Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

A Recession Doesn’t Equal a Housing Crisis

Everywhere you look, people are talking about a potential recession. And if you’re planning to buy or sell a house, this may leave you wondering if your plans are still a wise move. To help ease your mind, experts are saying that if we do officially enter a recession, it’ll be mild and short. As the Federal Reserve explained in their March meeting:

“. . . the staff’s projection at the time of the March meeting included a mild recession starting later this year, with a recovery over the subsequent two years.”

While a recession may be on the horizon, it won’t be one for the housing market record books like the crash in 2008. What we have to remember is that a recession doesn’t always lead to a housing crisis.

To prove it, let’s look at the historical data of what happened in real estate during previous recessions. That way you know why you shouldn’t be afraid of what a recession could mean for the housing market today.

A Recession Doesn’t Mean Falling Home Prices

To show that home prices don’t fall every time there’s a recession, it helps to turn to historical data. As the graph below illustrates, looking at recessions going all the way back to 1980, home prices appreciated in four of the last six of them. So historically, when the economy slows down, it doesn’t mean home values will always fall.

Most people remember the housing crisis in 2008 (the larger of the two red bars in the graph above) and think another recession will be a repeat of what happened to housing then. But today’s housing market isn’t about to crash because the fundamentals of the market are different than they were in 2008. Back then, one of the big reasons why prices fell was because there was a surplus of homes for sale at the same time distressed properties flooded the market. Today, the number of homes for sale is low, so while home prices may see slight declines in some areas and slight gains in others, a crash simply isn’t in the cards.

A Recession Means Falling Mortgage Rates

What a recession really means for the housing market is falling mortgage rates. As the graph below shows, historically, each time the economy slowed down, mortgage rates decreased.

Bankrate explains mortgage rates typically fall during an economic slowdown:

“During a traditional recession, the Fed will usually lower interest rates. This creates an incentive for people to spend money and stimulate the economy. It also typically leads to more affordable mortgage rates, which leads to more opportunity for homebuyers.”

This year, mortgage rates have been quite volatile as they’ve responded to high inflation. The 30-year fixed mortgage rate has hovered between roughly 6-7%, and that’s impacted affordability for many potential homebuyers.

But, if there is a recession, history tells us mortgage rates may fall below that threshold, even though the days of 3% are behind us.

Bottom Line

You don’t need to fear what a recession means for the housing market. If we do have a recession, experts say it will be mild and short, and history shows it also means mortgage rates go down.

Are you wondering if you should sell your house this spring? (Video)

Ensure Your House Shows Well and Is Priced Competitively For Today’s Market

Want to sell your house for the best final sale price possible? Then make sure your house shows well and is priced competitively for today’s market. Let’s work together when you sell to make sure your house will stand out to buyers in our local market.

Why Buying a Home Makes More Sense Than Renting Today

Wondering if you should continue renting or if you should buy a home this year? If so, consider this. Rental affordability is still a challenge and has been for years. That’s because, historically, rents trend up over time. Data from the Census shows rents have been climbing pretty steadily since 1988.

And, data from the latest rental report from Realtor.com shows rents continue to grow today, even though it’s at a slower pace than we saw at the height of the pandemic:

“In March 2023, the U.S. rental market experienced single-digit growth for the eighth month in a row . . . The median asking rent was $1,732, up by $15 from last month and down by $32 from the peak but is still $354 (25.7%) higher than the same time in 2019 (pre-pandemic).”

With rents much higher now than they were in more normal, pre-pandemic years, owning your home may be a better option, especially if the long-term trend of rents increasing each year continues. In contrast, homeowners with a fixed-rate mortgage can lock in a monthly mortgage payment for the duration of their loan (typically 15-30 years).

Owning a Home Could Be More Affordable if You Need More Space

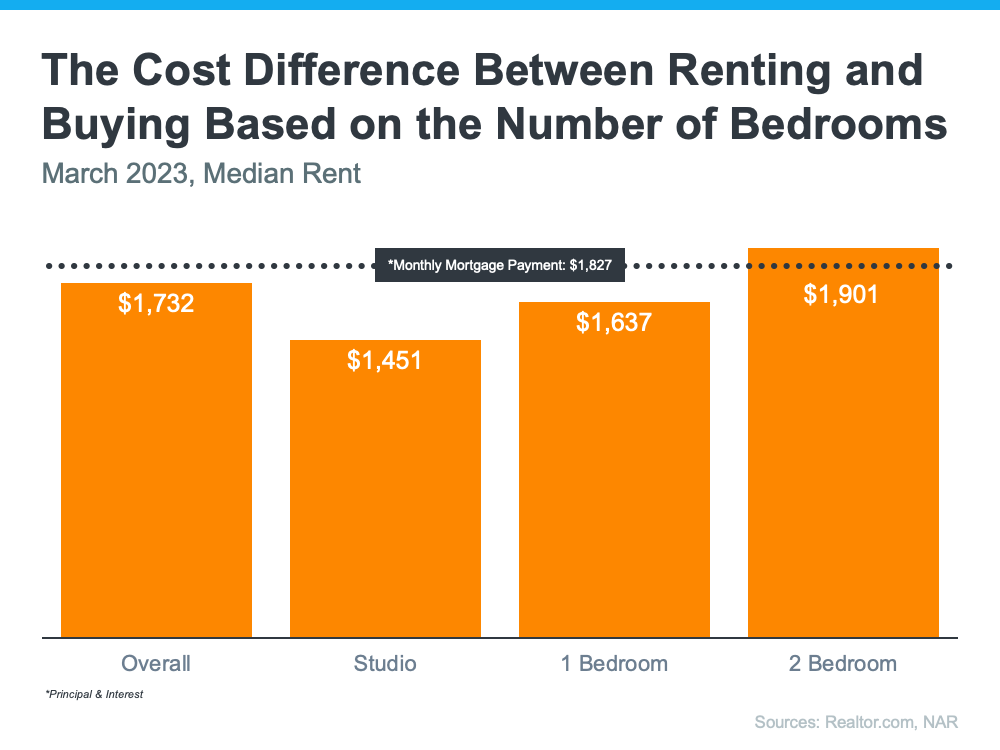

The graph below uses national data on the median rental payment from Realtor.com and median mortgage payment from the National Association of Realtors (NAR) to compare the two options. As the graph shows, depending on how much space you need, it’s typically more affordable to own than to rent if you need two or more bedrooms:

So, if you’re looking to live somewhere where you have two or more bedrooms to accommodate your household, give you more breathing room to spread out your belongings, or dedicate the extra space to practice your hobbies, it might make sense to consider homeownership.

Homeownership Allows You To Start Building Equity

In addition to shielding you from rising rents and being more affordable when you need more space, owning your home also allows you to start building your own equity, which in turn grows your net worth.

And, as home values typically rise over time and you pay off your mortgage, you build equity. That equity can set you up for success later on because you can use it to help fuel a move to an even bigger space down the line. That’s why, according to Zonda, the top reason millennial homeowners bought their home over the past year was to build their own equity instead of someone else’s.

Bottom Line

If you’re trying to decide whether to buy a home or continue renting, let’s connect to explore your options. With rents rising, it may make more sense to pursue your dream of homeownership.

Why FSBOs Should Let Go and List with a Pro!

Are you aware of any friends or homeowners considering selling their property on their own, also known as for sale by owner (FSBO)? Before they make a decision, it’s important to consider the following reasons why they should list with a professional real estate agent like MYSELF:

Representation

Dealing with legal paperwork and negotiations can be overwhelming. By having a professional represent them your friend can have peace of mind knowing their interests are protected throughout the entire process.

Experience

As a Realtor®, YOU have the knowledge and experience to guide homeowners through pricing their property correctly, effectively marketing it, and negotiating with buyers. By avoiding costly mistakes, your friend can save time and money.

Maximize Profit

Although homeowners can sell their property on their own, they may not get top dollar for it. Real estate agents have access to a vast network of potential buyers, know how to market properties to attract the right ones, and can negotiate the best price and terms for homeowners.

Marketing

Realtors have access to professional marketing tools and strategies that are proven to be effective, such as listing properties on multiple listing services, creating virtual tours, and promoting them on social media platforms.

Knowledge of the Market

Realtors have a comprehensive understanding of the local real estate market, which can help homeowners price their property correctly and competitively. Additionally, they can advise homeowners on current trends, what buyers are looking for, and what improvements they can make to increase their home’s value.

Effectively communicating the value of working with a Realtor like MYSELF is crucial in convincing your friend to list with a pro. In summary, listing with a Realtor can help homeowners save time, money, and stress while getting the most out of their property sale.

Encourage your friend to let go and list with a pro today, YOU!

Why Today’s Foreclosure Numbers Are Nothing Like 2008

You’ve likely seen headlines about the number of foreclosures climbing in today’s housing market. That may leave you with a few questions, especially if you’re thinking about buying a house. Understanding what they really mean is mission-critical if you want to know the truth about what’s happening today.

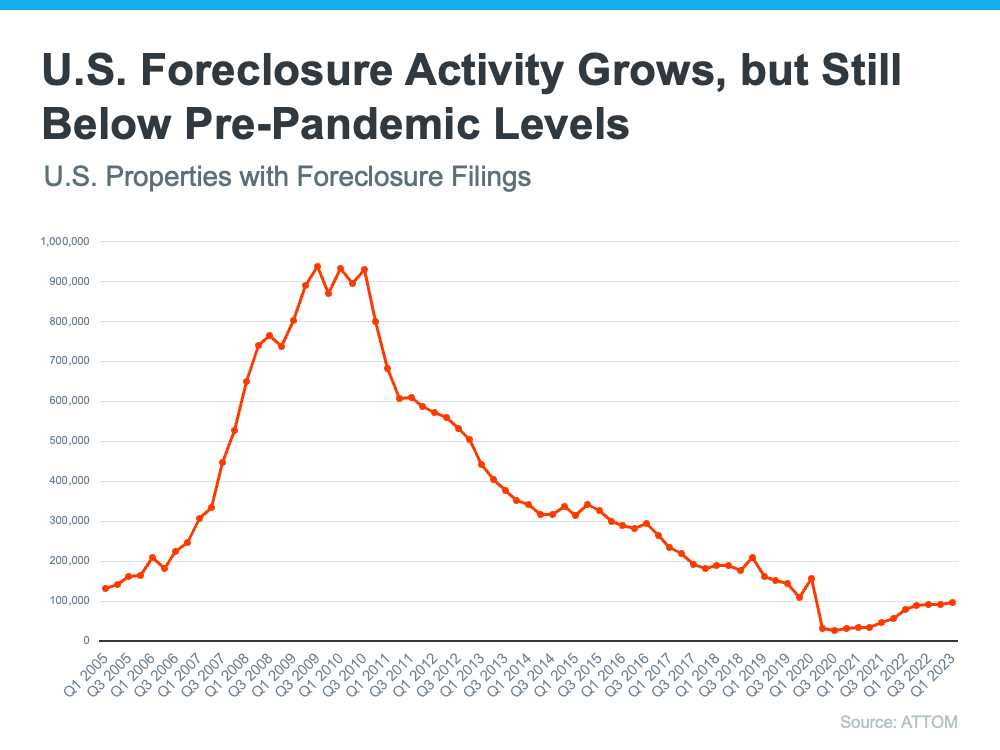

According to a recent report from ATTOM, a property data provider, foreclosure filings are up 6% compared to the previous quarter and 22% since one year ago. As media headlines call attention to this increase, reporting on just the number could actually generate worry and may even make you think twice about buying a home for fear that prices could crash. The reality is, while increasing, the data shows a foreclosure crisis is not where the market is headed.

Let’s look at the latest information with context so we can see how this compares to previous years.

It Isn’t the Dramatic Increase Headlines Would Have You Believe

In recent years, the number of foreclosures has been down to record lows. That’s because, in 2020 and 2021, the forbearance program and other relief options for homeowners helped millions of homeowners stay in their homes, allowing them to get back on their feet during a very challenging period. And with home values rising at the same time, many homeowners who may have found themselves facing foreclosure under other circumstances were able to leverage their equity and sell their houses rather than face foreclosure. Moving forward, equity will continue to be a factor that can help keep people from going into foreclosure.

As the government’s moratorium came to an end, there was an expected rise in foreclosures. But just because foreclosures are up doesn’t mean the housing market is in trouble. As Clare Trapasso, Executive News Editor at Realtor.com, says:

“There’s no reason to panic, at least not yet. Foreclosure filings began ticking up . . . after the federal foreclosure moratorium ended. The moratorium was enacted in the early days of COVID-19, when millions of Americans lost their jobs, to prevent a tsunami of homeowners losing their properties. So some of these proceedings would have taken place during the pandemic but got delayed due to the moratorium. This is a bit of a catch-up.”

Basically, there’s not a sudden flood of foreclosures coming. Instead, some of the increase is due to the delayed activity explained above while more is from economic conditions. As Rob Barber, CEO of ATTOM, explains:

“This unfortunate trend can be attributed to a variety of factors, such as rising unemployment rates, foreclosure filings making their way through the pipeline after two years of government intervention, and other ongoing economic challenges. However, with many homeowners still having significant home equity, that may help in keeping increased levels of foreclosure activity at bay.”

To further paint the picture of just how different the situation is now compared to the housing crash, take a look at the graph below. It shows foreclosure activity has been lower since the crash by looking at properties with a foreclosure filing going all the way back to 2005.

While foreclosures are climbing, it’s clear foreclosure activity now is nothing like it was during the housing crisis. In addition to all of the factors mentioned above, that’s also largely because buyers today are more qualified and less likely to default on their loans.

Today, foreclosures are far below the record-high number that was reported when the housing market crashed.

Bottom Line

Right now, putting the data into context is more important than ever. While the housing market is experiencing an expected rise in foreclosures, it’s nowhere near the crisis levels seen when the housing bubble burst, and that won’t lead to a crash in home prices.

Ways To Overcome Affordability Challenges in Today’s Housing Market

Some Highlights

- With so few homes on the market right now, widening the scope of your search to include nearby areas could help you find more options in your budget.

- You can also work with a trusted lender to consider alternative financing options and search for down payment assistance.

- If you’ve been searching for a home but are concerned about rising costs, make sure you have a team of trusted real estate professionals for expert advice.

4 Tips for Selling Your House (Video)

Planning to move? Here are 4 tips for selling your house. Let’s connect so I can guide you through the selling process this spring.

A First Impression Gone Wrong (True Executor Story)

According to the National Association of Realtors, staging (putting furniture and other things to make a property look more like a home) a house can increase the price and help the property sell faster.

Do you know why?

Before I answer that, let me ask you an important question:

How much easier would life be if you could get an offer within 30 days after listing the probate property for sale?

Ok, now for the why.

Only 10% of all home buyers have the ability to visualize what something would look like after they do their fix ups and move in.

If you are not familiar with the benefits of staging a house then you are missing out on TIME and MONEY.

TRUE STORY..

One time there was an real estate agent that was helping a woman sell 2 rental houses, same exact model and floor plan, both were fixed up to sell and both in the same general area.

The difference was one property was staged and the other was not…

Why? Because the seller did not want to invest the money to stage 2 houses, even though she could have and her real estate agent suggested that she do so.

Here is what happened:

The staged house sold 3 weeks faster (and for slightly more money) than the property that was not staged!

Staging is one of the best ways to increase the sales price of your probate property. I can show you how I have helped so many people just like you and just how easy this can be!

Remember, as the person in charge of the estate, you MUST always maximize the value of all assets that the estate holds, especially the real property.

Let me help you with some basic steps that can turn this selling experience into a painless and speedy process.

To make sure you are on the right path, call me at (810) 965-4566 or email me at bob.devore@coldwellbanker.com to set up an appointment…Why, you may ask?

Because I can show you my #1 strategy to make sure you will be getting the HIGHEST price possible for the estate’s real property.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link