Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

People Are Still Moving, Even with Today’s Affordability Challenges

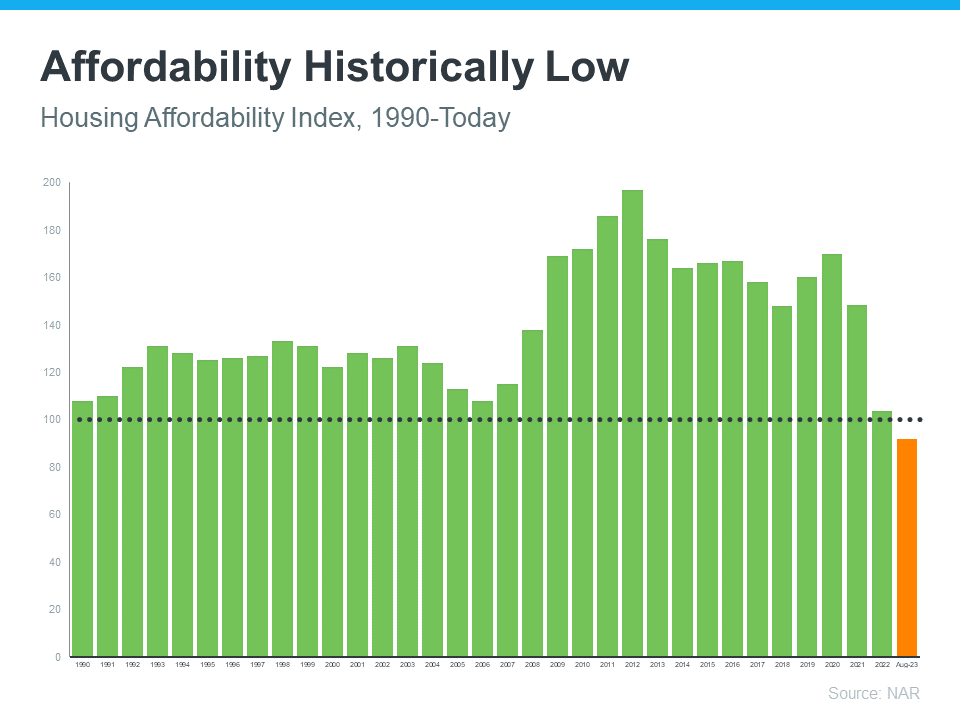

If you’re thinking about buying or selling a home, you might have heard that it’s tough right now because mortgage rates are higher than they’ve been over the past few years, and home prices are rising. That much is true. Take a look at the graph below. It breaks down how the current affordability situation stacks up to recent years.

The National Association of Realtors (NAR) explains how to read the values on the graph:

“To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home.”

The black dotted line represents that 100 value on the index. Essentially, the higher the bar, the more affordable homes are. As you can see, the orange bar for today shows higher mortgage rates and home prices have created a clear challenge. But, while affordability is definitely tighter right now, that doesn’t mean the housing market is at a standstill.

According to NAR, based on the pace of sales right now, just under 4 million homes will sell this year. With some simple math, let’s break down what that really means for you:

- 3.96 million homes divided by 365 days in a year = 10,849 houses sell each day

- 10,849 divided by 24 hours in a day = 452 houses sell per hour

- 452 divided by 60 minutes in an hour = about 8 houses sell each minute

So, on average, over 10,000 homes sell each day in this country. Whether you’re a buyer or a seller, this goes to show there are still ways to make your move possible, even at a time when affordability is tight.

An Agent Can Help You Make Your Move a Reality

You may be wondering how other homebuyers and sellers are making this happen now. One of the biggest game-changers in today’s market is working with a trusted local real estate agent. Great agents are helping other people just like you navigate today’s market and the current affordability situation, and their insight is invaluable right now.

True professionals will be able to offer advice tailored to your specific wants, needs, budget, and more. Not to mention, they’ll also be able to draw on their experience of what’s working for other buyers and sellers right now. This could mean broadening your search, if needed, to include other housing types like condos, townhouses, or neighborhoods a bit further out to help offset some of the affordability challenges today.

Bottom Line

You might think there aren’t many people buying or selling homes right now since affordability is tighter than it’s been in quite some time, but that’s not the case. It’s true that buying a home has become more expensive over the past couple of years, but people are still moving.

If you’re hoping to buy or sell a home today, know that other people are still making their goals a reality – and that’s happening in large part because of the help and advice of skilled local real estate agents. Want to talk to a trusted professional about your own move? Let’s connect.

Avoid These 3 Costly Mistakes When Buying a Home – Real Estate Agent’s Expert Tips

Avoid These 3 Costly Mistakes When Buying a Home – Real Estate Agent’s Expert Tips

Welcome to Bob DeVore’s Real Estate Channel! If you’re in the market to buy a new home, you won’t want to miss today’s video. In this episode, we’re diving deep into the 3 biggest mistakes that homebuyers often make – and more importantly, how to avoid them!

Buying a home is a significant financial and emotional investment, and these common pitfalls can make the process more stressful and costly than it needs to be. Whether you’re a first-time homebuyer or a seasoned pro, the insights and tips shared in this video will help you make smarter decisions and save money along the way.

In this video, we’ll cover:

1. **Overlooking the Importance of Pre-Approval:** Discover why getting pre-approved for a mortgage is a crucial first step in your homebuying journey. We’ll discuss the benefits of pre-approval and how it can give you a competitive edge in a competitive market.

2. **Skipping the Home Inspection:** Learn why a thorough home inspection is non-negotiable when buying a property. We’ll go over the risks of skipping this crucial step and provide guidance on what to look for in a qualified home inspector.

3. **Ignoring Your Budget:** One of the most common mistakes is falling in love with a house that’s beyond your budget. We’ll share practical strategies for setting a realistic budget and sticking to it, ensuring you find a home you love without straining your finances.

Don’t let these mistakes derail your homebuying dreams. Be sure to subscribe to our channel and hit the notification bell so you won’t miss any of our valuable real estate tips and advice.

If you’ve experienced other common homebuying mistakes or have questions about the process, feel free to share them in the comments below. We love engaging with our viewers and helping you navigate the world of real estate.

Thanks for tuning in, and we look forward to helping you on your journey to finding your dream home!

The Latest 2024 Housing Market Forecast

The new year is right around the corner, and you might be wondering if 2024 will be the right time to buy or sell a home. If you want to make the most informed decision possible, it’s important to know what the experts have to say about what’s ahead for the housing market. Spoiler alert: the projections may be better than you think. Here’s why.

Experts Forecast Ongoing Home Price Appreciation

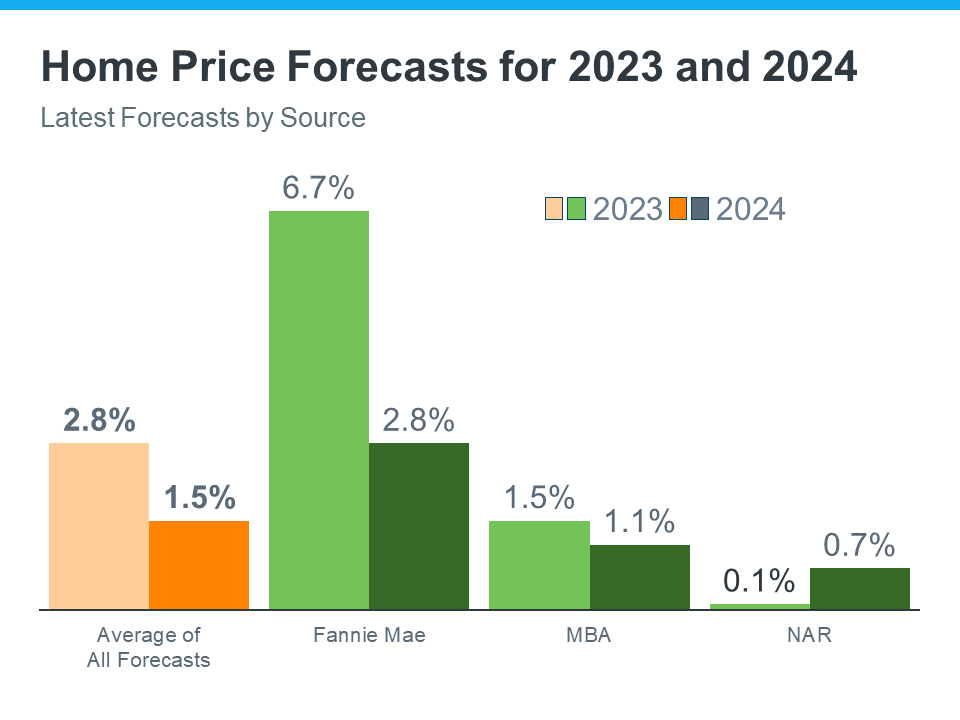

Take a look at the latest home price forecasts from Fannie Mae, the Mortgage Bankers Association (MBA), and the National Association of Realtors (NAR):

As you can see in the orange bars on the left, on average, experts forecast prices will end this year up about 2.8% overall, and increase by another 1.5% by the end of 2024. That’s big news, considering so many people thought prices would crash this year. The truth is, prices didn’t come tumbling way down in 2023, and that’s because there just weren’t enough homes for sale compared to the number of people who wanted or needed to buy them, and that inventory crunch is still very real. This is the general rule of supply and demand, and it continues to put upward pressure on prices as we move into the new year.

Looking forward, experts project home prices will continue to rise next year, but not quite as much as they did this year. Even though the expected rise in 2024 isn’t as big as in 2023, it’s important to understand home price appreciation is cumulative. In simpler terms, this means if the experts are right, according to the national average, after your home’s value goes up by 2.8% this year, it should go up by another 1.5% next year. That ongoing price growth is a big part of why owning a home can be a smart decision in the long run.

Projections Show Sales Should Increase Slightly Next Year

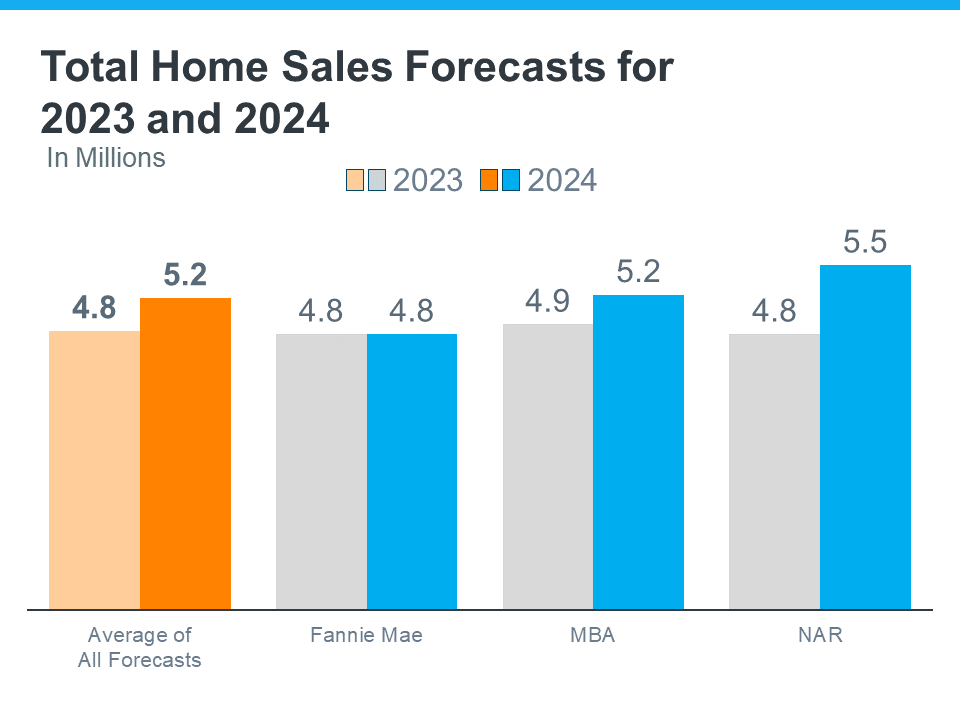

While 2023 hasn’t seen a lot of home sales relative to more normal years in the housing market, experts are forecasting a bit more activity next year. Here’s what those same three organizations project for the rest of this year, and in 2024 (see graph below):

While expectations are for just a slight uptick in total sales, improved activity next year is a good thing for the housing market, and for buyers and sellers like you. As people continue to move, that opens up options for hopeful buyers who are looking for a home.

So, what do these forecasts show? The housing market is expected to be more active in 2024. That may be in part because there will always be people who need to move. People will get new jobs, have children, get married or divorced – these and other major life changes lead people to move regardless of housing market conditions. That will remain true next year, and for years to come. And if mortgage rates come down, we’ll see even more activity in the housing market.

Bottom Line

If you’re thinking about buying or selling, it’s important to know what the experts are forecasting for the future of the housing market. When you’re in the know about what’s ahead, you can make the most informed decision possible. Let’s chat about the latest forecasts together, and craft a plan for your next move.

These Top Cities Show Home Prices Are Still Climbing

If you’re considering buying a home or selling your current one to find something that better suits your needs, you may have questions about what’s happening with home prices today. Here’s what you need to know.

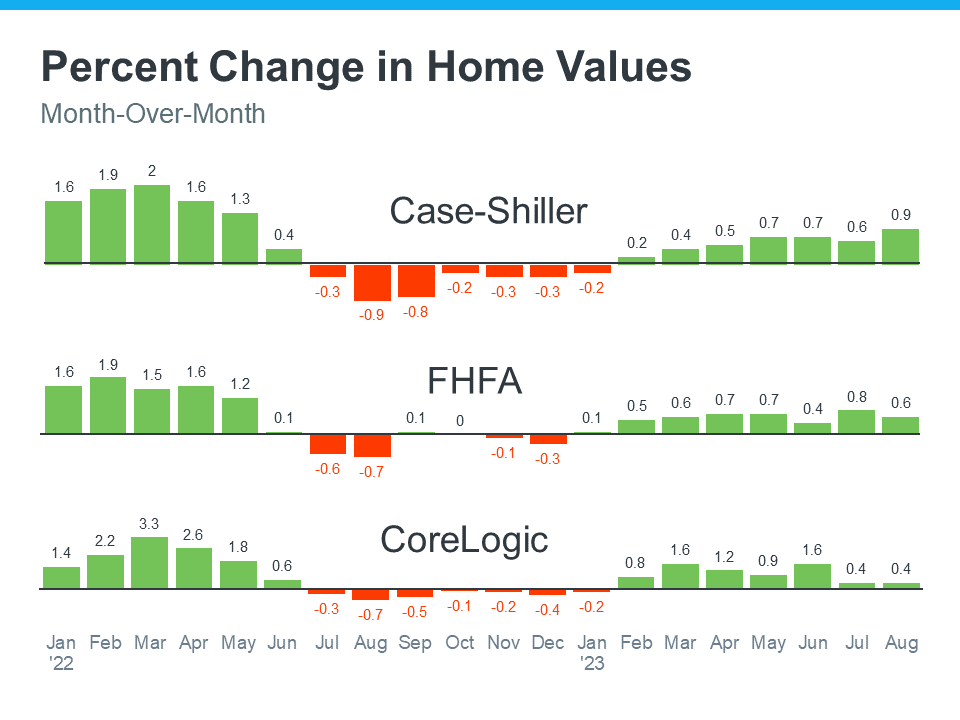

There’s still a lot of confusion and misinformation out there. So, no matter what you may have heard, the national data shows they’ve actually been climbing again (see graphs below):

As you can see, in the first half of 2022, home prices went way up. Those increases were dramatic and unsustainable. So, in the second half of 2022, prices adjusted. Those dips were small and didn’t last very long. Still, the news made a big deal about these slight declines, which may have made you worry.

But what’s important to know is that, in 2023, prices are going up again, and this time it’s at a more normal pace. The fact that all three reports now show more typical price increases this year is good news for the housing market.

Home Prices Are Rising Across the Top Cities in the U.S.

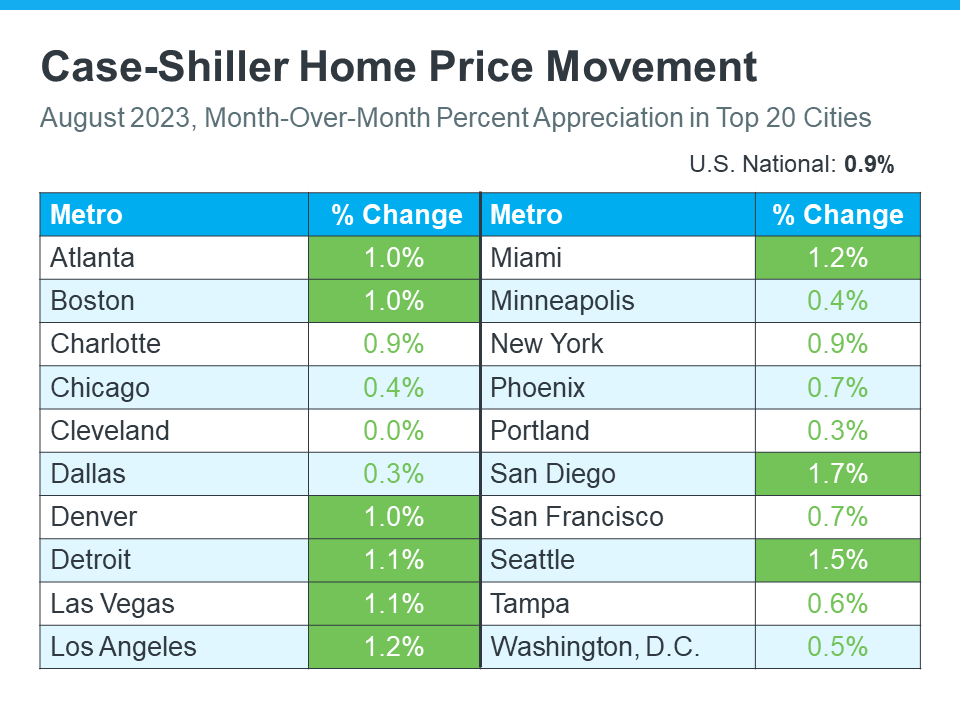

After seeing steady home price growth at the national level for the last several months, you may wonder if prices are going up in your local area, too. Know this: while this will vary from one area to the next, home prices are appreciating in these top cities Case-Shiller reports on in their monthly price index (see chart below):

That’s why so many experts are able to forecast home prices will end the year in the positive and continue going up in 2024.

Here’s How This Affects You

- For Buyers: If you’ve been waiting to buy a home because you were concerned it might lose value, the fact that home prices are going up should ease your worries. Buying a home before prices climb higher can be a smart move since home values typically appreciate over time.

- For Sellers: If you’ve been postponing selling your house because you were worried about how changing home prices would affect its value, now might be a good time to work with a real estate agent to put your house on the market. You don’t have to wait any longer because the data shows home prices are in your favor.

Bottom Line

If you delayed moving because you were concerned home prices would drop, don’t worry – the numbers show they’re going up nationally. To better understand how home prices are changing in your local area, let’s connect.

Life-Changing Events That Move the Housing Market

Life is a journey filled with unexpected twists and turns, like the excitement of welcoming a new addition, retiring and starting a new adventure, or the bittersweet feeling of an empty nest. If something like this is changing in your own life, you may be considering buying or selling a house. That’s because through all these life-altering events, there is one common thread—the need to move.

Reasons People Still Need To Move Today

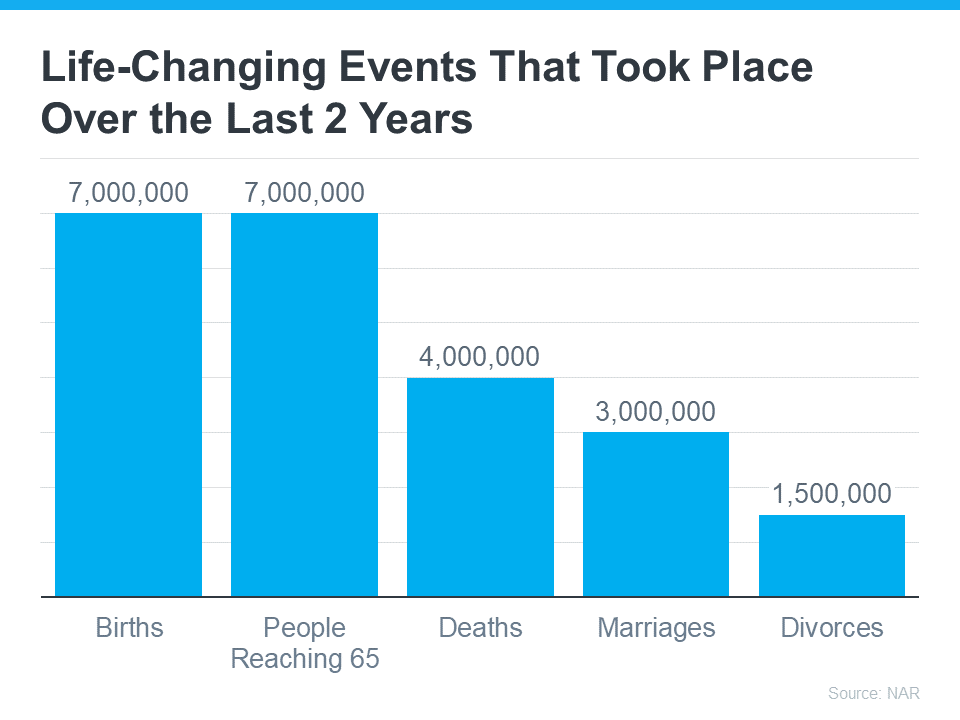

According to the National Association of Realtors (NAR) there have been a lot of this type of milestone or life change over the last two years (see graph below):

And, these big life changes are going to continue to impact people moving forward, even with the current affordability challenges brought on by higher mortgage rates and rising home prices.

As Claire Trapasso, Executive News Editor at Realtor.com, says:

“Because high mortgage rates, elevated home prices, and stubbornly low inventory make today’s housing market particularly challenging, many of today’s buyers are motivated by life changes, such as growing families, supporting elderly parents or grown children, or accommodating professional needs. . .”

Lean On a Real Estate Professional for Help

Whether you’re beginning your search for a home or preparing to sell your current house, you don’t have to go it alone. With their expertise, a real estate agent is an invaluable partner who can help you smoothly transition through these big moments in your life. Here are just a few examples.

When Buying a Home

If you’re welcoming a new addition and want more space, the need for a new home may be a top priority. While higher home prices and mortgage rates are creating challenges for buyers, you may have to find a way to meet your changing needs, even with today’s mortgage rates.

A skilled real estate agent can help. Their expertise and knowledge of the local housing market can save you a considerable amount of time and stress. An agent will take the time to understand your specific needs, budget, and preferences, allowing them to narrow down your search and present you with suitable options.

When Selling a House

If you’re retiring or going through a separation or divorce, your main focus may be to make the most out of your investment when selling your house, so you can find one that works better for you moving forward.

This is another place where a real estate agent’s expertise truly shines. They can accurately assess your home’s market value, suggest improvements to enhance its appeal, and craft a strategic marketing plan. Their negotiation skills are a big asset when it comes to making sure you get a fair price for your house, allowing you to move on to the next chapter of your life with confidence and peace of mind.

No matter your situation, lean on a trusted professional for help as you buy or sell a home.

Bottom Line

If recent life-changing events have you wanting or needing to move, let’s connect.

10 Interior Styling Mistakes to Avoid When Selling Your Home

Selling your home is an exciting and sometimes challenging endeavor. One key aspect of the process is ensuring your home looks its absolute best to attract potential buyers. The way you style and present your interiors can make a significant difference in how quickly and profitably your home sells. To help you make the most of this opportunity, Bob DeVore, your trusted Realtor with Coldwell Banker Professionals, is here to share the top 10 interior styling mistakes to avoid when selling your home.

1. Neglecting Decluttering:

Before showcasing your home to potential buyers, decluttering is an absolute must. A cluttered space can make your home feel smaller and less inviting. Remove personal items, excess furniture, and knick-knacks to create an open and spacious feel that allows buyers to envision themselves living in the space.

2. Over-Personalizing:

While your family photos and unique decor may have sentimental value, they can be distracting to potential buyers. Buyers need to be able to picture themselves living in your home, so consider neutralizing your interiors by removing overly personal items.

3. Ignoring Home Repairs:

Neglected maintenance issues can be a major turn-off for potential buyers. Be sure to address any visible repairs, such as leaky faucets, broken tiles, or peeling paint, before listing your home. A well-maintained property sends the message that you’ve taken care of your home.

4. Poor Lighting:

Inadequate lighting can make your home feel gloomy and uninviting. Maximize natural light by keeping windows clean and opening blinds or curtains during showings. Additionally, consider adding more lighting fixtures or updating bulbs to create a brighter, more welcoming atmosphere.

5. Failing to Stage Properly:

Home staging involves strategically arranging furniture and decor to highlight your home’s best features. Don’t underestimate the power of professional staging to transform your space and make it more appealing to potential buyers.

6. Leaving Strong Odors:

Unpleasant odors can be a major turn-off for buyers. Avoid cooking strong-smelling foods, and consider using air fresheners or diffusers with neutral scents to create a pleasant atmosphere. Also, be mindful of pet odors, and clean carpets and upholstery regularly.

7. Ignoring Curb Appeal:

First impressions matter, and the exterior of your home is the first thing buyers see. Neglecting curb appeal can deter potential buyers before they even step inside. Invest in landscaping, paint, and maintenance to make your home’s exterior as attractive as possible.

8. Misusing Color:

While bold colors may reflect your personal style, they can be off-putting to potential buyers with different tastes. Consider repainting rooms in neutral tones to appeal to a broader range of buyers and create a blank canvas for their imagination.

9. Overlooking Small Details:

Small details matter when it comes to presenting your home. Ensure that all light bulbs are working, that there are no chipped tiles, and that everything is clean and well-maintained. These seemingly minor details can add up to a more appealing overall impression.

10. Failing to Showcase Functional Spaces:

If you have a spare room that you’ve been using as a storage space or a catch-all, consider repurposing it into a functional space. Show buyers how they can use the room as a home office, guest bedroom, or playroom. A clear and functional space can help buyers see the full potential of your home.

Conclusion:

Avoiding these common interior styling mistakes can significantly enhance the appeal of your home to potential buyers, ultimately leading to a quicker and more profitable sale. If you’re ready to sell your home and want expert guidance throughout the process, contact Bob DeVore, your trusted Realtor with Coldwell Banker Professionals, today. Bob can help you navigate the real estate market and ensure your home stands out in the best possible way. Don’t miss out on the opportunity to make a positive impression and sell your home with confidence.

VA Loans Help Heroes Achieve Homeownership

Some Highlights

- VA home loans can help people who served our country become homeowners.

- These loans can help qualified individuals purchase a VA-approved home or condo, build a new home, or enhance their current one.

- Owning a home is the American Dream, and one way to show our appreciation to veterans is by providing them with important information about the advantages of VA home loans.

The 248th Marine Corps Birthday Message (Video)

On November 10, 2023, U.S. #Marines around the globe will celebrate 248 years of success on the battlefield and reaffirm their commitment to our Corps’ proud legacy of honor, courage and commitment. This year, the Commandant of the Marine Corps, Gen. Eric M. Smith and Sergeant Major of the Marine Corps Carlos A. Ruiz remind us all that Marines are professional warfighters who have earned their reputation of discipline and lethality in the crucible of combat.

The Great Debate: Buying vs. Renting a Home (Video)

Trying to decide if you want to rent or buy a home? Let’s connect so we can chat more about what’s right for you.

One of the most significant financial decisions people make in their lives is whether to buy or rent a home. This decision can have a profound impact on your finances, lifestyle, and long-term goals. As a real estate agent, I understand that this is a complex and highly personal choice. In this blog post, we will delve into the pros and cons of both buying and renting a home, helping you make an informed decision that aligns with your unique circumstances.

The Advantages of Buying

1. Building Equity: One of the most compelling reasons to buy a home is the opportunity to build equity. With each mortgage payment, you’re essentially investing in your own asset, which can appreciate over time. This can serve as a form of forced savings and a potential source of wealth.

2. Stability and Control: When you own a home, you have more control over your living space. You can make renovations and upgrades to personalize your home to your liking without needing permission from a landlord. This sense of stability and control can be very appealing.

3. Tax Benefits: Homeownership comes with several tax advantages, including deductions for mortgage interest, property taxes, and, in some cases, even energy-efficient upgrades. These deductions can reduce your overall tax burden.

4. Potential for Appreciation: Historically, real estate tends to appreciate over time, although it can be subject to market fluctuations. If your property’s value increases, you may benefit when it comes time to sell.

The Advantages of Renting

1. Flexibility: Renting provides flexibility that buying can’t match. You can easily move to a different neighborhood, city, or even country without the hassle of selling a property. This is especially advantageous for people whose jobs require frequent relocations.

2. Lower Upfront Costs: Renting typically involves lower upfront costs than buying a home. You won’t need to save for a down payment, and many rental properties include utilities, maintenance, and sometimes even furnishings in the monthly rent.

3. No Property Maintenance Responsibility: When you rent, you’re not responsible for property maintenance or repairs. This can save you both time and money, as these expenses are the landlord’s responsibility.

4. Predictable Monthly Costs: Renters generally have more predictable monthly housing costs since they don’t have to worry about property taxes, homeowners’ insurance, or fluctuating interest rates on a mortgage.

Choosing the Right Path

So, which path should you choose? The answer depends on your individual circumstances and long-term goals.

If you value stability, building equity, and are planning to stay in the same area for an extended period, buying may be the right choice for you. It can also be a wise financial investment if you’re in a market with strong appreciation potential.

On the other hand, if you value flexibility, want to avoid the responsibilities of homeownership, or are uncertain about your long-term plans, renting may be a better fit. Renting allows you to adapt to changing circumstances more easily.

It’s important to consult with a qualified real estate agent who can provide guidance tailored to your specific situation. They can help you evaluate your financial readiness for homeownership, explore available properties or rentals in your desired area, and assist you in making an informed decision.

Conclusion

The debate between buying and renting a home is not a one-size-fits-all scenario. Each option has its own set of advantages and disadvantages, and the right choice depends on your unique circumstances and priorities. As a real estate agent, my goal is to provide you with the information and support you need to make a well-informed decision that aligns with your financial goals and lifestyle preferences. Whether you choose to buy or rent, I’m here to assist you every step of the way in your real estate journey.

How VA Loans Can Help Make Homeownership Dreams Come True

For more than 79 years, Veterans Affairs (VA) home loans have helped millions of veterans buy their own homes. If you or someone you care about has served in the military, it’s essential to learn about this program and its advantages.

Here are some important things to know about VA loans before you buy a home.

The Many Advantages of VA Home Loans

VA home loans provide a pathway to homeownership for those who have served our nation, and they’re a great benefit for buyers who qualify. According to the Department of Veteran Affairs:

- Options for No Down Payment: Qualified borrowers can often purchase a home with no down payment. That’s a huge weight lifted when you’re trying to save for a home.

- Limited Closing Costs: There are limits on the types of closing costs you pay when you qualify for a VA home loan. So, more money stays in your pocket when it’s time to seal the deal.

- Don’t Require Private Mortgage Insurance (PMI): Many other loans with down payments under 20% require PMI. VA loans do not, which means veterans can save on their monthly housing costs.

A recent article from Veterans United sums up just how impactful this loan option can be:

“For the vast majority of military borrowers, VA loans represent the most powerful lending program on the market. These flexible, $0-down payment mortgages have helped more than 24 million service members become homeowners since 1944.”

Bottom Line

Owning a home is the American Dream. Veterans sacrifice a lot to protect our country, and one way we can show our appreciation is by making sure they know all the benefits of VA home loans. Thank you for your service.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link