Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

Thinking About Using Your 401(k) To Buy a Home?

Are you dreaming of buying your own home and wondering about how you’ll save for a down payment? You’re not alone. Some people think about tapping into their 401(k) savings to make it happen. But before you decide to dip into your retirement to buy a home, be sure to consider all possible alternatives and talk with a financial expert. Here’s why.

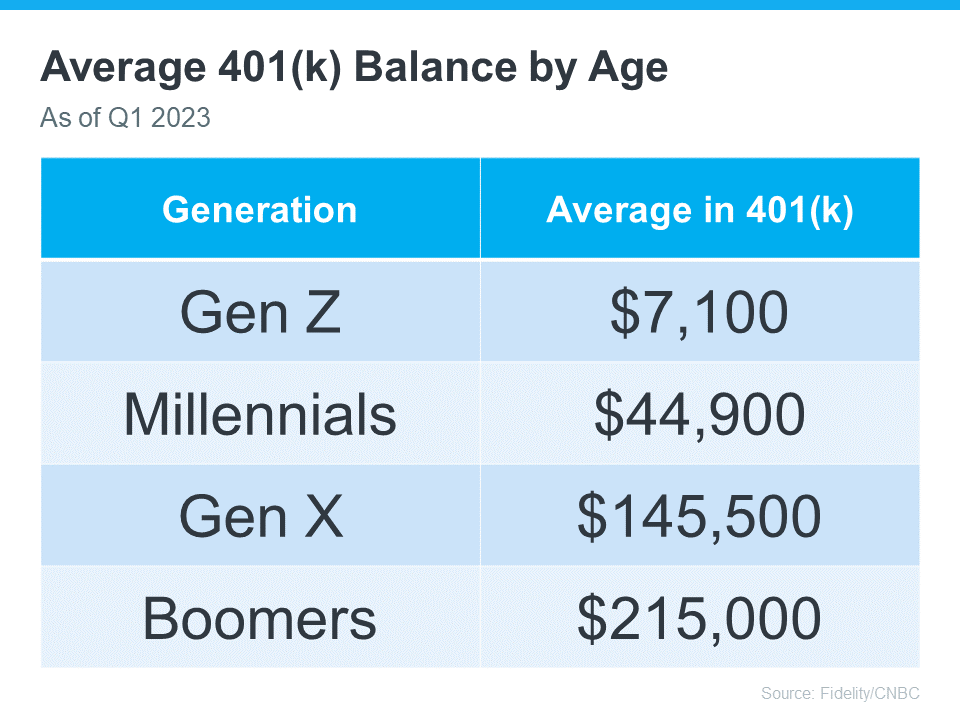

The Numbers May Make It Tempting

The data shows many Americans have saved a considerable amount for retirement (see chart below):

It can be really tempting when you have a lot of money saved up in your 401(k) and you see your dream home on the horizon. But remember, dipping into your retirement savings for a home could cost you a penalty and affect your finances later on. That’s why it’s important to explore all your options when it comes to saving for a down payment and buying a home. As Experian says:

“It’s possible to use funds from your 401(k) to buy a house, but whether you should depends on several factors, including taxes and penalties, how much you’ve already saved and your unique financial circumstances.”

Alternative Ways To Buy a Home

Using your 401(k) is one way to finance a home, but it’s not the only option. Before you decide, consider a couple of other methods, courtesy of Experian:

- FHA Loan: FHA loans allow qualified buyers to put down as little as 3.5% of the home’s price, depending on their credit scores.

- Down Payment Assistance Programs: There are many national and local programs that can help first-time and repeat homebuyers come up with the necessary down payment.

Above All Else, Have a Plan

No matter what route you take to purchase a home, be sure to talk with a financial expert before you do anything. Working with a team of experts to develop a concrete plan prior to starting your journey to homeownership is the key to success. Kelly Palmer, Founder of The Wealthy Parent, says:

“I have seen parents pausing contributions to their retirement plans in favor of affording a larger home often with the hope they can refinance in the future… As long as there is a tangible plan in place to get back to saving for their retirement goals, I encourage families to consider all their options.”

Bottom Line

If you’re still thinking about using your 401(k)-retirement savings for a home down payment, consider all your options and work with a financial professional before you make any decisions.

Buying Versus Renting A Home: Making Informed Real Estate Decisions (Video)

Welcome to Bob DeVore’s YouTube channel, your go-to source for all things real estate! If you’re on the fence about whether to buy or rent a home, you’re in the right place. In this video, we’ll explore the age-old debate of buying versus renting and provide you with valuable insights to help you make the best decision for your unique circumstances.

🏡 Homeownership vs. Renting 🏡

Making the choice between homeownership and renting is a significant financial decision, and it’s essential to weigh the pros and cons. Our video breaks down the advantages and disadvantages of both options, so you can better understand what suits your lifestyle, budget, and long-term goals.

📊 Financial Considerations 📊

We’ll dive deep into the financial aspects of buying a home, such as mortgage rates, down payments, property taxes, and ongoing costs, as well as the financial flexibility that comes with renting. By the end of this video, you’ll have a clear picture of how each choice impacts your wallet.

🏠 Lifestyle and Long-Term Goals 🏠

Your housing decision isn’t just about money; it’s also about your lifestyle and future plans. We’ll discuss how homeownership can offer stability and the opportunity to build equity, while renting provides flexibility and reduced maintenance responsibilities. Discover which aligns better with your personal goals.

🔑 Expert Advice 🔑

As a seasoned real estate agent with years of experience, I’ll share my professional insights and tips to help you navigate the real estate market effectively. Whether you’re a first-time homebuyer or considering renting for the foreseeable future, you’ll find valuable advice in this video.

🌟 Subscribe and Stay Informed 🌟

Don’t forget to hit that subscribe button and ring the notification bell to stay updated on our latest real estate tips, market trends, and home-buying guidance. Your dream home might be closer than you think!

📢 Connect With Us 📢

Have questions or need personalized advice? Feel free to reach out to us in the comments section or through our website [Your Website URL]. We’re here to help you make informed real estate decisions.

Homeowner Net Worth Has Skyrocketed

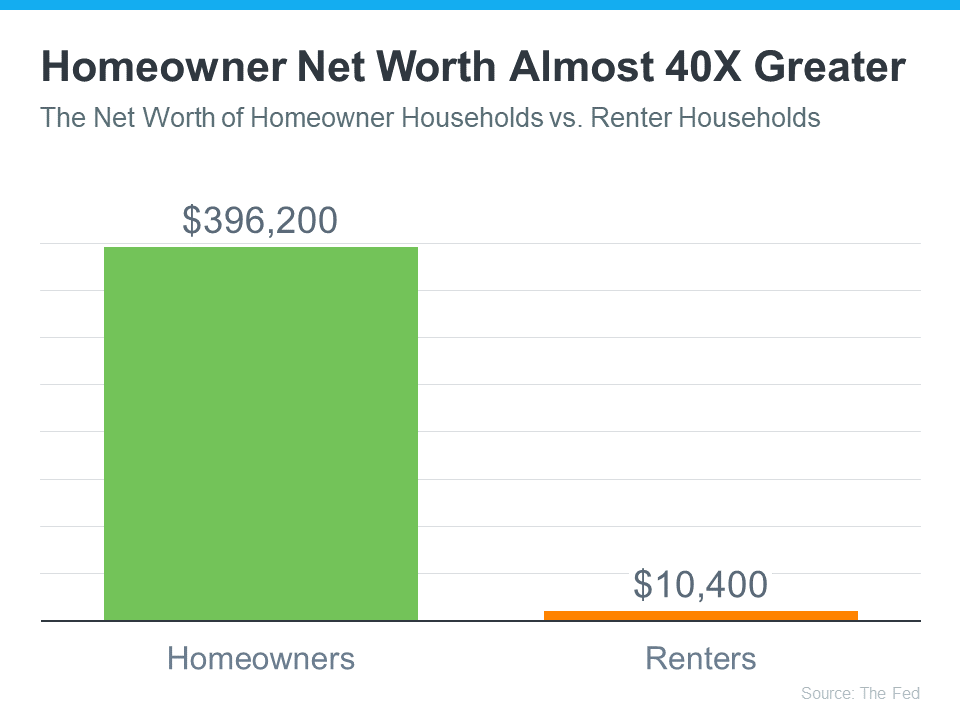

If you’re weighing your options to decide whether it makes more sense to rent or buy a home today, here’s one key data point that could help you feel more confident in making your decision. Every three years, the Federal Reserve Board releases the Survey of Consumer Finances (SCF). That report covers the difference in net worth for both homeowners and renters. Spoiler alert: the gap between the two is significant.

The average homeowner’s net worth is almost 40X greater than a renter’s. And here’s the data to prove it (see graph below):

The Big Reason Homeowner Net Worth Is So High

In the previous version of that report, the net worth of the average homeowner was roughly $255,000 and that of the average renter was $6,300. But in the release that just came out this year, the gap widened as homeowner net worth climbed dramatically. As the Survey of Consumer Finances (SCF) report says:

“. . . the 2019-2022 growth in median net worth was the largest three-year increase over the history of the modern SCF, more than double the next-largest one on record.”

One of the biggest reasons homeowner net worth skyrocketed is home equity.

Over the last few years, known as the ‘unicorn’ years for housing, home prices went through the roof. That’s because there weren’t enough homes for sale, and there was a big influx of buyers rushing to buy them and take advantage of the then record-low mortgage rates. That imbalance of supply and demand pushed prices higher and higher. As a result, most homeowners who had a home during that time saw their equity grow a lot.

If you’re still in the middle of making your decision on whether to rent or buy, you may wonder if you missed the boat on the big net worth boost. But here’s what you need to realize. As a recent article in The Ascent explains:

“Whether your net worth increased in recent years or not, there are steps you can take to boost that number in the coming years. . . buying a home can be a great way to grow your net worth, since home values have a tendency to rise over time.”

Historically, home prices climb over time. Even now that mortgage rates are closer to 7-8%, prices are still rising in many areas of the country because supply is still low compared to demand. That’s why expert forecasts for the next few years call for ongoing appreciation – just at a pace that’s more typical for the housing market.

While it likely won’t be the record ramp-up that happened over the last few years, people who buy now should continue to grow equity in the years ahead. That means, if you’re ready and able to buy a home today, you’ll be making an investment that’ll help build your net worth in the long run.

As Jessica Lautz, Deputy Chief Economist at the National Association of Realtors (NAR), says:

“. . . when deciding to rent vs buy, one must calculate the total cost of homeownership (maintenance, utilities, commuting, etc.) and the total financial benefit. Based on new Fed data . . . the median net worth of homeowners was $396,200 vs renters at $10,400. There is no question about the wealth gains that homeownership provides.”

Bottom Line

If you’re on the fence about whether to rent or buy a home, remember that homeownership can give your net worth a big boost over time. If you want to learn more about this or the many other benefits of owning a home, let’s connect.

Reasons To Sell Your House Before the New Year

As the year winds down, you may have decided it’s time to make a move and put your house on the market. But should you sell now or wait until January? While it may be tempting to hold off until after the holidays, here are three reasons to make your move before the new year.

Get One Step Ahead of Other Sellers

Typically, in the residential real estate market, homeowners are less likely to list their houses toward the end of the year. That’s because people get busy around the holidays and sometimes deprioritize selling their house until the start of the new year when their schedules and social calendars calm down. But that gives you an opportunity to get one step ahead.

Selling now, while other homeowners may hold off until after the holidays, can help you get a leg up on your competition. Start the process with a real estate agent today so you can get your house on the market before your neighbors do.

Get Your House in Front of Eager Buyers

Even though the supply of homes for sale did grow compared to last year, it’s still low. That means there aren’t enough homes on the market today. While some buyers may also delay their plans to move until January, others will still need to move for personal reasons or because something in their life has changed.

Those buyers are still going to be active later this year and will be seriously motivated to make their move happen because they need to. Unfortunately, the challenge they’ll face is a shortage of available inventory to meet their needs. A recent article from Investopedia says:

“. . . if your house is up for sale in the winter and someone is looking at it, chances are that person is serious and ready to buy. Anyone shopping for a new home between Thanksgiving and New Year’s is likely going to be a serious buyer. Putting your home on the market at this time of year and attracting a serious buyer can often result in a quicker sale.”

Use Your Equity To Fuel Your Move

Keep in mind that homeowners today have record amounts of equity. According to CoreLogic, the average amount of equity per mortgage holder has climbed to almost $290,000. That means the equity you have in your house right now could cover some, if not all, of a down payment on the home of your dreams.

And as you weigh the reasons to sell before year-end, it’s important to remember the reasons that sparked your desire to move in the first place. Maybe it’s time for a new home in a location that suits you better, one that offers the perfect space for you and your loved ones, or maybe your needs have evolved over time. A local real estate agent can help you determine how much home equity you have and how you can use it to achieve your goal of making a move.

Bottom Line

Listing your home before the new year can offer unique benefits. Less competition, motivated buyers, and your equity gains can all play to your advantage. Reach out, and let’s achieve your goals before winter sets in.

Do You See It?

For over a century, home has been our purpose – it’s a place and a feeling unlike any other. Benefit from our powerful network and get world-class guidance when you buy or sell with Coldwell Banker Professionals.

10 Smart Financial Moves to Wrap up 2023, Set Yourself Up to Thrive in 2024

As tempting as it is to leave your year-end financial to-dos until December, you’re better off getting started months earlier. Now.

After all, the time between November and the new year can be a mad dash with holiday prep, travel, and parties piled on top of your typical day-to-day responsibilities.

Moreover, you may need to talk with a tax pro or a financial planner about decisions, and they could be too swamped to accommodate last-minute appointments.

Here are ten things to do to improve your financial life as the year winds down and you gear up for 2024.

1. Build your emergency fund. Be sure you have enough savings to cover an emergency without dipping into long-term investments for unexpected expenses like a job loss, a car repair, or a medical bill. How much you need is personal, but setting aside three to six months’ worth of expenses is one rule of thumb. Learn more and calculate what you might need.

2. Max out retirement accounts. By contributing the maximum possible to your 401(k)s, and IRAs, you may be able to lower your taxable income for 2023 and set yourself up for a brighter financial future. Also, max out your Roth IRA if you’re able to. Those under 50 can contribute $6,500, and those over 50 can contribute $7,500 for 2023.

3. Manage Flexible Spending Accounts and Health Savings Accounts. Keep an eye on your FSA, and don’t leave FSA money on the table. If you’re eligible for an HSA, contribute to it. Read more about eligibility and contribution limits.

4. Take your required minimum distributions (RMDs). The SECURE 2.0 Act raised the age for starting RMDs to 73. If you’re required to take an RMD and don’t, you could incur a penalty of 25% of the RMD amount not withdrawn. Learn more about RMDs and visit the U.S. Securities and Exchange Commission to calculate your RMD.

5. Review your will and estate plans. If you don’t have a will — only 46% of Americans aged 55 and over have a will, says Caring.com’s 2023 Wills and Estate Planning Study — create one.

Furthermore, review who you’ve named as your medical and financial power of attorney to decide if they are still the right people for the job.

6. Review your tax withholdings. If you’re withholding too little tax, you may have to pay a chunk of money at tax time. If you withhold too much, you’re missing the opportunity to use or invest that money during the year until you receive your tax refund. Find the sweet spot that covers your tax dues and maximizes your return.

7. Update your insurance policies. If you’ve had life changes — a home addition, a new baby, a marriage, or a divorce — it’s important to review your insurance policies and be sure you’re appropriately covered.

8. Tweak your investments. Meet with your tax and financial planners to review your financial picture, especially if you’re considering retirement soon. See how your portfolio is performing, set your savings targets, and adjust your portfolio based on your tax needs and short- and long-term goals. You may find that you’re in terrific financial shape, that you need to be a more aggressive saver, or that you need to adjust your investments to be sure they’re in line with your risk tolerance.

9. Consider your aging plans. Think about how and where you want to live and how well-suited your home is for aging in place. If you plan to stay where you are, consider the upgrades you’ll need and start saving and planning for them. Here’s a checklist to help you determine what home features you need to add.

10. Prep for the 2023 tax deadline. Since you’re already going through all your financial documents, it’s a good time to organize your receipts and paperwork — retirement contributions, business expenses, charitable donations, etc. — to get a step ahead on your 2023 tax prep.

2023 Houzz Bathroom Trends Study Reveals Growing Emphasis on Universal Design, Aging, and Safety

Asian elderly woman patient use toilet bathroom handle security in nursing hospital, healthy strong medical concept.

In the ever-evolving realm of bathroom renovation, homeowners are now placing a significant focus on factors like aging gracefully and ensuring safety within their living spaces. The key takeaway from the latest 2023 U.S. Houzz Bathroom Trends Study is that they’re also integrating universal design elements that cater to both present needs and future considerations, catering to individuals of all ages and abilities.

This development holds particular promise, given that bathrooms tend to be one of the most perilous areas within a home for seniors. According to the Centers for Disease Control and Prevention, falls are the leading cause of injury-related fatalities among adults aged 65 and above.

The Houzz study indicates a noteworthy increase in homeowners addressing special needs during bathroom renovations, with 66% doing so, up from 54% in 2021. Furthermore, nearly half (44%) of homeowners anticipate the emergence of special needs within the next five years.

To enhance safety, homeowners are incorporating an array of features, including:

– Grab bars (58%)

– Nonslip flooring (58%)

– Curbless showers (43%)

– Additional lighting (33%)

– ADA-compliant toilets (26%)

– Wheelchair-accessible doorways (21%)

– Lower vanity height (3%)

– Lower fixtures (2%)

Flooring, while not solely driven by safety concerns, remains a significant focus. The study reveals that 83% of homeowners upgrade their bathroom flooring during renovations, with a third opting for nonslip flooring outside the shower.

Primary bathrooms are also seeing expansions, with 22% of homeowners enlarging their primary bathrooms by repurposing square footage from closets (44%), bedrooms (24%), and hallways (7%). Post-renovation, almost 3 in 5 bathrooms (59%) measure 100 square feet or more.

Additionally, 26% of homeowners remove their tubs during renovation, and the majority (77%) opt for larger shower spaces. For one in five, the new shower is a whopping 50% larger than the old one.

Low-curb (43%) entries have gained popularity since the previous year, experiencing a 1% increase. Curbless entries are the preference for 24% of homeowners, marking a 3% uptick from last year.

Sustainability is another notable trend, with 87% of homeowners incorporating environmental features such as:

– LED lightbulbs (62%)

– Water-efficient fixtures (46%)

– Timeless design (44%)

– Energy-efficient fixtures (34%)

– Light dimmers (34%)

For 69% of homeowners, long-term cost-effectiveness drives these choices, while 54% prioritize their environmental friendliness.

Other highlights from the study include:

– Median spending on all bathroom remodels has surged by 50%, from $9,000 in 2021 to $13,500 in 2022. Median expenditure on major and minor remodels has risen by 33% and 60%, respectively.

– Wood has surpassed white and grey vanities as the top choice for 33% of homeowners.

– A significant 86% of homeowners opt for style changes in their bathrooms, with transitional styling (23%) reigning as the most popular choice for the second consecutive year, followed by contemporary (16%), modern (15%), traditional (11%), and farmhouse (5%).

In conclusion, this study offers valuable insights into the evolving trends in bathroom design, with an increasing emphasis on universal design, aging considerations, and safety enhancements. Stay informed about the latest developments and keep your home a safe and stylish haven.

Learn more about fall prevention through these resources:

– Centers for Disease Control

– Mayo Clinic

– National Institute on Aging

And remember, Medicare open enrollment ends on December 7th. Don’t delay in reviewing your options to ensure the best care and cost savings for 2024. Explore the resources below to make informed decisions:

– Medicare – call 1-800-633-4227, TTY users call 1-877-486-2048

– National Council on Aging

– The State Health Insurance Assistance Program (SHIP) – SHIP provides unbiased advice on Medicare choices. Use the site’s “Find Your Local SHIP” feature to locate one-on-one assistance in choosing a Medicare plan.

– USA Today’s 2024 Medicare open enrollment date and how to prepare.

The Impact of Bob DeVore

Join us on #BeTheImpactDay and discover how Bob DeVore delivers personalized service, expert guidance, and maximum exposure for your real estate journey. 🏡💼 #RealEstate

Unlock the Power of Home Staging: An Executor’s Insight

living room Mid Century style with warm colors. Ai generative

Did you know that a mere 10% of individuals possess the unique skill of envisioning a home with their personal touch? It’s a fascinating fact about human psychology.

But what does this revelation mean for you?

It means that only one in ten people, when viewing a probate property for sale, can truly visualize the potential beauty of the home after they’ve put in the effort to fix it up and make it their own.

Here’s a nugget of wisdom from the National Association of Realtors: staging a house can work wonders, increasing its selling price and expediting the sale process.

Now, pause for a moment and ask yourself this question:

How would your life change if you received an offer within just 30 days of listing your house for sale?

If you’re not well-versed in the benefits of home staging, you might be missing out on precious TIME and MONEY.

Home staging is a powerful tool, and it’s one of the most effective ways to boost the sales price of your probate property. I’m here to illustrate how I’ve assisted numerous clients, much like yourself, in realizing this potential with ease.

Keep in mind, as the individual responsible for the estate, you have an obligation to maximize the value of all assets, especially the real property within the estate’s portfolio.

Allow me to guide you through some fundamental steps that can transform the selling experience into a painless and swift process.

So, what’s the next step?

To ensure you’re on the right track, give me a call at (810) 965-4566 or shoot me an email at bob.devore@coldwellbanker.com to schedule an appointment. During our meeting, I’ll reveal my #1 strategy to help you secure the HIGHEST possible price for the estate’s real property.

I’m here to assist you, so reach out today. It’s a complimentary consultation, and there’s absolutely no obligation on your part!

Steer Clear of These 7 Costly Mistakes Executors Often Make

Note book and light bulb on wood table

Probate executors and administrators are no strangers to the pitfalls that can drain an estate’s finances. These blunders have, in some cases, resulted in staggering losses, ranging from thousands to tens of thousands of dollars. It’s my sincerest hope that you can avoid falling into the same traps!

Here are the Top 7 Mistakes that many Probate Executors and Administrators Make:

#1 Neglecting the Crucial Questions When Interviewing a Real Estate Agent for Selling Probate Property

#2 Failing to Define a Clear Desired Outcome

#3 Relying Solely on the Probate Attorney for All Aspects of the Probate Process

#4 Procrastinating the Initiation of the Probate Process

#5 Overlooking Accurate Accounting Record Keeping

#6 Prioritizing Personal Connections Over the Expertise of a CPRES Agent (Certified Probate Real Estate Specialist) for Listing the Property

#7 Being Unaware of the Pros and Cons of Selling the Property, Renting it, or Retaining it within the Probate Estate

I understand that your probate responsibilities keep you busy. Feel free to save my contact information, and when the time is right, reach out to me, Bob, to discuss your probate real estate needs and address any concerns you may have. Your peace of mind is my priority!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link