Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

Your Pivotal Moment as an Executor: Navigating Probate Property Sales

Digital composite of Man pushing rolling round rock

What defines your journey as a probate executor? The answer might surprise you.

For many probate executors and administrators, their defining moment comes when they grapple with determining the pricing strategy for the real property held within the probate estate.

This makes perfect sense because the property is often the most valuable asset in the estate, serving as the financial lifeline for settling debts and covering expenses.

Here are seven essential considerations every executor or administrator should keep in mind when venturing into the realm of selling probate property:

1. Ensure you possess the necessary legal documentation to legally sign a listing agreement.

2. Inform all beneficiaries about the actions you intend to take regarding the property sale, typically through the guidance of an attorney.

3. Maintain meticulous records of all your activities, communications, and actions. Consider keeping a ‘communication log’ to transparently showcase the effort you’re putting in.

4. Obtain a property appraisal for the sale. This is a prudent and proactive approach to ensure your probate property is priced appropriately.

5. Always collaborate with a Certified Probate Real Estate Specialist (CPRES) who has received formal training in handling these specific property types.

6. During the agent selection process, inquire about the marketing program they intend to implement throughout the listing. Effective marketing is the cornerstone of maximizing property exposure and ensuring a successful sale.

7. Don’t hesitate to ask questions. Knowledge empowers you, and the more informed you are, the more control and confidence you’ll have throughout the entire probate process.

Your role as an executor is pivotal, and I’m here to provide guidance and support whenever you need it. Feel free to reach out for assistance in navigating the complexities of probate property sales.

Unlocking Exclusive Insights: What Probate Agents and Attorneys Often Keep to Themselves

As a decision maker who takes action, you understand the value of connecting with others who share your commitment to making informed choices. That’s precisely why I, Bob, a Certified Probate Real Estate Specialist, am here to provide you with exceptional support and service.

When you work with me, you can expect:

– Getting you the absolute best price for the property within the probate estate.

– Receiving top-notch service that sets the industry standard.

– Ensuring a smooth and successful outcome tailored to your needs.

I recognize that managing tasks like collecting mail, handling bills and utilities, property repairs, yard maintenance, and communication with attorneys and heirs can be overwhelming and time-consuming. That’s why I’m including a Probate Timeline link Click Here. Here’s what you can expect from it:

– A user-friendly, timeline chart.

– Your invaluable guide throughout the probate process.

– A stress-relieving tool providing clarity on every step.

– A roadmap to keep you on course and ensure everyone involved (attorneys, Realtors, accountants, etc.) is on the same page.

Probate Attorney Pitfalls: What You Should Expect

Lawyer hands holding a legal book and clarify the law to client while sign a contract at lawyer office

When dealing with probate matters, it’s crucial to have the right support in place. Not all probate attorneys are too busy to help, but sometimes their actions (or lack thereof) can speak volumes. One of the most frustrating experiences can be waiting for a timely phone call back that never seems to come.

In some states, like Florida, where there’s a high volume of probate cases, attorneys may specialize in probate law. However, for many, the concept of a dedicated “probate attorney” may not exist.

At times, you may find that your questions as a probate executor or administrator are answered in the resources I’ve provided, such as The Probate Timeline or the Probate Glossary of Terms that I’ve shared with you earlier.

What sets my service apart is not just my dedication and work ethic but also my specialization in probate real estate. I go the extra mile to equip you with valuable resources that empower you in your role.

Now, you might wonder if there’s a real difference between me and other real estate agents. The answer is a resounding YES.

I am a Certified Probate Real Estate Specialist (CPRES), which sets me apart from traditional real estate agents. As your CPRES, I am committed to ensuring that you fulfill your fiduciary responsibility to all parties involved in the estate. This includes selling the property for the highest possible price, even if the estate has substantial debts.

The more you engage with my services, the more evident it becomes that I genuinely care about my clients. I am here to assist you every step of the way as you navigate the complexities of settling your probate estate.

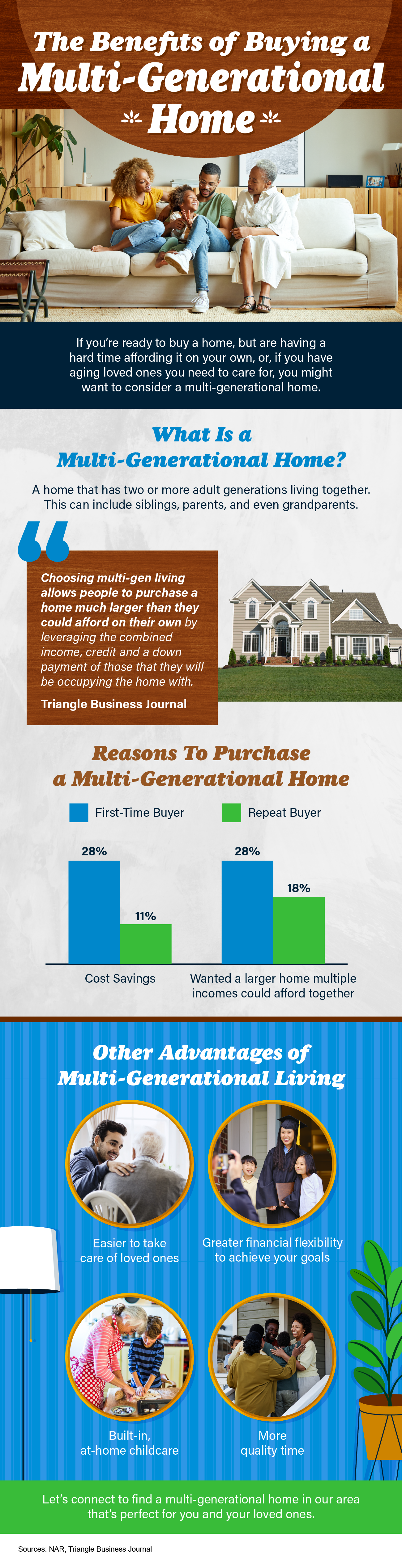

The Benefits of Buying a Multi-Generational Home

Some Highlights

- If you’re ready to buy a home but are having a hard time affording it on your own, or, if you have aging loved ones you need to care for, you might want to consider a multi-generational home.

- Living with siblings, parents, and even grandparents can help you save money, give or receive childcare, and spend quality time together.

- Let’s connect to find a home in our area that’s perfect for you and your loved one’s needs.

Understanding the Recent Increase in Foreclosures and Bankruptcies (Video)

The Rise in Foreclosures and Bankruptcies Isn’t a Cause for Concern.

In today’s real estate market, it’s important to stay informed about the trends that affect our industry. One topic that has been gaining attention lately is the increase in foreclosures and bankruptcies. While some may be worried about this uptick, it’s essential to put things into perspective.

The Rise in Foreclosures and Bankruptcies: A Closer Look

The rise in foreclosures and bankruptcies isn’t necessarily a cause for concern. Instead, it indicates that the market is gradually returning to more normal levels. As the economy experiences fluctuations, it’s natural to see occasional increases in these types of financial events.

Understanding the Market Dynamics

To gain a better understanding of what’s happening in the market and how it might impact your real estate goals, it’s crucial to stay informed. If you have questions or concerns about these trends or any other aspect of the real estate market, I’m here to help.

Let’s Connect and Navigate the Market Together

Don’t hesitate to reach out if you have any questions or if you’re looking for guidance on your real estate journey. Together, we can navigate the current market conditions and work towards your goals. Your success in the real estate market is my top priority. Let’s connect and discuss how I can assist you.

Don’t Believe Everything You Read About Home Prices

According to the latest data from Fannie Mae, 23% of Americans still think home prices will go down over the next twelve months. But why do roughly 1 in 4 people feel that way?

It has a lot to do with all the negative talk about home prices over the past year. Since late 2022, the media has created a lot of fear about a price crash and those concerns are still lingering. You may be hearing people in your own life saying they’re worried about home prices or see on social media that some influencers are saying prices are going to come tumbling down.

If you’re someone who still thinks prices are going to fall, ask yourself this: Which is a more reliable place to get your information – clickbait headlines and social media or a trusted expert on the housing market?

The answer is simple. Listen to the professionals who specialize in residential real estate.

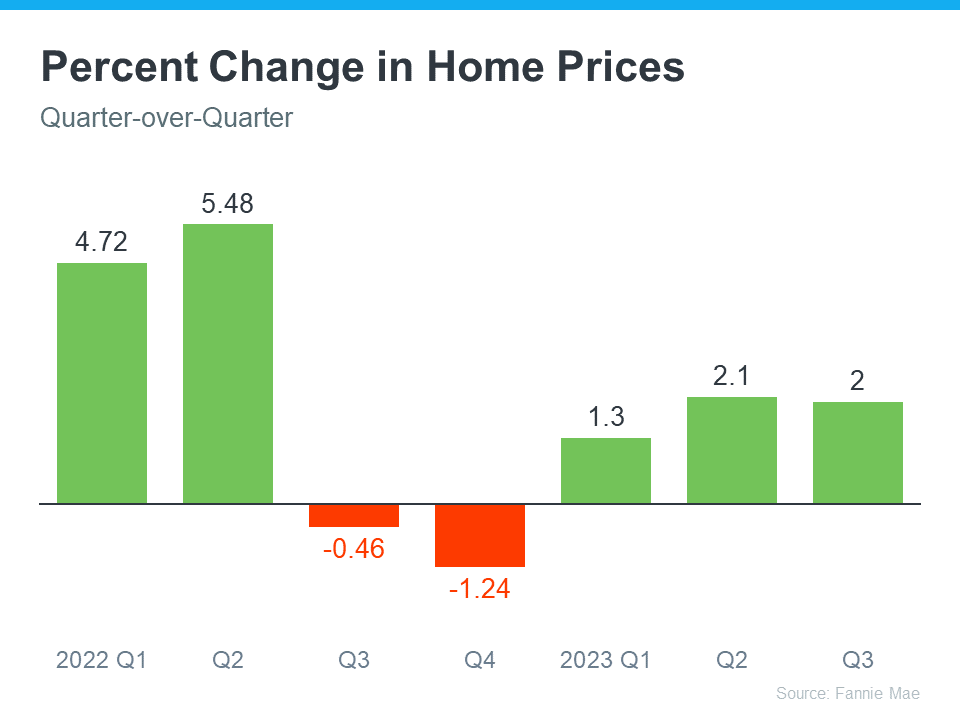

Here’s the latest data you can actually trust. Housing market experts acknowledge that nationally, prices did dip down slightly late last year, but that was short-lived. Data shows prices have already rebounded this year after that slight decline in 2022 (see graph below):

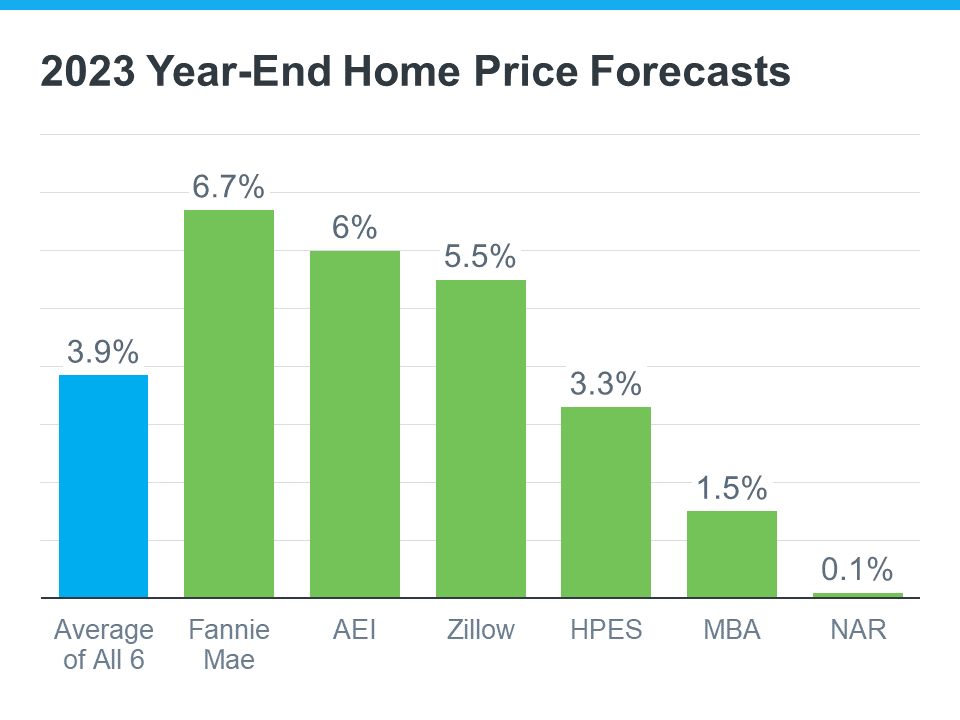

But it’s not just Fannie Mae that’s reporting this bounce back. Experts from across the industry are showing it in their data too. And that’s why so many forecasts now project home prices will net positive this year – not negative. The graph below helps prove this point with the latest forecasts from each organization:

What’s worth noting is that, just a few short weeks ago, the Fannie Mae forecast was for 3.9% appreciation in 2023. In the forecast that just came out, that projection was updated from 3.9% to 6.7% for the year. This increase goes to show just how confident experts are that home prices will net positive this year.

So, if you believe home prices are falling, it may be time to get your insights from the experts instead – and they’re saying prices aren’t falling, they’re climbing.

Bottom Line

There’s been a lot of misleading information about home prices over the past year. And that’s still having an impact on how people are feeling about the housing market today. But it’s best not to believe everything you hear or read.

If you want information you can trust, turn to the real estate experts. Their data shows home prices are on the way back up and will net positive for the year. If you have questions about what’s happening in our local area, let’s connect.

Bob DeVore: Your Trusted Real Estate Partner (Video)

In the ever-evolving world of real estate, having a reliable and experienced partner by your side can make all the difference. Meet Bob DeVore, your trusted real estate professional who is dedicated to helping you navigate the intricacies of buying or selling a property. With a wealth of knowledge and a commitment to excellence, Bob is the partner you can rely on for all your real estate needs.

## Experience Matters

Bob DeVore brings a wealth of experience to the table. With over two decades in the real estate industry, he has successfully handled a wide range of transactions, from first-time homebuyers to seasoned investors. His extensive experience allows him to anticipate potential challenges and provide effective solutions, ensuring a smooth and seamless experience for his clients.

## Local Expertise

One of Bob’s standout qualities is his in-depth knowledge of the local real estate market. He understands that real estate is not just about properties; it’s also about communities, neighborhoods, and lifestyle. Whether you’re looking for a cozy family home, an investment property, or a luxury estate, Bob can guide you to the ideal location that suits your preferences and needs.

## Personalized Service

Bob DeVore believes in the power of personalized service. He takes the time to listen to your goals and aspirations, ensuring that every step of the real estate journey is tailored to your unique situation. Whether you’re a first-time homebuyer or a seasoned seller, Bob is committed to providing you with the attention and care you deserve.

## Effective Communication

Effective communication is key in the real estate process, and Bob excels in this aspect. He keeps you informed and educated throughout the entire process, making sure you understand every decision and its implications. You can count on Bob to be responsive, transparent, and always available to address your questions and concerns.

## Negotiation Expertise

Bob DeVore’s negotiation skills are second to none. He knows how to strike the right balance between your interests and the other party’s, ensuring that you get the best possible deal. His negotiation expertise has saved his clients both time and money while achieving their real estate goals.

## Commitment to Success

Above all, Bob is committed to your success. Whether you’re buying your dream home or selling a property, he will go above and beyond to make your real estate dreams a reality. His dedication to achieving your goals is unwavering, and he’ll work tirelessly to ensure you have a positive and rewarding real estate experience.

## Conclusion

In the world of real estate, having a trusted partner like Bob DeVore can be a game-changer. With his extensive experience, local expertise, personalized service, effective communication, negotiation skills, and commitment to your success, Bob is the real estate professional you can rely on. Whether you’re a first-time buyer or an experienced investor, Bob DeVore is here to guide you through every step of your real estate journey. Contact him today and discover why he’s the trusted real estate partner you’ve been looking for.

3 Common Mistakes Made by Novice Sellers in Real Estate (Video)

Selling a property can be a complex and challenging process, especially for those who are new to the real estate market. While it’s natural to feel a mix of excitement and nervousness when putting your property on the market, it’s essential to avoid some common mistakes that novice sellers often make. In this blog post, we’ll explore three of these mistakes and provide insights on how to steer clear of them to achieve a successful sale.

1. Incorrectly Pricing Your Property:

One of the most significant mistakes novice sellers make is pricing their property inaccurately. Setting the right price is crucial for attracting potential buyers and maximizing your return on investment. Overpricing your property can deter buyers, causing your listing to languish on the market for an extended period. On the other hand, underpricing your property means leaving money on the table.

To avoid this mistake, work with a qualified real estate agent who can conduct a comparative market analysis (CMA) to determine the optimal price for your property. They will consider factors like the current market conditions, similar properties in your area, and any unique features your property offers. By pricing your property correctly from the beginning, you’ll increase your chances of a faster sale at the best possible price.

2. Neglecting Property Presentation:

First impressions matter in real estate, and novice sellers often underestimate the importance of property presentation. Failing to stage, clean, or declutter your home can result in a lack of interest from potential buyers. In today’s competitive market, it’s crucial to make your property stand out.

To avoid this mistake, invest time and effort into preparing your home for sale. Consider professional staging to highlight your property’s best features and create a warm, inviting atmosphere. Ensure that your property is clean, well-maintained, and free of any personal clutter. A well-presented home not only attracts more buyers but also helps them envision themselves living there.

3. Ignoring Marketing Strategies:

Novice sellers may underestimate the power of effective marketing. Simply listing your property on a few online platforms is not enough to reach a broad audience and attract serious buyers. Failing to implement a robust marketing strategy can result in your property remaining unnoticed and unsold.

To avoid this mistake, work closely with your real estate agent to develop a comprehensive marketing plan. This plan should include professional photography, high-quality listing descriptions, and a multi-channel marketing approach that leverages online platforms, social media, and traditional marketing techniques. The goal is to expose your property to as many potential buyers as possible, increasing your chances of a successful sale.

In conclusion, selling a property as a novice seller can be a daunting task, but by avoiding these common mistakes, you can significantly improve your chances of a successful and profitable sale. Collaborate with an experienced real estate agent who can guide you through the process and help you navigate these challenges, ultimately leading to a smoother and more rewarding selling experience.

What Are Accessory Dwelling Units and How Can They Benefit You?

Maybe you’re in the market for a home and are having a hard time finding the right one that fits your budget. Or perhaps you’re already a homeowner in need of extra income or a place for loved ones. Whether as a potential homebuyer or a homeowner with changing needs, accessory dwelling units, or ADUs for short, may be able to help you reach your goals.

What Is an ADU?

As AARP says:

“An ADU is a small residence that shares a single-family lot with a larger, primary dwelling.”

“An ADU is an independent, self-contained living space with a kitchen or kitchenette, bathroom and sleeping area.”

“An ADU can be located within, attached to, or detached from the main residence. It can be created out of an existing structure (such as a garage) or built anew.”

If you’re thinking about whether an ADU makes sense for you as a buyer or a homeowner, here’s some useful information and benefits that ADUs can provide. Keep in mind, that regulations for ADUs vary based on where you live, so lean on a local real estate professional for more information.

The Benefits of ADUs

Freddie Mac and the AARP identify some of the best features of ADUs for both buyers and homeowners:

- Living Close by, But Still Separate: ADUs allow loved ones to live together while having separate spaces. That means you can enjoy each other’s company and help each other out with things like childcare, but also have privacy when needed. If this appeals to you, you may want to consider buying a home with an ADU or adding an ADU onto your house. According to Freddie Mac:

“Having an accessory dwelling unit on an existing property has become a popular way for homeowners to offer independent living space to family members.”

- Aging in Place: Similarly, ADUs allow older people to be close to loved ones who can help them if they need it as they age. It gives them the best of both worlds – independence and support from loved ones. For example, if your parents are getting older and you want them nearby, you may want to buy a home with an ADU or build one onto your existing house.

- Affordable To Build: Since ADUs are often on the smaller side, they’re typically less expensive to build than larger, standalone homes. Building one can also increase your property’s value.

- Generating Additional Income: If you own a home with an ADU or if you build an ADU on your land, it can help generate rental income you could use toward your own mortgage payments. It’s worth noting that because an ADU exists on a single-family lot as a secondary dwelling, it typically cannot be sold separately from the primary residence. But that’s changing in some states. Work with a professional to understand your options.

These are a few of the reasons why many people who benefit from ADUs think they’re a good idea. As Scott Wild, SVP of Consulting at John Burns Research, says:

“It’s gone from a small niche in the market to really a much more impactful part of new housing.”

Bottom Line

ADUs have some great advantages for buyers and homeowners alike. If you’re interested, reach out to a real estate professional who can help you understand local codes and regulations for this type of housing and what’s available in your market.

Foreclosures and Bankruptcies Won’t Crash the Housing Market

If you’ve been following the news recently, you might have seen articles about an increase in foreclosures and bankruptcies. That could be making you feel uneasy, especially if you’re thinking about buying or selling a house.

But the truth is, even though the numbers are going up, the data shows the housing market isn’t headed for a crisis.

Foreclosure Activity Rising, but Less Than Headlines Suggest

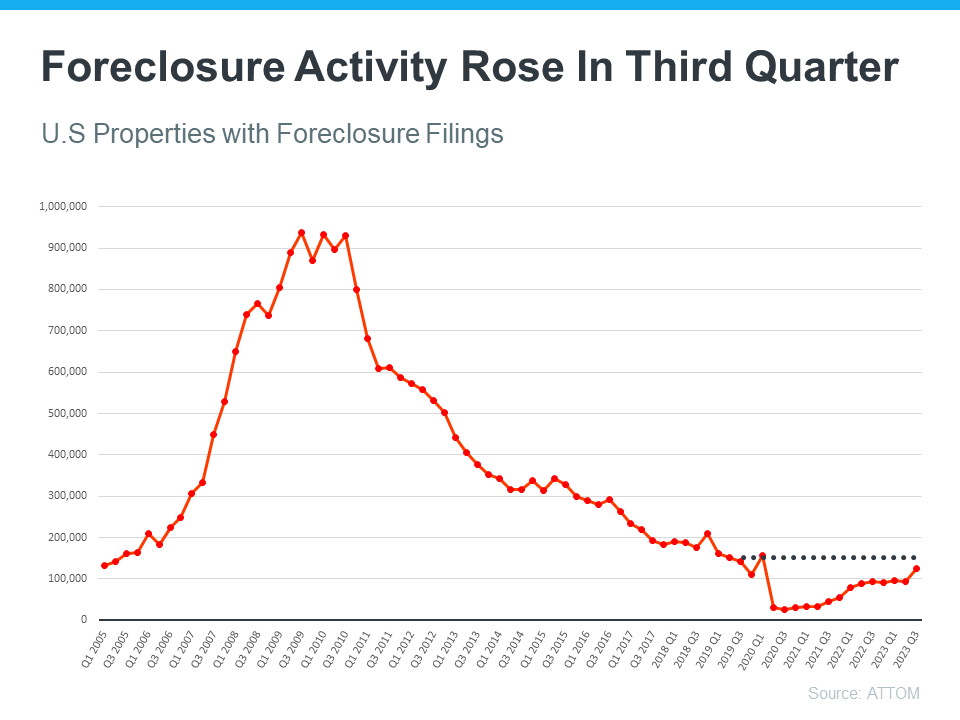

In recent years, the number of foreclosures has been very low. That’s because, in 2020 and 2021, the forbearance program and other relief options were put in place to help many homeowners stay in their homes during that tough time.

When the moratorium ended, there was an expected rise in foreclosures. But just because they’re up, that doesn’t mean the housing market is in trouble.

To help you see how much things have changed since the housing crash in 2008, check out the graph below using research from ATTOM, a property data provider. It looks at properties with a foreclosure filing going all the way back to 2005 to show that there have been fewer foreclosures since the crash.

As you can see, foreclosure filings are inching back up to pre-pandemic numbers, but they’re still way lower than when the housing market crashed in 2008. And today, the tremendous amount of equity American homeowners have in their homes can help people sell and avoid foreclosure.

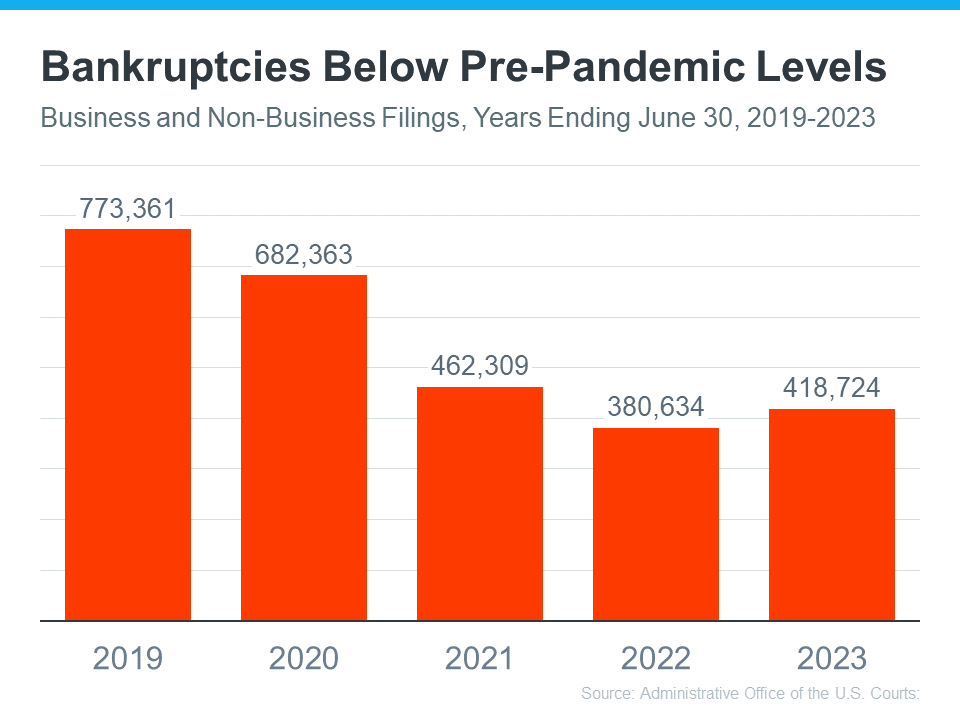

The Increase in Bankruptcies Isn’t Dramatic Either

As you can see below, the financial trouble many industries and small businesses felt during the pandemic didn’t cause a dramatic increase in bankruptcies. Still, the number of bankruptcies has gone up slightly since last year, nearly returning to 2021 levels. But that isn’t cause for alarm.

The numbers for 2021 and 2022 were lower than more typical years. That’s in part because the government provided trillions of dollars in aid to individuals and businesses during the pandemic. So, let’s instead focus on the bar for this year and compare it to the bar on the far left (2019). It shows the number of bankruptcies today is still nowhere near where it was before the pandemic. Both of these two factors are reasons why the housing market isn’t in danger of crashing.

Bottom Line

Right now, it’s crucial to understand the data. Foreclosures and bankruptcies are rising, but these leading indicators aren’t signaling trouble that would cause another crash.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link