Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

The Grandparent Wish of Wanting To Move Closer to Grandchildren (Video)

Welcome to Bob DeVore’s Blog!

🏡 Are you a grandparent with the heartfelt wish of moving closer to your precious grandchildren? 🏡 Recent data highlights the strong desire among grandparents to be near their loved ones, and we’re here to help make that wish come true!

At Coldwell Banker Professionals we specialize in assisting buyers and sellers in various markets, including the senior market. Whether you’re a move-up buyer looking for your dream retirement home, a seller seeking expert guidance, or a member of the baby boomer generation navigating the housing market, you’ve come to the right place.

On this channel, we provide valuable insights and updates on the housing market to keep you informed about the latest trends and opportunities. We understand the unique needs and desires of seniors and grandparents, and we’re dedicated to finding you the perfect home that brings you closer to your grandchildren.

👉 Are you ready to take the next step in your journey to be nearer to your loved ones? Connect with us today to explore the possibilities and make your grandparent wish a reality!

Don’t forget to hit that subscribe button and ring the notification bell to stay updated with our informative videos on real estate for seniors, market updates, and more. We’re here to guide you every step of the way.

Your dream home, your family, and your grandchildren are just a click away. Let’s make your grandparent wish come true together!

Unlocking the Secrets of Multiple Listing Service (MLS) | Bob DeVore’s YouTube Channel

Welcome to Bob DeVore’s’s YouTube channel, your ultimate destination for all things real estate! 🏡

In this episode, we’re diving deep into the world of Multiple Listing Service (MLS) – the powerhouse behind real estate transactions. Whether you’re a seasoned real estate professional or a first-time homebuyer, understanding how MLS works is crucial.

🔍 What is MLS?

Discover the ins and outs of the Multiple Listing Service, a comprehensive database that real estate agents use to list, search, and sell properties. We’ll break down how MLS helps streamline the buying and selling process, ensuring you’re informed every step of the way.

📈 Benefits of MLS for Sellers:

Learn why sellers benefit from having their properties listed on MLS. We’ll discuss how MLS exposure can lead to increased visibility, faster sales, and potentially higher selling prices.

🏡 Benefits of MLS for Buyers:

If you’re a buyer, you won’t want to miss this! Find out how MLS empowers you to access a vast array of property listings, helping you find your dream home with ease.

🧐 How to Navigate MLS:

Navigating the MLS platform can be a breeze with the right guidance. We’ll share tips and tricks to help you make the most of this invaluable resource.

🤝 Working with a Realtor:

Curious about the role of a real estate agent in the MLS process? We’ll explain how experienced professionals like [Real Estate Agent’s Name] can leverage MLS to your advantage.

👩💼 Bob DeVore:

As your host, Bob DeVore, with Coldwell Banker Professionals, I’ve had years of experience using MLS to help clients achieve their real estate goals. I’m excited to share my expertise and insights with you in this video!

🔔 Don’t forget to hit the “Subscribe” button and turn on the notification bell, so you never miss an episode packed with real estate knowledge and advice.

Join us in unraveling the mysteries of the Multiple Listing Service! If you have any questions or topics you’d like us to cover in future videos, drop them in the comments below.

Thanks for tuning in, and let’s embark on this MLS journey together! 🏠🗝️

#RealEstate #MLS #PropertyListings #Homebuying #SellingHomes #RealEstateTips

The Risks of Selling Your House on Your Own

Are you thinking about selling your house as a For Sale by Owner (FSBO)? If so, know there’s a whole lot more time and expertise needed in that process than you might think. While the idea of doing it all by yourself might seem tempting, it’s important to recognize the challenges you may face if you take it on all by yourself. As a recent article from Bankrate explains:

“Choosing the right price, crafting a compelling listing, marketing to potential buyers, coordinating showings, preparing paperwork: All of these are tasks that, in the absence of a real estate agent, you will have to do yourself.”

Here’s a bit more information on just a few of those things and how you may miss out if you don’t use an agent.

You May Not Price it Right

Pricing your house right is key to a successful sale. Real estate agents have experience navigating this housing market and understand the art of pricing a home to sell today. Unfortunately, homeowners who sell on their own often lack this all-important experience. That can lead to two common consequences: overpricing or underpricing the house.

An article from Nerd Wallet offers this advice:

“If your home is overpriced, you run the risk of buyers not seeing the listing. . . . But price your house too low and you could end up leaving some serious money on the table. A bargain-basement price could also turn some buyers away, as they may wonder if there are any underlying problems with the house.”

Don’t run this risk. Instead, partner with an agent to make sure your house is priced at current market value, so it catches the eyes of eager buyers. This will put your house in a position to make the best first impression possible.

You Don’t Have as Much Experience in Marketing a House

In this digital age, online marketing has become a real game-changer, especially when it comes to selling your house. A recent report from the National Association of Realtors (NAR), explains:

“Among all generations of home buyers, the first step taken in the home search process was to look online for properties.”

When you partner with a real estate agent who knows how to take advantage of online marketing tools and resources, you’ll be able to get in front of these tech-savvy house hunters, boosting your chances of a successful sale. But, if you’re attempting to sell your house on your own, you might find yourself missing out on the full power of online and social media strategies.

You May Not Be Comfortable Handling All the Back-and-Forth

When you decide to sell your house, you’re not just on a quest to find a buyer; you’re also stepping into a world of negotiations. You’ll have to coordinate with a bunch of people, including the buyer, the buyer’s agent, the inspection company, the appraiser, and more. It’s a dance where every move counts, and the expertise of a real estate agent can make a world of difference in keeping these negotiations on track and sealing the deal.

As NerdWallet says:

“Your listing agent will also, of course, be on your side throughout negotiations. They’ll double-check paperwork that comes through, communicate with the buyer’s agent and other parties to the sale, and generally stay on top of things through to closing day.”

Bottom Line

If you’re thinking about selling your house and the idea of going it alone has crossed your mind, be sure to think through that decision carefully. Let’s connect to discuss how a real estate agent has the experience needed to take all that stress off your plate.

What Are the Real Reasons You Want To Move Right Now?

If you’re considering selling your house right now, it’s likely because something in your life has changed. And while things like mortgage rates play a big role in your decision, you don’t want that to overshadow why you thought about making a move in the first place.

It’s true mortgage rates are higher right now, and that has an impact on affordability. As a result, some homeowners are deciding they’ll wait to sell because they don’t want to move and have a higher mortgage rate on their next home.

But your lifestyle and your changing needs matter, too. As a recent article from Realtor.com says:

“No matter what interest rates and home prices do next, sometimes homeowners just have to move—due to a new job, new baby, divorce, death, or some other major life change.”

Here are a few of the most common reasons people choose to sell today. You may find any one of these resonates with you and may be reason enough to move, even today.

Relocation

Some of the things that can motivate a move to a new area include changing jobs, a desire to be closer to friends and loved ones, wanting to live in your ideal location, or just looking for a change in scenery.

For example, if you just landed your dream job in another state, you may be thinking about selling your current home and moving for work.

Upgrading

Many homeowners decide to sell to move into a larger home. This is especially common when there’s a need for more room to entertain, a home office or gym, or additional bedrooms to accommodate a growing number of loved ones.

For example, if you’re living in a condo and your household is growing, it may be time to find a home that better fits those needs.

Downsizing

Homeowners may also decide to sell because someone’s moved out of the home recently and there’s now more space than needed. It could also be that they’ve recently retired or are ready for a change.

For example, you’ve just kicked off your retirement and you want to move somewhere warmer with less house to maintain. A different home may be better suited for your new lifestyle.

Change in Relationship Status

Divorce, separation, or marriage are other common reasons individuals sell.

For example, if you’ve recently separated, it may be difficult to still live under one roof. Selling and getting a place of your own may be a better option.

Health Concerns

If a homeowner faces mobility challenges or health issues that require specific living arrangements or modifications, they might sell their house to find one that works better for them.

For example, you may be looking to sell your house and use the proceeds to help pay for a unit in an assisted-living facility.

With higher mortgage rates and rising prices, there are some affordability challenges right now – but your needs and your lifestyle matter too. As a recent article from Bankrate says:

“Deciding whether it’s the right time to sell your home is a very personal choice. There are numerous important questions to consider, both financial and lifestyle-based, before putting your home on the market. . . . Your future plans and goals should be a significant part of the equation . . .”

Bottom Line

If you want to sell your house and find a new one that better fits your needs, let’s connect. That way, you’ll have someone to guide you through the process and help you find a home that works for you.

How Buying a Multi-Generational Home Helps with Affordability Today

In today’s world of rising housing costs, many buyers are looking for ways to still be able to buy a home. Some of them have found a solution in multi-generational living.

Multi-generational living is when two or more adult generations live together under one roof. This includes siblings, parents, or even grandparents. Here’s an in-depth look at why more buyers are choosing this option today, so you can see if it may be right for you too.

Reasons To Buy a Multi-Generational Home

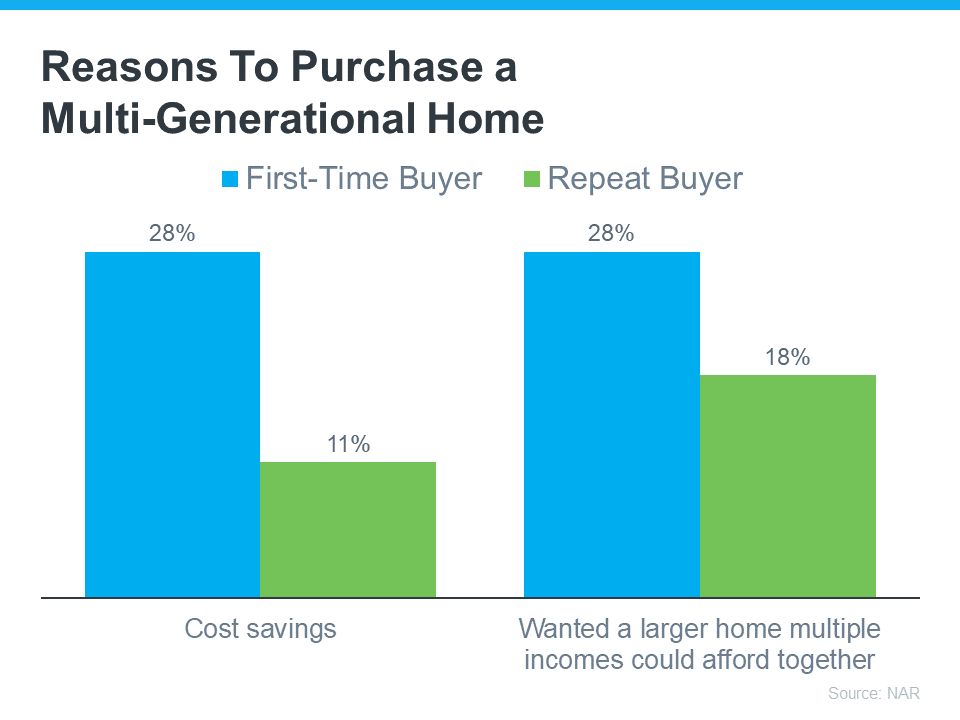

According to a recent study by the National Association of Realtors (NAR), the top two reasons people are opting for multi-generational homes today have to do with affordability (see graph below):

Cost Savings: About 28% of first-time buyers and 11% of repeat buyers are deciding on a multi-generational home to save on costs. By pooling their resources, households can share the financial responsibilities like mortgage payments, utilities, property taxes, and maintenance, to make homeownership more affordable. This is especially helpful for first-time homebuyers who may be finding it tough to afford a home on their own in today’s market.

More Space: Another 28% of first-time buyers and 18% of repeat buyers are doing it because they want a larger home they couldn’t afford on their own. For some of the repeat buyers who listed this as a main motivator, it could be because they find themselves taking care of older parents while also welcoming back young adults who’ve returned to the nest. With everyone chipping in and combining their incomes, suddenly, that big dream home with more space is within reach. As the Triangle Business Journal explains:

“Choosing multi-gen living allows people to purchase a home much larger than they could afford on their own by leveraging the combined income, credit and a down payment of those that they will be occupying the home with.”

Lean on an Expert

If you’re interested in this too, partner with a local real estate agent. Finding the perfect multi-generational home isn’t as simple as shopping for a regular house. That’s because there are more people with even more opinions and needs that should be considered.

You’ve got to make sure everyone has their own space, find room for shared household time, and possibly even create adaptable areas for older relatives. It’s a puzzle, and the pieces need to fit just right. Your real estate agent has the expertise and local knowledge to help you find that home where everyone can be comfortable without breaking the bank. As MoneyGeek.com puts it:

“Having a good multigenerational property can improve the prospects of success when living with loved ones. A multigenerational home should fit the specific needs of most family members regardless of age or health. Speaking to a real-estate agent can help you gain clarity and locate a fit.”

Bottom Line

Buying a multi-generational home can be a smart way to tackle some of today’s affordability challenges. When you team up to share expenses, you can make your dream of homeownership more attainable. If this sounds like an option for you and your loved ones, let’s connect to help you find a home that’s the perfect fit.

Are Higher Mortgage Rates Here To Stay?

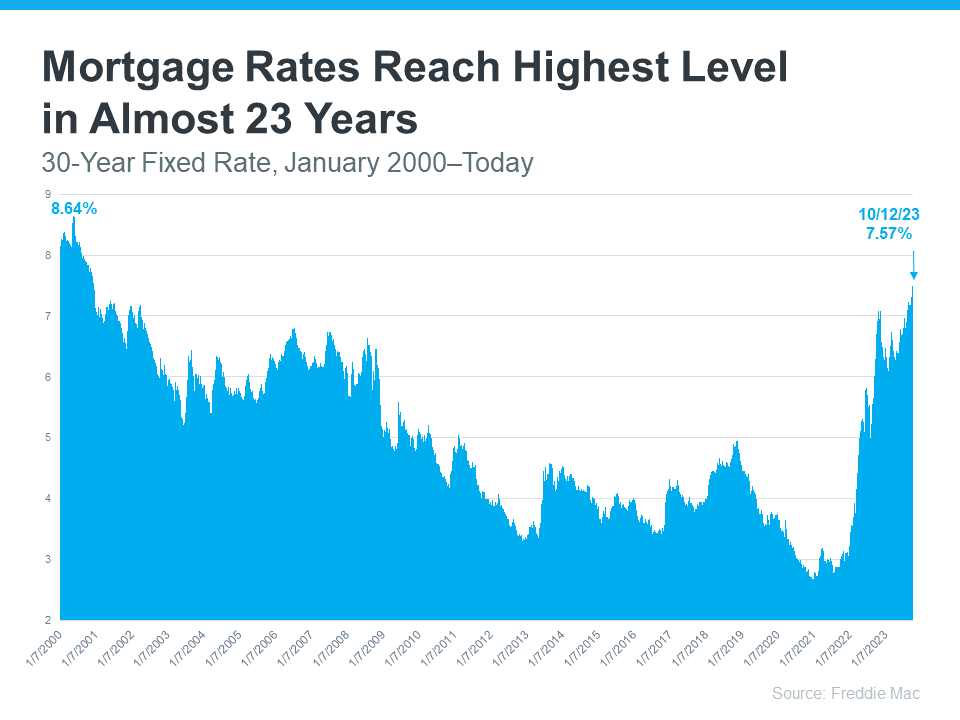

Mortgage rates have been back on the rise recently and that’s getting a lot of attention from the press. If you’ve been following the headlines, you may have even seen rates recently reached their highest level in over two decades (see graph below):

That can feel like a little bit of a gut punch if you’re thinking about making a move. If you’re wondering whether or not you should delay your plans, here’s what you really need to know.

How Higher Mortgage Rates Impact You

There’s no denying mortgage rates are higher right now than they were in recent years. And, when rates are up, that affects overall home affordability. It works like this. The higher the rate, the more expensive it is to borrow money when you buy a home. That’s because, as rates trend up, your monthly mortgage payment for your future home loan also increases.

Urban Institute explains how this is impacting buyers and sellers right now:

“When mortgage rates go up, monthly housing payments on new purchases also increase. For potential buyers, increased monthly payments can reduce the share of available affordable homes . . . Additionally, higher interest rates mean fewer homes on the market, as existing homeowners have an incentive to hold on to their home to keep their low interest rate.”

Basically, some people are deciding to put their plans on hold because of where mortgage rates are right now. But what you want to know is: is that a good strategy?

Where Will Mortgage Rates Go from Here?

If you’re eager for mortgage rates to drop, you’re not alone. A lot of people are waiting for that to happen. But here’s the thing. No one knows when it will. Even the experts can’t say with certainty what’s going to happen next.

Forecasts project rates will fall in the months ahead, but what the latest data says is that rates have been climbing lately. This disconnect shows just how tricky mortgage rates are to project.

The best advice for your move is this: don’t try to control what you can’t control. This includes trying to time the market or guess what the future holds for mortgage rates. As CBS News states:

“If you’re in the market for a new home, experts typically recommend focusing your search on the right home purchase — not the interest rate environment.”

Instead, work on building a team of skilled professionals, including a trusted lender and real estate agent, who can explain what’s happening in the market and what it means for you. If you need to move because you’re changing jobs, want to be closer to family, or are in the middle of another big life change, the right team can help you achieve your goal, even now.

Bottom Line

The best advice for your move is: don’t try to control what you can’t control – especially mortgage rates. Even the experts can’t say for certain where they’ll go from here. Instead, focus on building a team of trusted professionals who can keep you informed. When you’re ready to get the process started, let’s connect.

Discover Your Perfect Neighborhood (Video)

Explore key attractions and vibrant community vibes with Bob DeVore! 🏞️🏛️🍽️ Discover parks, museums, farmers markets, and more in your ideal neighborhood.

The Difference Between Renting and Buying a Home

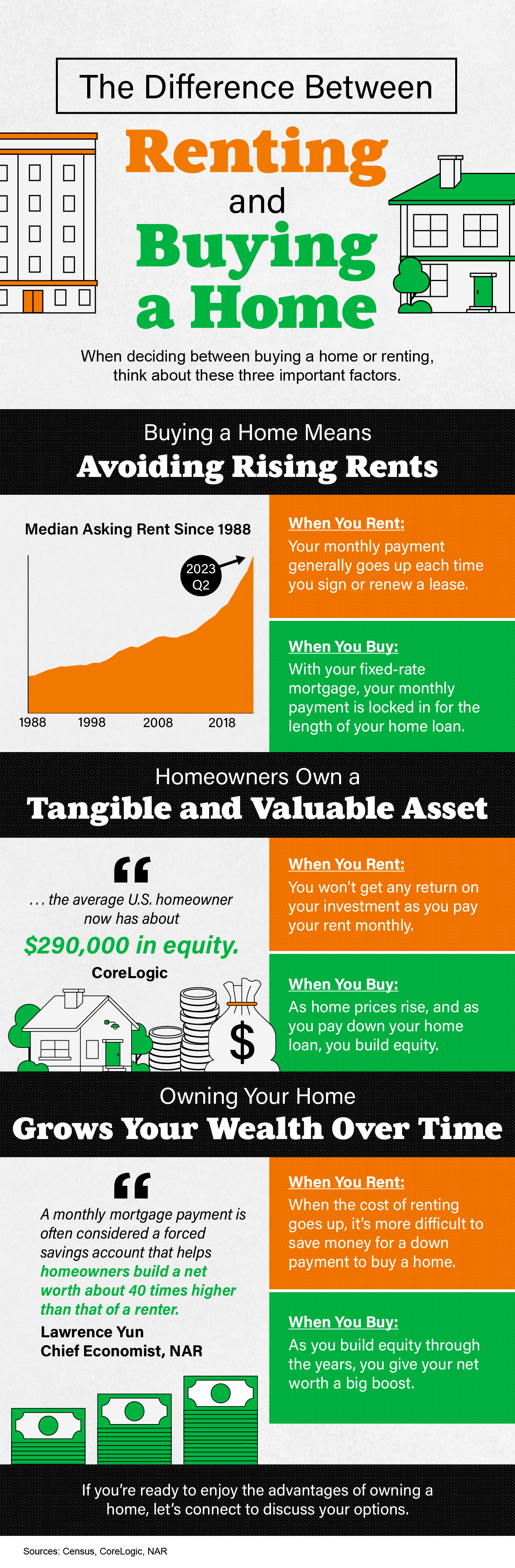

Some Highlights

- When deciding between buying a home or renting, think about these three important factors.

- Buying a home means avoiding rising rents, owning a tangible and valuable asset, and growing your wealth over time.

- If you’re ready to enjoy the advantages of owning a home, let’s connect to discuss your options.

Forecasting Year-End Home Prices (Video)

Let’s connect so you know what’s going on with home prices in our local area.

Growing Your Net Worth with Homeownership

Take a moment to imagine where you want to be in a few years. You might be thinking about your job, money, wanting more stability, or goals you want to reach soon. Is homeownership a part of that vision? If it is, you should know owning a home has a whole lot of financial benefits.

One of the many reasons to buy a home is that it’s a great way to build wealth and gain financial stability. That’s because the value of most homes increases over time, which in turn grows your net worth. Here’s how home values are rising right now. According to Zillow:

“The total value of the U.S. housing market – the sum of Zillow’s estimated value for every U.S. home – is now slightly less than $52 trillion, which is $1.1 trillion higher than the previous peak reached last June.”

Basically, homeownership is a tremendous wealth-building tool. And with home values back on the rise across the nation, now might be a good time to consider if owning a home is something you want to reach for.

Here’s a look at some data to see how much owning a home can really make a difference in your life.

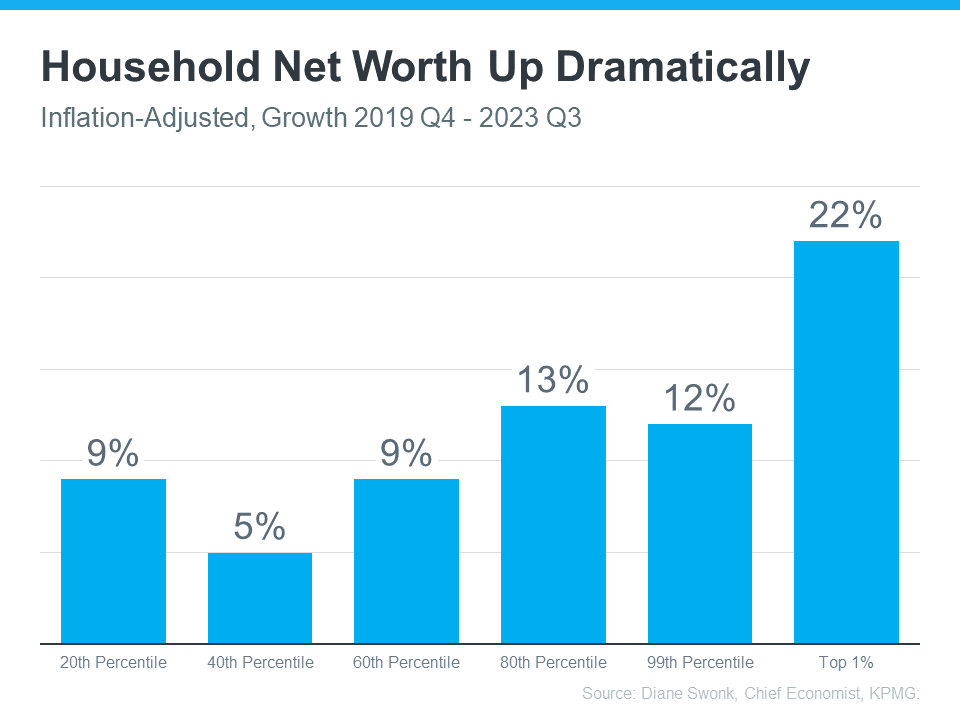

Household Net Worth Is Rising

Data shows that while those in the top 1% saw the most dramatic net worth increase, people from every single tax bracket have seen their wealth grow over the past few years (see graph below):

For many of those people, the rising value of their home plays a big part in that.

Owning a Home Helps You Achieve Financial Success

You can tell homeownership had a lot to do with that growth because there’s a significant net worth gap between homeowners and renters. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“. . . homeownership is a catalyst for building wealth for people from all walks of life. A monthly mortgage payment is often considered a forced savings account that helps homeowners build a net worth about 40 times higher than that of a renter.”

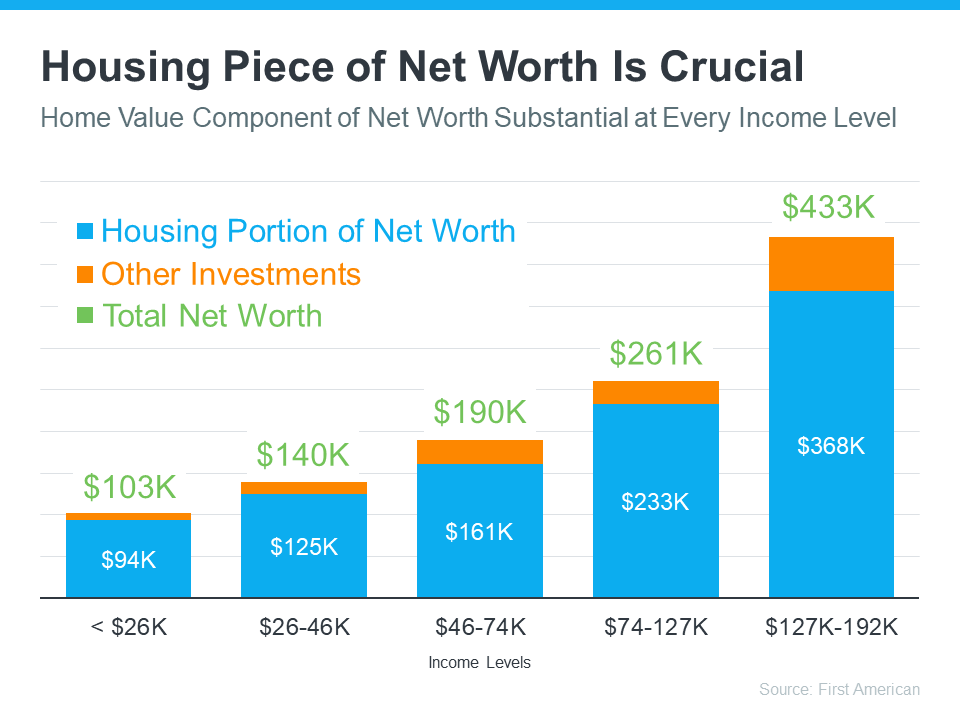

The big reason why? Homeowner’s build equity. Home equity is the value of your home minus the amount you owe on your mortgage. And for most homeowners, that’s the largest contributor to their net worth. Here’s the data from First American to prove it (see graph below):

The blue portion of each bar represents housing as a portion of net worth – and it’s clearly a bigger contributor than other investments like stocks, gold, and cryptocurrencies. As you can see, across different income levels, homeownership does more to build the average household’s wealth than anything else.

Bottom Line

One of the biggest benefits of owning a home is that it can provide an avenue to grow your net worth. Let’s connect so you can start investing in homeownership.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link