Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

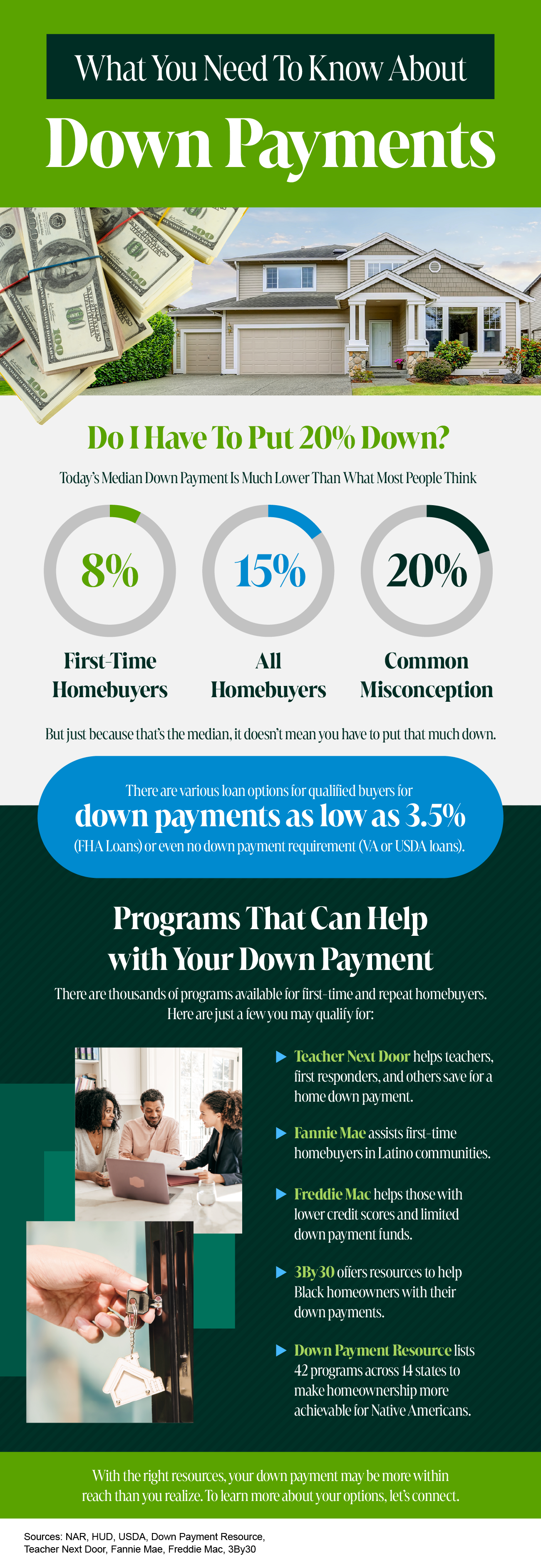

What You Need To Know About Down Payments

Some Highlights

- If you want to buy a home, you may not need as much for your down payment as you think.

- There are various loan options for qualified buyers with down payments as low as 3.5% or even no down payment requirement. There are also thousands of programs available to help homebuyers with their down payments.

- With the right resources, your down payment may be more within reach than you realize. To learn more about your options, let’s connect.

Experts Forecast Home Prices Will Go Up Over the Next 5 Years (Video)

Experts forecast home prices will go up over the next five years. Let’s connect to discuss why that’s a good thing for you.

If Your House Hasn’t Sold Yet, It May Be Overpriced

Has your house been sitting on the market a while without selling? If so, you should know that’s pretty unusual, especially right now. That’s because the supply of homes available for sale is still far lower than what we’d see in a normal year. That means buyers have fewer options than they usually would, so your house should be an oasis in an inventory desert.

So, if homebuyers have limited choices and your house still hasn’t sold, there’s a reason why. Let’s break one potential sticking point that may be turning buyers away: your asking price.

Especially with today’s higher mortgage rates already putting a stretch on their budget, buyers are being a bit more sensitive about price. As a recent article from the Wall Street Journal (WSJ) says:

“If you are serious about selling your home now, don’t get greedy with the asking price. This is still a seller’s home market as there simply aren’t enough affordable homes for sale in many parts of the country. But with average 30-year mortgage rates above 6%, buyers are much more price-sensitive than they were a year ago.”

Why Setting the Right Price Matters

While you want to maximize the return on your investment when you sell your house, you also need to be realistic based on current market conditions. The simple truth is your house is only going to sell for what people are willing to pay right now.

This can be a hard thing to accept. Especially since emotions can run high during the selling process, which only complicates matters more. After all, you may have lived in this house for years, so it’s only natural you’re emotionally tied to it – and those heartstrings can make it harder to be objective.

But it’s important to acknowledge that a bigger-than-expected price tag deters buyers and may make them dismiss your house as a possibility before even seeing it. And if no one’s looking at it, how will it sell?

If you want to get your house sold, you’ll need to do something to spark interest in your home again. That’s where a local real estate agent comes in. They’ll help use data to find out if it’s priced too high for your local market. They balance the value of homes in your neighborhood, current market trends and buyer demand, the condition of your house, and more to find the right price for your house, so you can close this chapter and start your next one.

Bottom Line

While it’s true there aren’t that many homes available for sale right now, your home’s asking price still matters. And, if it’s not selling, it may be priced too high.

The Surprising Trend in the Number of Homes Coming onto the Market

If you’re thinking about moving, it’s important to know what’s happening in the housing market. Here’s an update on the supply of homes currently for sale. Whether you’re buying or selling, the number of homes in your area is something you should pay attention to.

In the housing market, there are regular patterns that happen every year, called seasonality. Spring is the peak homebuying season and also when the most homes are typically listed for sale (homes coming onto the market are known in the industry as new listings). In the second half of each year, the number of new listings typically decreases as the pace of sales slows down.

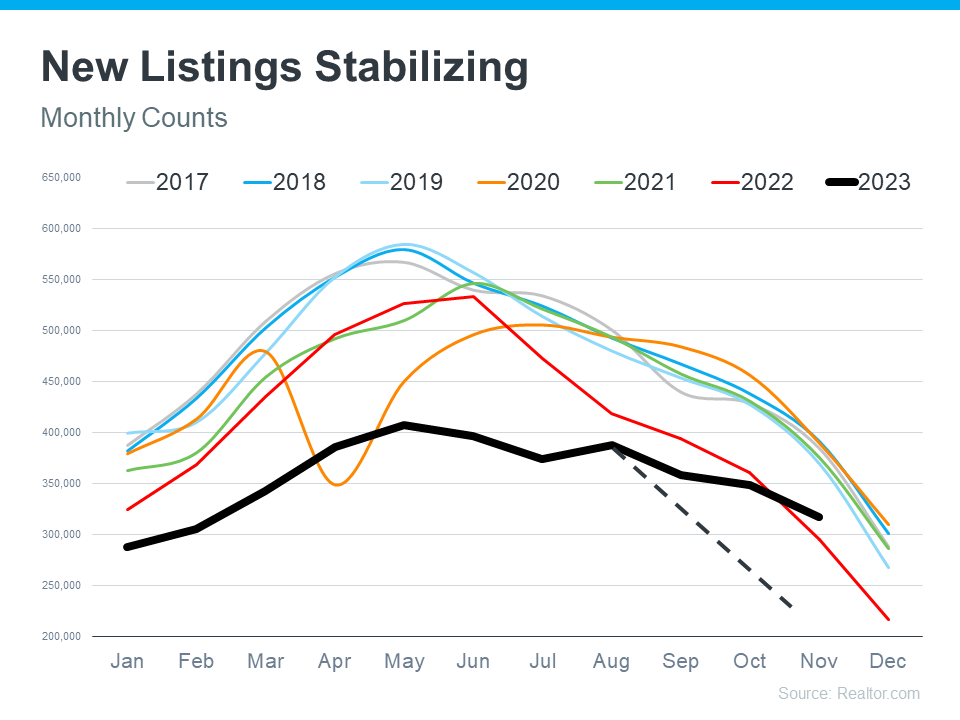

The graph below uses data from Realtor.com to provide a visual of this seasonality. It shows how this year (the black line) is breaking from the norm (see graph below):

Looking at this graph, three things become clear:

- 2017-2019 (the blue and gray lines) follow the same general pattern. These years were very typical in the housing market and their lines on the graph show normal, seasonal trends.

- Starting in 2020, the data broke from the normal trend. The big drop down in 2020 (the orange line) signals when the pandemic hit and many sellers paused their plans to move. 2021 (the green line) and 2022 (the red line) follow the normal trend a bit more, but still are abnormal in their own ways.

- This year (the black line) is truly unique. The steep drop off in new listings that usually occurs this time of year hasn’t happened. If 2023 followed the norm, the line representing this year would look more like the dotted black line. Instead, what’s happening is the number of new listings is stabilizing. And, there are even more new listings coming to the market this year compared to the same time last year.

What Does This Mean for You?

- For buyers, new listings stabilizing is a positive sign. It means you have a more steady stream of options coming onto the market and more choices for your next home than you would have at the same time last year. This opens up possibilities and allows you to explore a variety of homes that suit your needs.

- For sellers, while new listings are breaking seasonal norms, inventory is still well below where it was before the pandemic. If you look again at the graph, you’ll see the black line for this year is still lower than normal, meaning inventory isn’t going up dramatically and prices aren’t heading for a crash. And with less competition from other sellers than you’d see in a more typical year, your house has a better chance to be in the spotlight and attract eager buyers.

Bottom Line

Whether you’re on the hunt for your next home or thinking of selling, now might just be the perfect time to make your move. If you have questions or concerns about the availability of homes in our local area, let’s connect.

Down Payment Assistance Programs Can Help Pave the Way to Homeownership

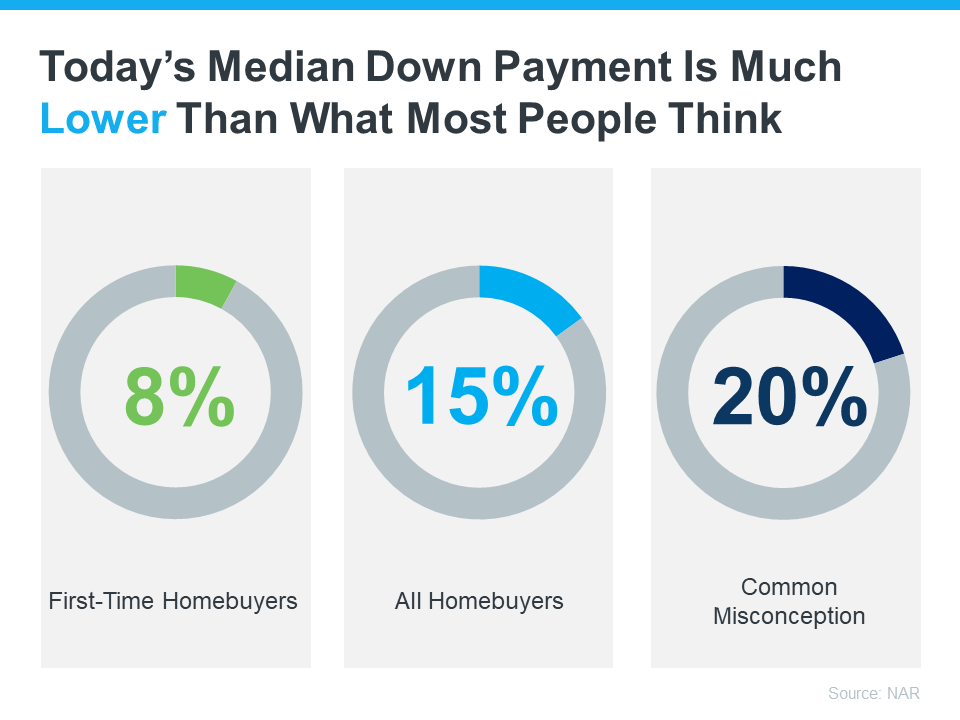

If you’re looking to buy a home, your down payment doesn’t have to be a big hurdle. According to the National Association of Realtors (NAR), 38% of first-time homebuyers find saving for a down payment the most challenging step. But the reality is, you probably don’t need to put down as much as you think:

Data from NAR shows the median down payment hasn’t been over 20% since 2005. In fact, the median down payment for all homebuyers today is only 15%. And it’s even lower for first-time homebuyers at 8%. But just because that’s the median, it doesn’t mean you have to put that much down. Some qualified buyers put down even less.

For example, there are loan types, like FHA loans, with down payments as low as 3.5%, as well as options like VA loans and USDA loans with no down payment requirements for qualified applicants. But let’s focus in on another valuable resource that may be able to help with your down payment: down payment assistance programs.

First-Time and Repeat Buyers Are Often Eligible

According to Down Payment Resource, there are thousands of programs available for homebuyers – and 75% of these are down payment assistance programs.

And it’s not just first-time homebuyers that are eligible. That means no matter where you are in your homebuying journey, there could be an option available for you. As Down Payment Resource notes:

“You don’t have to be a first-time buyer. Over 39% of all [homeownership] programs are for repeat homebuyers who have owned a home in the last 3 years.”

The best place to start as you search for more information is with a trusted real estate professional. They’ll be able to share more information about what may be available, including additional programs for specific professions or communities.

Additional Down Payment Resources That Can Help

Here are a few down payment assistance programs that are helping many of today’s buyers achieve the dream of homeownership:

- Teacher Next Door is designed to help teachers, first responders, health providers, government employees, active-duty military personnel, and veterans reach their down payment goals.

- Fannie Mae provides down-payment assistance to eligible first-time homebuyers living in majority-Latino communities.

- Freddie Mac also has options designed specifically for homebuyers with modest credit scores and limited funds for a down payment.

- The 3By30 program lays out actionable strategies to add 3 million new Black homeowners by 2030. These programs offer valuable resources for potential buyers, making it easier for them to secure down payments and realize their dream of homeownership.

- For Native Americans, Down Payment Resource highlights 42 U.S. homebuyer assistance programs across 14 states that ease the path to homeownership by providing support with down payments and other associated costs.

Even if you don’t qualify for these types of programs, there are many other federal, state, and local options available to look into. And a real estate professional can help you find the ones that meet your needs as you explore what’s available.

Bottom Line

Achieving the dream of having a home may be more within reach than you think, especially when you know where to find the right support. To learn more about your options, let’s connect.

Finding Your Ideal Home in Today’s Real Estate Market

In the ever-evolving landscape of the real estate market, it’s undeniable that mortgage rates and home prices have surged compared to last year. These changes are certainly affecting what you can afford, and the reduced availability of homes for sale is adding to the challenges prospective buyers face today. However, fear not! There are effective strategies to overcome these hurdles and turn your dream of homeownership into a reality.

As you embark on your home-buying journey this season, it’s crucial to be strategic in your approach. To help you streamline your priorities and preferences, we recommend the following organization:

1. **Must-Haves:** These are the essential features your future home must possess to align with your lifestyle and needs.

2. **Nice-To-Haves:** These are the desirable features that would enhance your living experience but are not absolute dealbreakers. If a home meets all your must-haves and some of these nice-to-haves, it’s certainly worth considering.

3. **Dream State:** Here’s where you can let your imagination run wild. Dream features are not necessities, but if you stumble upon a home within your budget that encompasses all your must-haves, most of your nice-to-haves, and any dream features, it’s a clear winner.

Remember, it’s essential to remain open-minded during your home search. If you limit your options solely to homes with all your dream features, you may inadvertently make the process more challenging for yourself and strain your budget unnecessarily. Features like granite countertops or a backyard pool, although appealing, can often be added after the purchase. Sometimes, the perfect home is the one you perfect after buying it.

Given the current affordability challenges and the limited supply of housing, a strategic approach is key to finding a home that meets your needs while staying within your budget. If you’re ready to embark on this exciting journey, feel free to direct message me, and together, we can make your homeownership dreams a reality.

Your Essential Probate Survival Toolkit: Clear and Practical Resources

Judge wooden gavel, stamp and model of house with construction plans.

You don’t need Probate Gobbledygook; you crave plain English, and I’ve got just the toolkit for you! Be sure to star this email, as the resources listed below are fantastic references for your convenience.

As a probate executor, you’re a leader who understands the importance of simplifying complexities. You recognize that complexity often stands in the way of progress, and that’s why I’m honored to assist numerous probate executors and administrators, just like you. My mission is to make your journey smoother, providing the clarity necessary to make the best decisions for the probate estate.

Below are all the resources that I have been providing you over the last few months.

Click the links below to download your items:

Probate Real Estate and You: Avoiding the 7 Biggest Mistakes Made in Probate Real Estate – eBook

Special Report : Going Through Probate for the Inexperienced

Special Report: How to Build Your Team of Pros

Estate Executor’s and Administrator’s Duties During the Probate Process

Personal Property Inventory and Appraisal Form

If you ever have questions or wish to arrange a free phone consultation, don’t hesitate to reach out to me at (810) 965-4566 or via email at bob.devore@coldwellbanker.com. Rest assured, I will promptly respond to your inquiries!

In today’s probate landscape, there’s a shortage of true professionals, individuals holding a CPRES designation. Consequently, executors of probate estates often have lowered expectations regarding the quality of service they receive.

A genuine professional brings immense value to their clients, just as I’ve strived to provide you with valuable and actionable information in each of my emails. Your satisfaction and confidence in navigating the probate process are of utmost importance to me.

Unlock the Value of Your Probate Property: Introducing the PBPO

As a probate executor, you’re a true champion. Your role encompasses handling paperwork, navigating the legal system, mediating disputes among heirs, and making crucial decisions about both personal property and real estate. Not everyone possesses the ability to carry out these duties as effectively as you do. I want to express my sincere appreciation for all that you do. Please know that I’m here for you whenever you need assistance with your probate matters. Rest assured, no one will work harder for you than I will!

Now, you might be wondering, “What can I provide that has proven most helpful to other executors?” The answer lies in a PBPO – a Probate Broker Price Opinion.

**What exactly is a PBPO, you ask?** A PBPO stands for Probate Broker Price Opinion, and it offers an exceptionally accurate estimate of your property’s value.

You might be wondering, “Bob, why is a PBPO more accurate than an appraisal?” Well, here’s the key difference: Appraisers conducting estate evaluations rarely step inside the houses they assess. Instead, they rely on computer data and often consult real estate agents for additional details.

This is where Certified Probate Real Estate Specialists (CPRES) like myself come into play. We deal with property sales daily and have firsthand knowledge of the properties that appraisers only see on their screens.

When it comes to determining a property’s value, it ultimately boils down to what a buyer is willing to pay. Real estate agents, especially those who are CPRES certified, excel in understanding buyer behavior, as it’s an integral part of their daily work.

Most people aim to sell their assets for the highest possible price. Collaborating with a real estate agent who is a Certified Probate Real Estate Specialist (CPRES) is the surest way to achieve this goal.

One common mistake that many executors and administrators make is listing estate property with a non-CPRES certified real estate agent, inadvertently resulting in the loss of thousands of dollars. Don’t fall into that trap!

A Certified Probate Real Estate Specialist (CPRES) ensures you fulfill your fiduciary duty to all parties involved in the estate, safeguarding you against future issues. You can count on me to protect your interests and secure the BEST POSSIBLE OFFER in today’s market.

To aid you in the decision-making process, I am offering a Probate Broker Price Opinion (PBPO) at no cost or obligation to you. Typically, such a service comes at a cost due to the time and effort it requires to conduct a truly professional PBPO. However, I believe in empowering you with the knowledge needed to evaluate your real property effectively.

Make your life easier today. All you need to do is give me a call at (810) 965-4566 or send me an email at bob.devore@coldwellbanker.com, and I will arrange a convenient time for us to meet, either by phone, a home visit, or at my office, to present this invaluable PBPO to you. Your peace of mind is my priority!

Avoid These 5 Costly Executor Mistakes in Probate Sales

Businesswoman and Male lawyer or judge consult having team meeting with client, Law and Legal services concept.

Hello, it’s Bob DeVore again, here to provide you with invaluable insights that set me apart as a real estate agent in the industry. Today, let’s explore the colossal mistakes that many executors and administrators inadvertently make while settling a probate estate:

**Mistake 1:** **Believing the Appraisal Price is the True Property Value**

One common misconception is assuming that the appraisal price reflects the actual value of the property. In reality, there can be disparities in property value in three scenarios:

– When an appraiser determines the estate’s value.

– When the property is listed on the market.

– When the property is ultimately sold.

One exception arises when the property is sold to the first buyer without exposing it to a broader pool of potential buyers via the internet. The more exposure a property receives, the higher its sales price tends to be. Ensure you consult a Certified Probate Real Estate Specialist (CPRES) agent and obtain a Probate Comparable Market Analysis (CMA), particularly crucial for properties undergoing the probate process.

**Mistake 2:** **Not Enlisting a Specialist in Probate Sales**

To circumvent potential complications during the selling process, it’s essential to collaborate with a Certified Probate Real Estate Specialist.

**Mistake 3:** **Delaying the Filing of Tax Documents**

Before taking any steps related to the real property’s sale within the estate, consult your accountant to determine the estate’s tax liabilities, if any.

**Mistake 4:** **Neglecting Proper Documentation Before Property Sale**

Ensure that you have obtained Letters of Administration or Letters Testamentary from the probate court before finalizing the property’s sale. A Certified Probate Real Estate Specialist can assist you in gathering the necessary information.

**Mistake 5:** **Skipping Repair Quotes from Multiple Contractors**

Examine the potential benefits of making repairs to the property before selling. It’s advisable to obtain repair quotes from at least two contractors or handymen.

As a Certified Probate Real Estate Specialist (CPRES), I am here to guide you through the probate sales process and help you avoid these costly mistakes and more. Rest assured, you can count on receiving not only the highest possible price for your property but also the finest service throughout the entire journey. Your satisfaction and success are my top priorities.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link