mortgage rates, it will likely contribute to the gradual decrease that’s already happening.

And while the anticipated rate cut represents a positive shift for the future of the housing market, it’s important to consider your options right now. Jacob Channel, Senior Economist at LendingTree, sums it up well:

“Timing the market is basically impossible. If you’re always waiting for perfect market conditions, you’re going to be waiting forever. Buy now only if it’s a good idea for you.”

Bottom Line

The expected Federal Funds Rate cut, driven by improving inflation and slower job growth, is likely to have a positive, though gradual, impact on mortgage rates. That could help unlock opportunities for you. When you’re ready, let’s connect. That way you’ll be prepared to take action when the time is right for you.

Should You Sell Now? The Lifestyle Factors That Could Tip the Scale

Are you on the fence about whether to sell your house now or hold off? It’s a common dilemma, but here’s a key point to consider: your lifestyle might be the biggest factor in your decision. While financial aspects are important, sometimes the personal motivations for moving are reason enough to make the leap sooner rather than later.

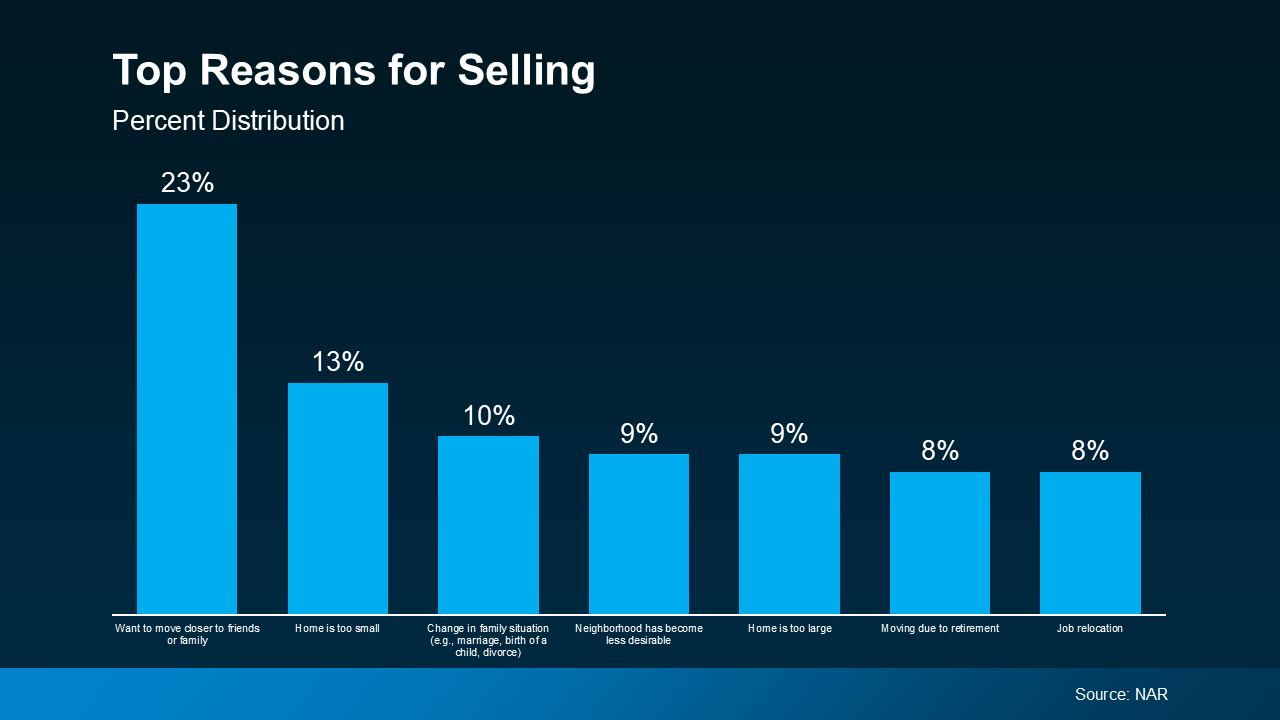

An annual report from the National Association of Realtors (NAR) offers insight into why homeowners like you chose to sell. All of the top reasons are related to life changes. As the graph below highlights:

As the visual shows, the biggest motivators were the desire to be closer to friends or family, outgrowing their current house, or experiencing a significant life change like getting married or having a baby. The need to downsize or relocate for work also made the list.

As the visual shows, the biggest motivators were the desire to be closer to friends or family, outgrowing their current house, or experiencing a significant life change like getting married or having a baby. The need to downsize or relocate for work also made the list.

If you, like the homeowners in this report, find yourself needing features, space, or amenities your current home just can’t provide, it may be time to consider talking to a real estate agent about selling your house. Your needs matter. That agent will walk you through your options and what you can expect from today’s market, so you can make a confident decision based on what matters most to you and your loved ones.

Your agent will also be able to help you understand how much equity you have and how it can make moving to meet your changing needs that much easier. As Danielle Hale, Chief Economist at Realtor.com, explains:

“A consideration today’s homeowners should review is what their home equity picture looks like. With the typical home listing price up 40% from just five years ago, many home sellers are sitting on a healthy equity cushion. This means they are likely to walk away from a home sale with proceeds that they can use to offset the amount of borrowing needed for their next home purchase.”

Bottom Line

Your lifestyle needs may be enough to motivate you to make a change. If you want help weighing the pros and cons of selling your house, let’s have a conversation.

Could a 55+ Community Be Right for You?

If you’re thinking about downsizing, you may be hearing about 55+ communities and wondering if they’d be a good fit for you. Here’s some information that could help you make your decision.

What Is a 55+ Community?

It’s important to note that these communities aren’t just for people who need extra support – they can be pretty vibrant, too. Many people who are downsizing opt for this type of home because they’re looking to be surrounded by people in a similar season of life. U.S. News explains:

“The terms ‘55-plus community,’ ‘active adult community,’ ‘lifestyle communities’ and ‘planned communities’ refer to a setting that caters to the needs and preferences of adults over the age of 55. These communities are designed for seniors who are able to care for themselves but may be looking to downsize to a community with others their same age and with similar interests.”

Why It’s Worth Considering This Type of Home

If that sounds like something that may interest you, here’s one thing to consider. You may find you’ve got a growing list of options if you look at this type of community. According to 55places.com, the number of listings tailored for homebuyers in this age group has increased by over 50% compared to last year.

And a bigger pool of options could make your move much less stressful because it’s easier to find something that’s specifically designed to meet your needs.

Other Benefits of 55+ Communities

On top of that, there are other benefits to seeking out this type of home. An article from 55places.com, highlights just a few:

- Lower-Maintenance Living: Tired of mowing the lawn or pulling weeds? Many of these communities take care of this for you. So, you can spend more time doing fun things, and less time on maintenance.

- On-Site Amenities: Some feature lifestyle amenities like a clubhouse, fitness center, and more, so it’s easy to stay active. Plus, others offer media rooms, libraries, spas, arts and craft studios, and more.

- Like-Minded Neighbors: Additionally, these types of homes usually offer clubs, outings, meet-ups, and more to foster a close-knit community.

- Accessible Floor Plans: Not to mention, many have first-floor living options, ample storage spaces, and modern floor plans so you can have a home tailored to this phase in your life.

Bottom Line

If this sounds appealing to you, let’s talk about what’s available in our area, and the unique amenities for each community. You may find a 55+ home is exactly what you’ve been searching for.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link