Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

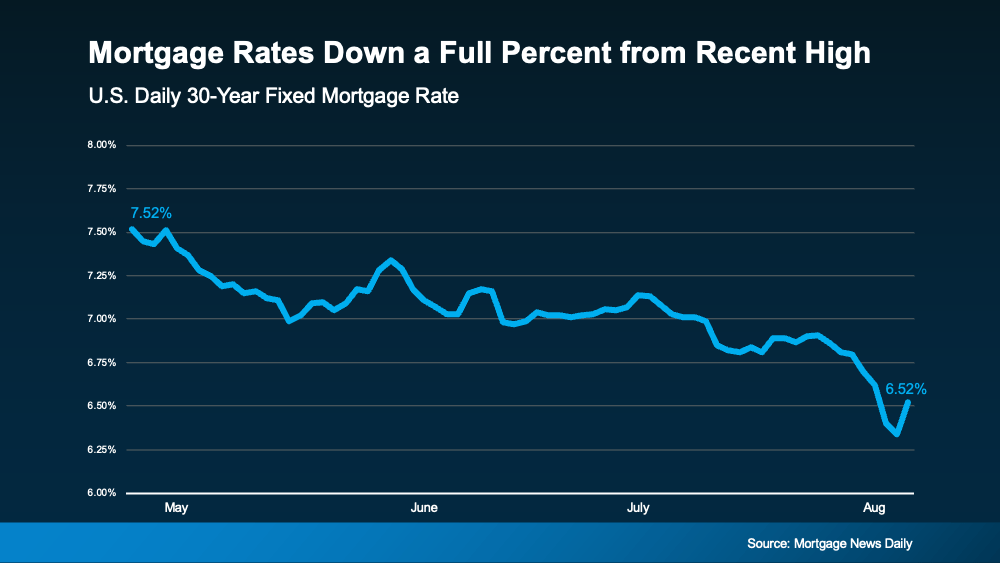

Mortgage Rates Down a Full Percent from Recent High

Mortgage rates have been one of the hottest topics in the housing market lately because of their impact on affordability. And if you’re someone who’s looking to make a move, you’ve probably been waiting eagerly for rates to come down for that very reason. Well, if the past few weeks are any indication, you may be getting your wish.

Mortgage Rates Trend Down in Recent Weeks

There’s big news for mortgage rates. After the latest reports on the economy, inflation, the unemployment rate, and the Federal Reserve’s recent comments, mortgage rates started dropping a bit. And according to Freddie Mac, they’re now at a level we haven’t seen since February. To help show the downward trend, check out the graph below:

Maybe you’re seeing this and wondering if you should ride the wave and see how low they’ll go. If that’s the case, here’s some important perspective. Remember, the record-low rates from the pandemic are a thing of the past. If you’re holding out hope to see a 3% mortgage rate again, you’re waiting for something experts agree won’t happen. As Greg McBride, Chief Financial Analyst at Bankrate, says:

Maybe you’re seeing this and wondering if you should ride the wave and see how low they’ll go. If that’s the case, here’s some important perspective. Remember, the record-low rates from the pandemic are a thing of the past. If you’re holding out hope to see a 3% mortgage rate again, you’re waiting for something experts agree won’t happen. As Greg McBride, Chief Financial Analyst at Bankrate, says:

“The hopes for lower interest rates need the reality check that ‘lower’ doesn’t mean we’re going back to 3% mortgage rates. . . the best we may be able to hope for over the next year is 5.5 to 6%.”

And with the decrease in recent weeks, you’ve got a big opportunity in front of you right now. It may be enough for you to want to jump back in.

The Relationship Between Rates and Demand

If you wait for mortgage rates to drop further, you might find yourself dealing with more competition as other buyers re-ignite their home searches too.

In the housing market, there’s generally a relationship between mortgage rates and buyer demand. Typically, the higher rates are, the lower buyer demand is. But when rates start to come down, things change. Buyers who were on the fence over higher rates will resume their searches. Here’s what that means for you. As a recent article from Bankrate says:

“If you’re ready to buy, now might be the time to strike. Home prices have been rising primarily because of a longstanding shortage of homes for sale. That’s unlikely to change, and if mortgage rates do fall below 6%, it’s possible buyers would enter the market en masse, further pushing up prices and resurrecting bidding wars.”

Bottom Line

If you’ve been waiting to make your move, the recent downward trend in mortgage rates may be enough to get you off the sidelines. Rates have hit their lowest point in months, and that gives you the opportunity to jump back in before all the other buyers do too.

If you’re ready and able to start the process, reach out and let’s get started.

Helpful Negotiation Tactics for Today’s Housing Market

If you haven’t already heard, homebuyers are regaining some negotiating power in today’s market. And while that doesn’t make this a buyer’s market, it does mean buyers may be able to ask for a little more. So, sellers need to be ready for that possibility and know what they’re willing to negotiate.

Whether you’re looking to buy or sell a house, here’s a quick rundown of potential negotiations that may pop up during your transaction. That way, you’re prepared no matter which side of the deal you’re on.

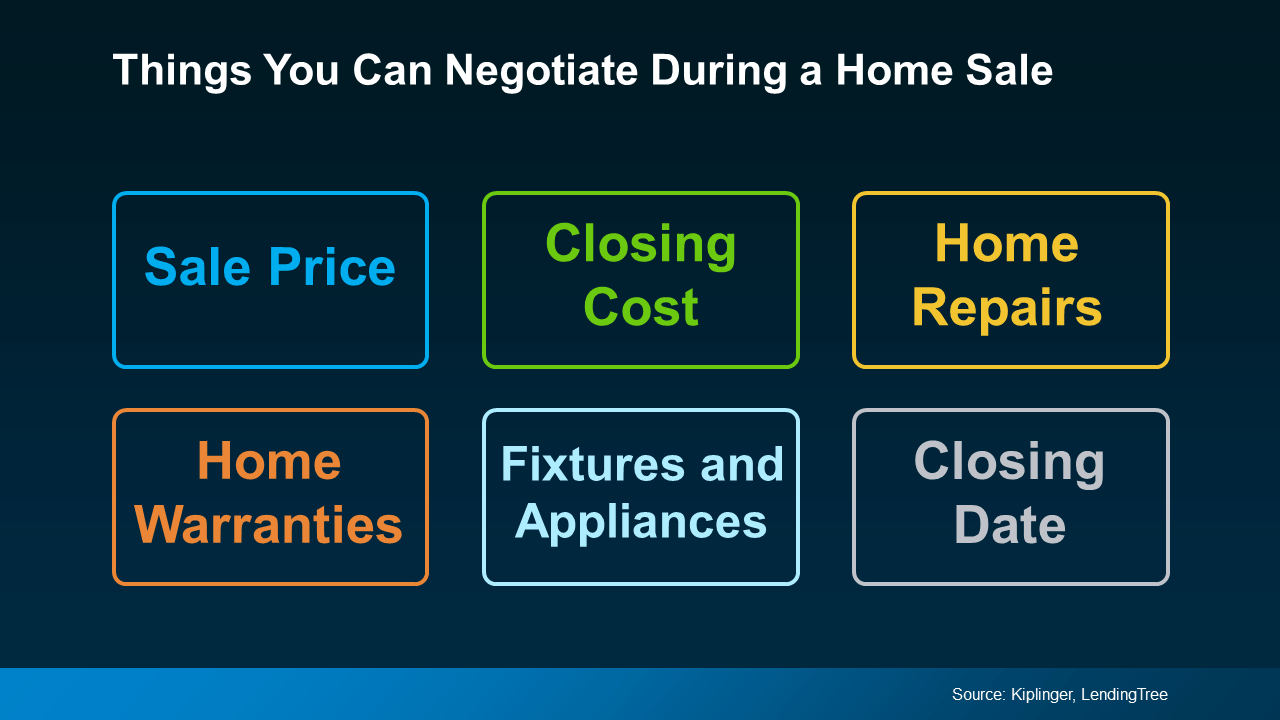

What Can You Negotiate?

Most things in a home purchase are on the negotiation table. Here’s a list of just a few of those options, according to Kiplinger and LendingTree:

- Sale Price: The most obvious is the price of the home. And that lever is being pulled more often today. Buyers don’t want to overpay when affordability is already so tight. And sellers who aren’t realistic about their asking price may have to consider adjusting their price.

- Home Repairs: Based on the inspection, a buyer is within their rights to ask the seller to make reasonable repairs. If the seller doesn’t want to do that, they could offer to reduce the home price or cover some closing costs, so the buyer has the money to take them on themselves.

- Fixtures: Buyers can also ask for appliances or furniture to convey when the house changes hands. Having the seller throw in the washer and dryer cuts down on expenses the buyer would have when moving in. As the seller, you could leave your existing ones behind to sweeten the deal for your buyer, and get yourself new ones for your next place.

- Closing Costs: Closing costs typically run about 2-5% of the home’s purchase price. Buyers can ask the seller to pay for some or all of these expenses to offset the cash the buyer has to bring to the table.

- Home Warranties: Buyers can also ask the seller to pay for a home warranty. This is great for buyers worried about the maintenance costs that may pop up after taking possession of the home. And since this concession usually isn’t terribly expensive for the seller, it can be a good option for both parties.

- Closing Date: Buyers can ask for a faster or extended closing window based on their own timetable. The seller can also advocate for what they need based on their move to find the right compromise.

One thing is true whether you’re a buyer or a seller, and that’s how much your agent can help you throughout the process. Your agent is your go-to for any back-and-forth. They’ll handle the conversations and advocate for your best interests along the way. As Bankrate says:

“Agents have expert negotiating skills. Without one, you must negotiate the terms of the contract on your own.”

They may also be able to uncover what the buyer or seller is looking for in their discussions with the other agent. And that insight can be really valuable at the negotiation table.

Bottom Line

Buyers are regaining a bit of negotiation power in today’s market. Buyers, knowing what levers you can pull will help you feel confident and empowered going into your purchase. Sellers, having a heads up of what they may ask for gives you the chance to think through what you’ll be willing to offer.

Want to chat more about what to expect and the options you have? Let’s connect.

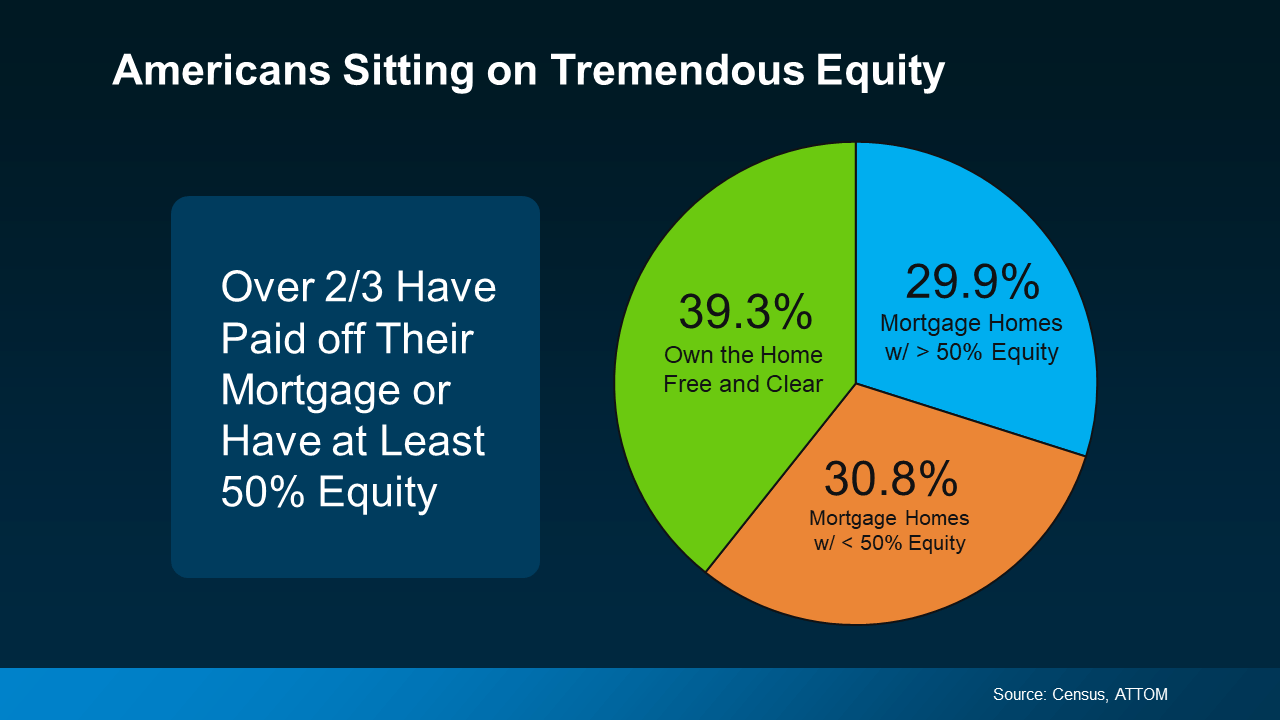

What Every Homeowner Should Know About Their Equity

Curious about selling your home? Understanding how much equity you have is the first step to unlocking what you can afford when you move. And since home prices rose so much over the past few years, most people have much more equity than they may realize.

Here’s a deeper look at what you need to know if you’re ready to cash in on your investment and put your equity toward your next home.

Home Equity: What Is It and How Much Do You Have?

Home equity is the difference between how much your house is worth and how much you still owe on your mortgage. For example, if your house is worth $400,000 and you only owe $200,000 on your mortgage, your equity would be $200,000.

Recent data from the Census and ATTOM shows Americans have significant equity right now. In fact, more than two out of three homeowners have either completely paid off their mortgages (shown in green in the chart below) or have at least 50% equity in their homes (shown in blue in the chart below):

Today, more homeowners are getting a larger return on their homeownership investments when they sell. And if you have that much equity, it can be a powerful force to fuel your next move.

Today, more homeowners are getting a larger return on their homeownership investments when they sell. And if you have that much equity, it can be a powerful force to fuel your next move.

What You Should Do Next

If you’re thinking about selling your house, it’s important to know how much equity you have, as well as what that means for your home sale and your potential earnings. The best way to get a clear picture is to work with your agent, while also talking to a tax professional or financial advisor. A team of experts can help you understand your specific situation and guide you forward.

Bottom Line

Home prices have gone up, which means your equity probably has too. Let’s connect so you can find out how much you have in your home and move forward confidently when you sell.

3 Graphs That Show We’re Not Headed for a Housing Market Crash (Video)

Back in 2008, there were too many homes on the market. Today, it’s just the opposite. The three main sources of inventory show this isn’t like the last time.

3 Reasons Why We’re Not Headed for a Housing Crash

Back in 2008, there was an oversupply of homes for sale. Today, there’s an undersupply. The three main sources of inventory show this isn’t like the last time. Existing homes, new homes, and foreclosures are all way below the levels we saw during the housing crash. Inventory data shows there just aren’t enough homes available to have a repeat of what happened back in 2008.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link