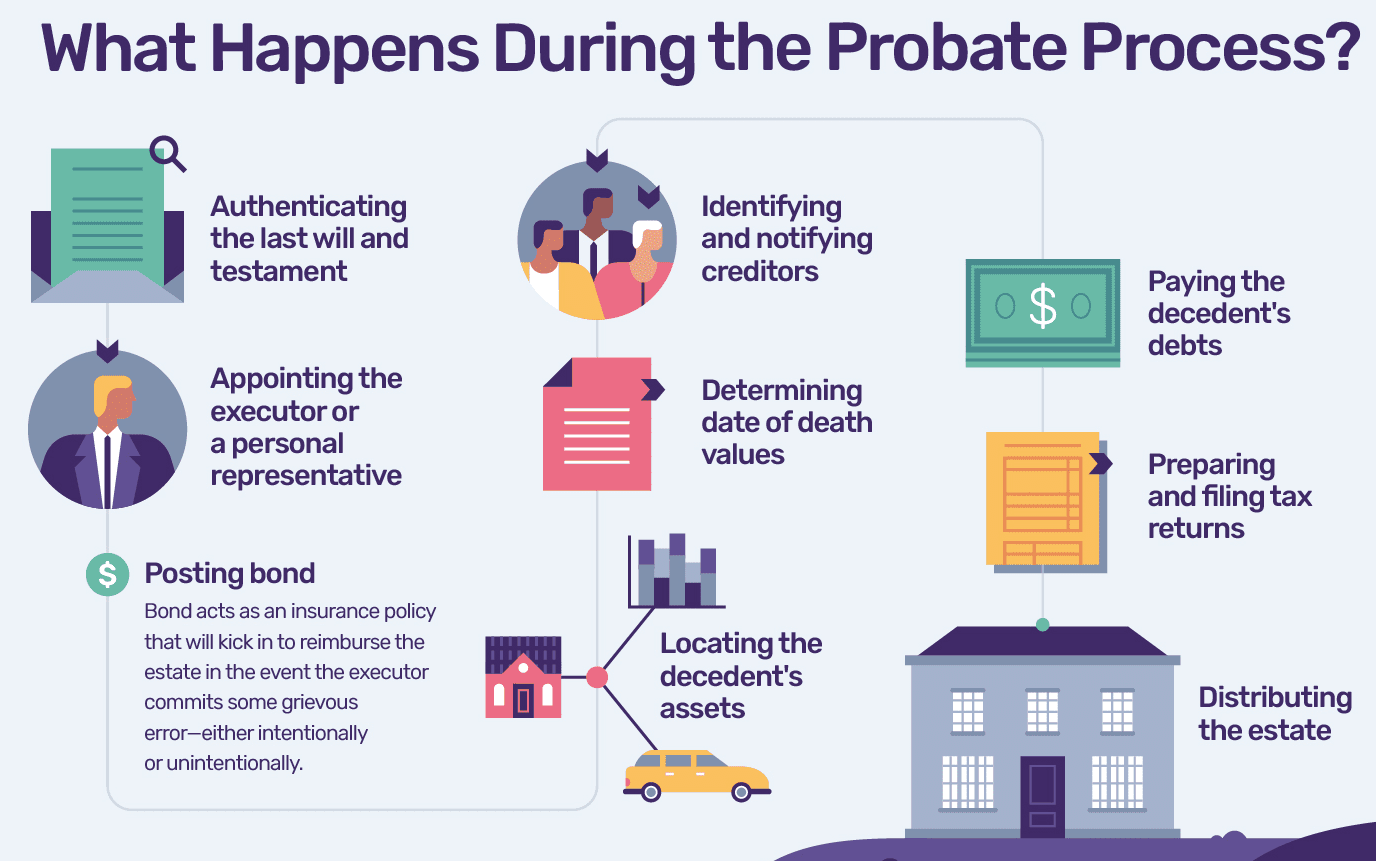

The Steps to Probate

Being an executor or administrator of a probate estate is not for everyone.

You have been trusted to be the personal representative of a probate estate because you know how to get things done and you care. When challenges arise, you are the person that takes an axe to them and you overcome.

…But will the monster of overwhelm occasionally stalk you?

(Ask any probate executor or administrator and they will tell you, YES, the process can be overwhelming!)

I understand. Picking up all the mail, paying all the bills/utilities, handling repairs of the property, maintaining the yard, back-and-forth calls and/or trips to the attorney, going to the bank, all while dealing with other beneficiaries…It can be overwhelming!

Now picture this:

Imagine that starting right now, you no longer have the monster of worry and overwhelm about your responsibilities as a probate executor/administrator nagging at you.

Imagine being able to focus on the reason that you are an executor/administrator of a probate estate in the first place (because nobody knows the best course of action to overcome challenges like you do!).

Does that sound good? …It gets even better.

Because you downloaded my free eBook, Probate Real Estate and You: Avoiding the 7 Biggest Mistakes Made in Probate Real Estate, I am going to send you the TWO following “axes” (Just think of each tool that I send you as an axe** that you can use to chop up any challenges that may arise)

- Something You Can Use Right Now…A 6 Page Booklet Called “The Steps to Probate” >>CLICK HERE TO DOWNLOAD NOW<<

For More Probate Answers, please Click Here.

Avoiding the 7 Biggest Mistakes Made in Probate Real Estate

Every day, many people across America experience the loss of a loved one. That’s just a part of life’s journey. For every person who passes away, another person must take on the task of managing the estate. Are you this person? If you’re reading this blog, the answer is most likely yes. Let me assure you that this task does not have to be overwhelming.

First, I would like to extend our sincere condolences on the loss of your loved one. Our goal is to provide top-quality professional service throughout the probate process. Often, this process is quite stressful, so having the right team to help you can bridge the gap between stress and success.

I would like to offer you a free e-book to help you through the Probate Process. The e-book will discuss:

Mistake 1: Not having the right guidance and counsel to help you through the probate process

Mistake 2: Not knowing how probate works

Mistake 3: Selecting the wrong service providers to help liquidate the estate and prepare it for sale

Mistake 4: Thinking the probate process will only take a few weeks and relying on your attorney to handle everything

Mistake 5: Not securing the estate’s personal property

Mistake 6: Leaving the property uninsured or underinsured as you settle the estate

Mistake 7: Attempting to sell the estate’s real property without understanding the market

Here are two major reasons to read this book:

- You need to have a clear picture of all your options, so you will know you’ve made the best choice when it comes to selling the property held in the estate.

- Avoiding the top seven mistakes discussed in this e-book will save you time and help you avoid unnecessary stress — and could potentially save you thousands of dollars.

This e-book is designed to alert you to various mistakes that many executors and administrators make when they manage an estate. I hope that by sharing information that my team and I have accumulated through our experience and education, we can help you deal with some of the uncertainties you may encounter during the process.

Download Your Free e-book Today

For More Probate Answers, please Click Here.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link